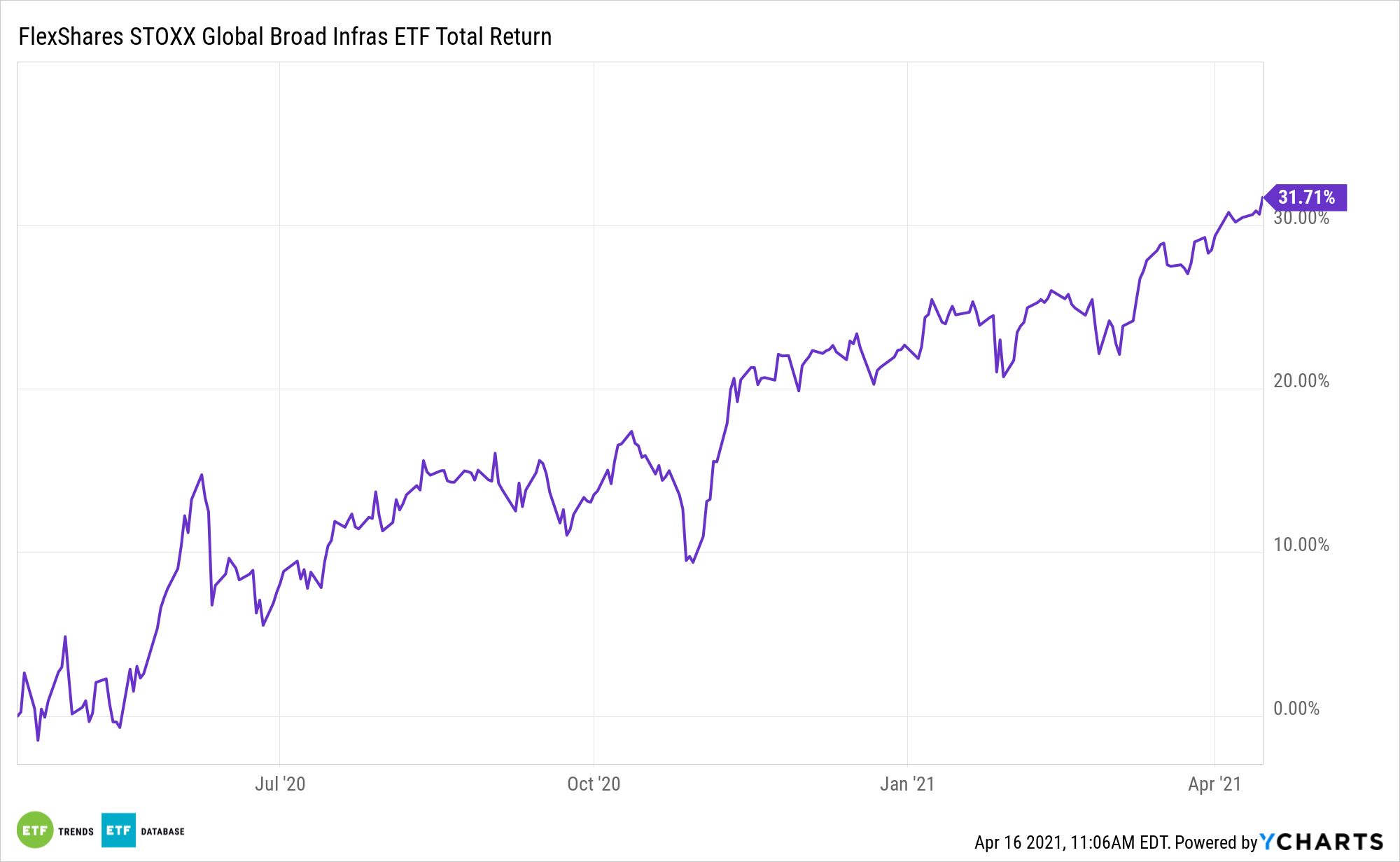

The Biden Administration’s big, bold infrastructure effort has plenty of related exchange traded funds attracting attention, but the FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEArca: NFRA) is one of the standouts in a crowded field.

NFRA tries to reflect the performance of the STOXX Global Broad Infrastructure Index, which identifies equities that derive the majority of revenue from the infrastructure business, providing exposure to both traditional and non-traditional infrastructure sectors.

See also: The Latest U.S. Infrastructure Grade? A C-. ‘NFRA’ Can Help

“President Joe Biden’s ambitious infrastructure package could spell big upside for a handful of exchange-traded funds with exposure to the semiconductor, health care and industrials sectors, Bank of America told its clients,” reports Thomas Franck for CNBC. “ETF strategist Jared Woodard wrote that the end of the Covid-19 pandemic and Biden’s $2 trillion infrastructure plan are expected to spark a ‘boom’ in capital expenditures as companies build new factories and plants in the U.S.”

NFRA: Ready to Soar?

President Joe Biden’s infrastructure plan is opening up ETF trading possibilities from multiple angles. One way is playing its healthcare component via funds like NFRA.

The spending plan will be the next partisan hurdle in Congress where members agree that further capital investments are needed to support an economy trying to emerge from the coronavirus pandemic, but are divided over the size and inclusion of programs traditionally seen as social services. Paying for the new projects will almost certainly be a contentious issue.

Biden is largely expected to make corporate America foot the bill. He could increase the corporate tax rate to 28% from 21% and fix loopholes in the tax code that allow companies to move profits overseas.

“Recent fiscal packages contain some clear catalysts that will send capex higher,” the Bank of America strategist wrote. The “US capital stock is the oldest it has ever been, with an average age of 22 years. Consumers want goods made locally, want jobs kept locally, and reward decision-makers who listen.”

The Biden pitch includes $621 billion to rebuild the country’s infrastructure, including roads, bridges, highways, and ports, along with a $174 billion investment in the electric vehicle market to pave the way toward a nationwide charging network by 2030.

Additionally, Congress will be asked to allocate $400 billion toward expanding affordable homes or community-based care for aging Americans and those suffering from disabilities.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.