Investors are often lead to believe that bonds are steady investments. They can also be wired to think that junk bonds are exceptionally volatile.

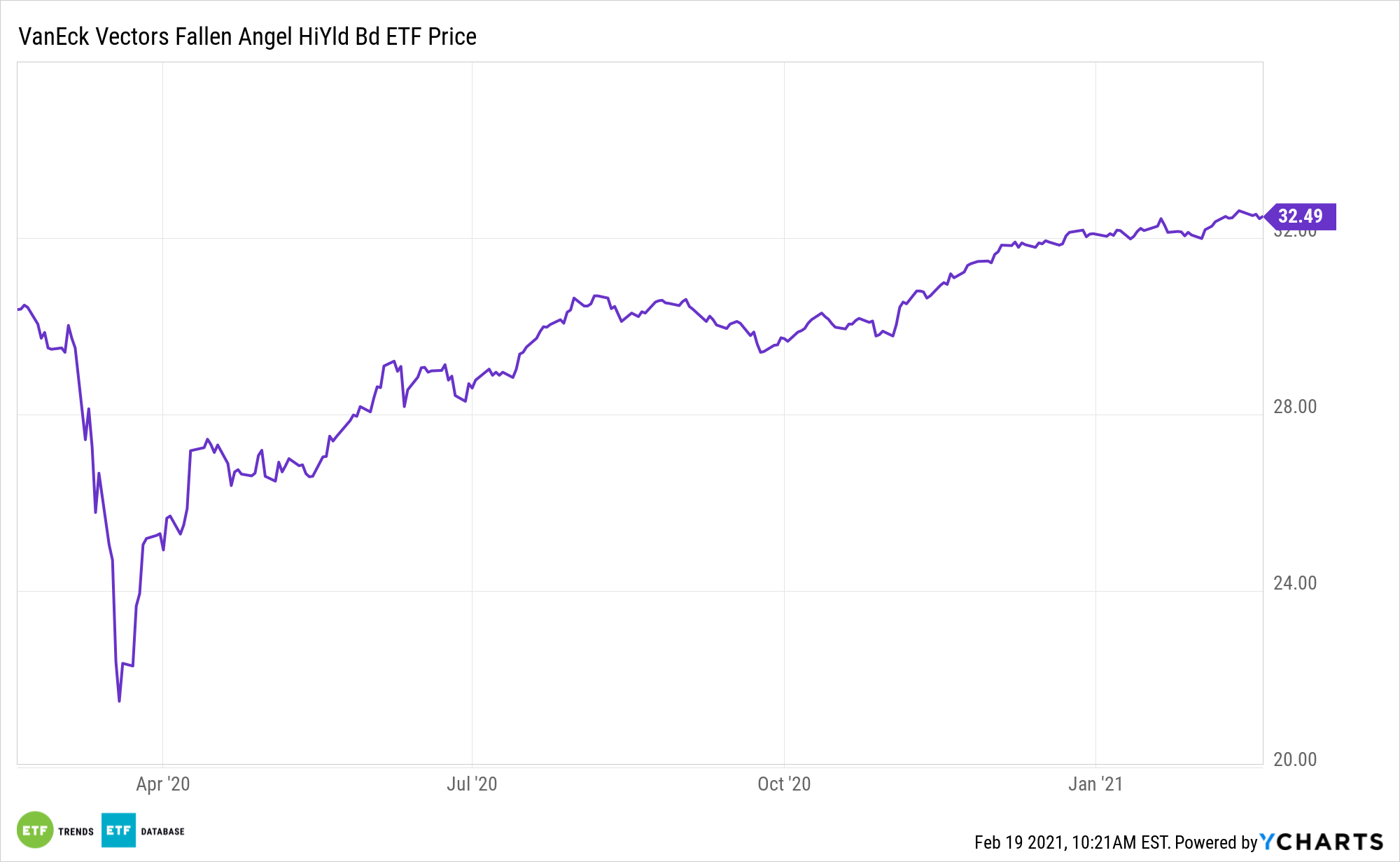

Yet many fallen angels funds like the VanEck Vectors Fallen Angel High Yield Bond ETF (NASDAQ: ANGL) are surprisingly consistent. That’s a positive for investors.

ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index. The index is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance.

“We believe that in this uncertain environment, high yield investors should be selective and focus on fallen angel bonds—which are bonds originally issued with investment grade ratings—as a potential source of outperformance relative to the broad high yield bond market,” writes William Sokol, VanEck senior ETF product manager. “Fallen angels have provided outperformance in 13 of the last 17 calendar years, a level of consistency that we believe may be attractive in a changing market environment such as the one we are currently in.”

ANGL Boasts an Enviable Track Record

Fallen angels have outperformed the broad high yield bond market in 12 of the last 16 calendar years, and that out-performance has often been accrued with a better risk/reward profile than is found with other junk bonds.

“Investors that focused on fallen angel high yield bonds were particularly well positioned for the massive $170 billion wave of downgrades that occurred last year,” notes Sokol. “Fallen angels historically experience forced selling by investment grade investors ahead of a credit ratings downgrade, and are purchased at deep discounts, on average. That discount provides upside potential, and with the significant downgrade volumes, market volatility and risk aversion in the first half of last year, discounts were approximately twice the historical average.”

Historically, fallen angels have provided intriguing opportunities for investors who can be flexible with their portfolios. Thanks to a combination of rules, regulations, and other factors, they have provided selective investors with opportunities to purchase corporate bonds at attractive levels.

“Given today’s low absolute spread levels, the market may be susceptible to bouts of volatility and drawdowns, and fallen angels may provide a cushion in such periods, compared to lower rated high yield bonds,” concludes Sokol. “Higher economic growth and continued low rates, however, will be generally credit positive, in our opinion. In this more favorable credit environment, we think the bigger story could be the potential for more rising stars.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.