Seasoned fixed income investors know that the lower they go in terms of credit quality, the higher the risk profile they take on.

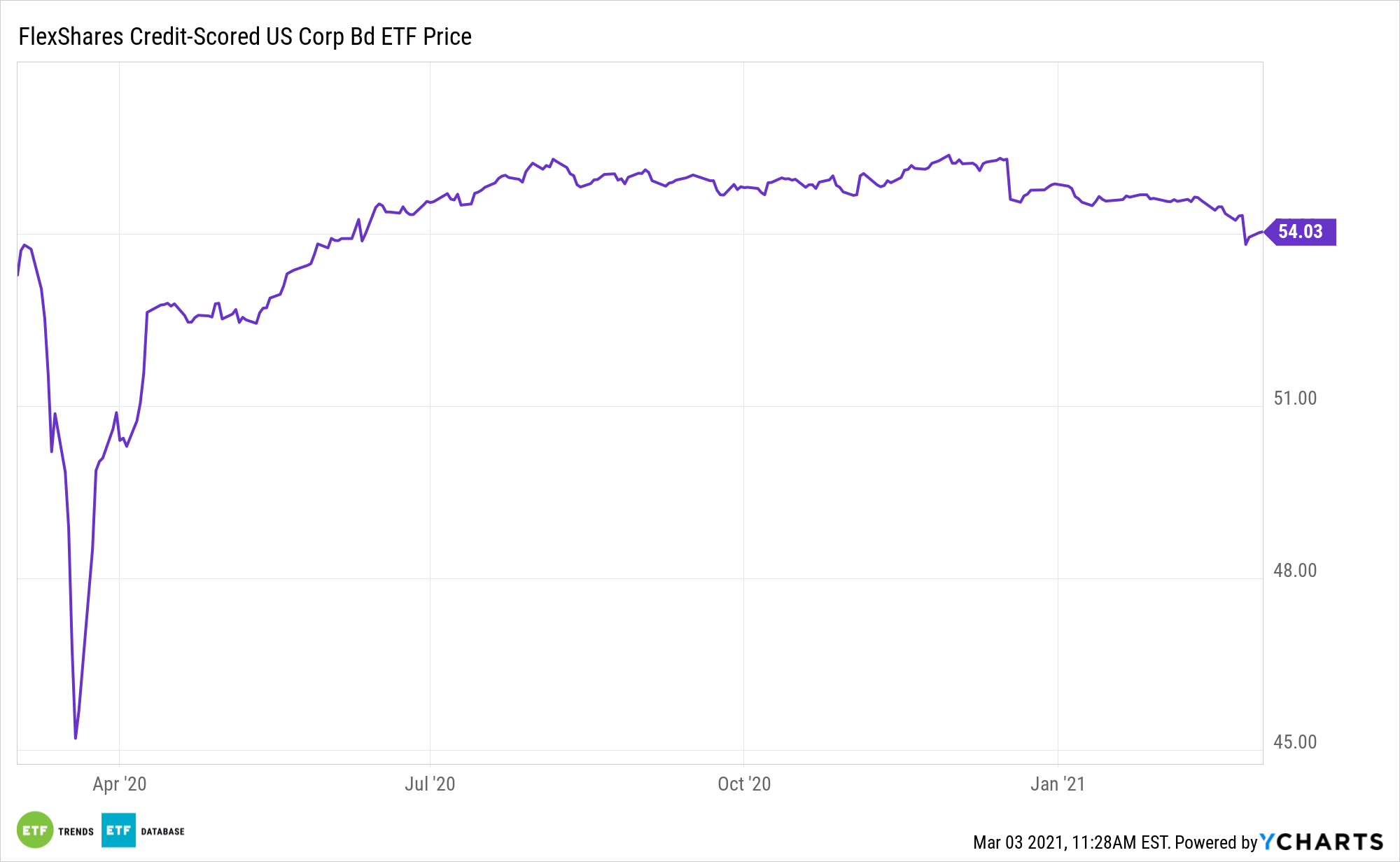

The FlexShares Credit‐Scored US Corporate Bond Index Fund (NasdaqGM: SKOR) is one avenue for combating this risk, and it’s a good idea to consider in the current bond climate.

SKOR tracks the Northern Trust Credit-Scored US Corporate Bond Index, which focuses on issues from companies with quality characteristics such as strength in management efficiency, profitability, and solvency, according to FlexShares. The fund is increasingly relevant for investors seek stout credit quality.

“During the COVID-19-led global recession, our corporate ratings performed as designed,” according to S&P Dow Jones Indices. “The number of defaults rose, but all entities that defaulted in 2020 began the year rated speculative grade–and 94% with a rating in the ‘B’ category or lower. Default and downgrade rates were in line with the rank ordering of our ratings, with higher default and downgrade rates among the lower ratings, and vice versa. Annual stability rates displayed positive rank ordering in 2020, and most ratings had stability rates above their long-term averages.”

A Good SKORing Methodology Is Crucial

The federal government backstopping U.S. corporate debt during the height of the pandemic gave the bond markets a nice boost, and some hedge funds are expecting that the party isn’t over just yet. Some funds are doubling down on corporate bonds, particularly the riskier and longer duration variety.

“The global coronavirus pandemic led to the deepest recession the world has seen since the Great Depression. Global GDP declined 4% in 2020 amid lockdowns to contain the virus’ spread, while governments and central banks stepped in with unprecedented amounts of fiscal and monetary stimulus,” adds S&P. “The number of rated corporate defaults in 2020 hit its highest level since the financial crisis in 2009.”

SKOR’s scoring methodology indicates the fund is appropriate for a broad swath of investors, including those looking to reduce risk.

“The FlexShares Credit Scoring Model addresses the corporate bond liquidity challenge by optimizing a carefully selected subset of all credit issuers of which illiquid, orphaned and small lot names have been removed,” adds FlexShares. “The model also takes into account multiple factors to aid in developing improved corporate bond indexes, including the characteristics of issuers’ total debt structure, minimum exposure percentages, and odd-lot trade restrictions.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.