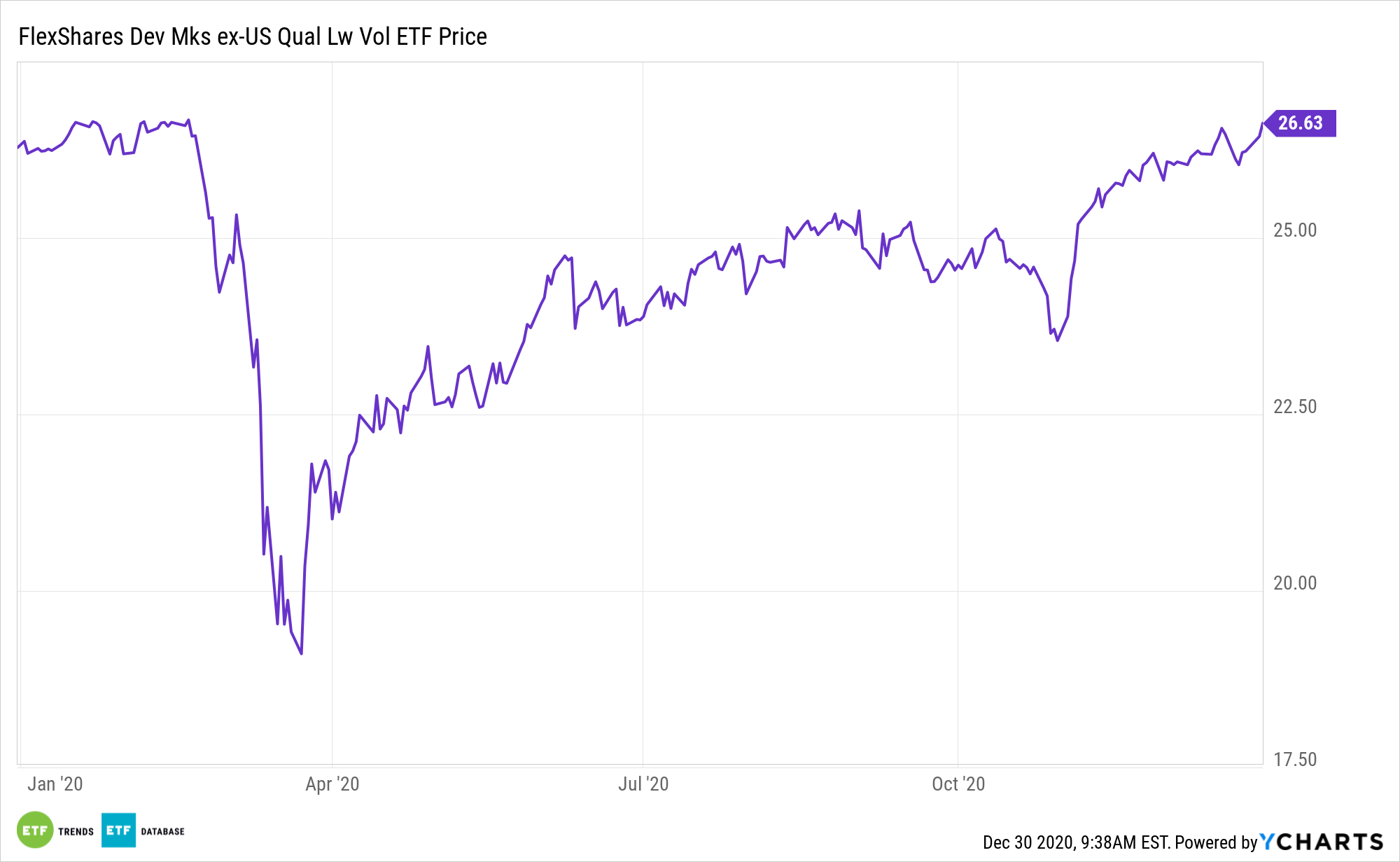

Japanese stocks are turning in some impressive performances. U.S. investors can participate in that upside without the full commitment with diversified developed markets ETFs like the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints, in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

Japan is one of the largest geographic exposures in the FlexShares ETF, making it a relevant consideration for investors looking for ex-US exposure heading into 2021.

“Japanese stocks hit their highest levels in 31 years on Tuesday. Sure, global markets are in a good mood as investors continue to be bullish about the continued economic recovery. But the global economy is also serving Japan well,” reports Jacob Sonenshine for Barron’s.

Investing in Japanese Equities Is Looking Better and Better

Japan has been able to handle the effects of Covid-19 well, especially given its proximity to China. As an FX Street article outlines, the country has been able to rebound faster than the United States.

Value-seeking investors could look to developing markets like Japan if they want to stay away from the heightened risk posed by investing in emerging markets.

“What’s more, Japan is an export-oriented country that wants its currency to be relatively weak to make its exports globally competitive. The won, however, has strengthened against the dollar and the renminbi, both of which are used to buy Japanese exports. Still, the currency headwind for Japan is outweighed by the brightening global economic environment,” according to Barron’s.

Japan does show some solid fundamentals. Specifically, the weaker yen, strong corporate fundamentals, bargain valuations and central bank buying are all positives. Furthermore, Japan’s political temperature is relatively stable. Additionally, stocks in the world’s third-largest economy are inexpensive relative to their U.S. counterparts.

Quality should not be conflated with low volatility, but there are times when quality stocks display low volatility traits. That was the case during the March market swoon, indicating that the quality factor can provide some protection during times of elevated market stress. QLVD’s ability to blend both factors is a potential advantage for investors.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.