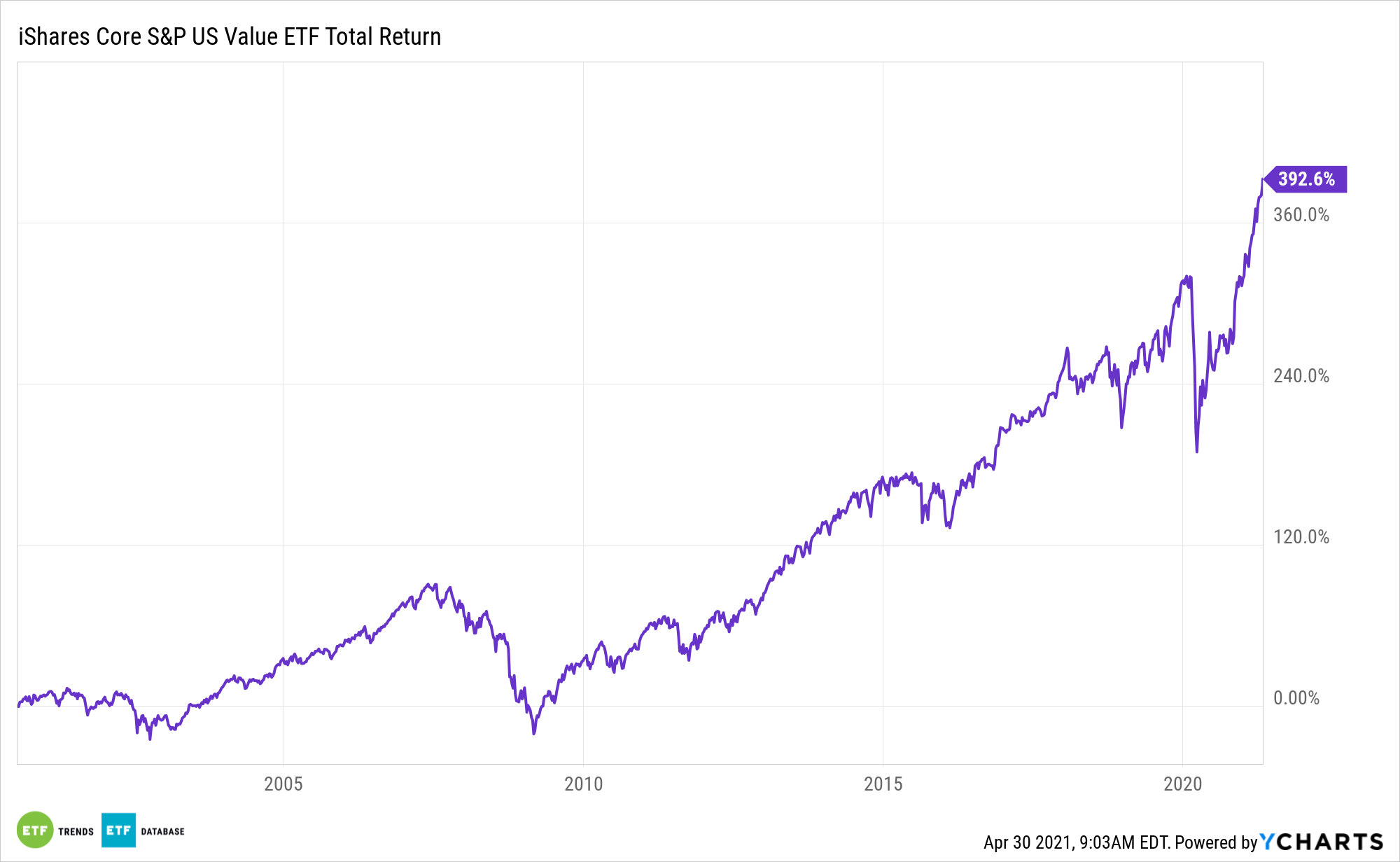

Value stocks are back in a big way and that’s good news for cost-conscious investors who aren’t interested in stock-picking.

The iShares Core S&P U.S. Value ETF (IUSV) is part of that group.

IUSV Seeks to track the investment results of the S&P 900 Value Index, which measures the performance of the large- and mid-capitalization value sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

Although value is on a torrid pace today, investors can still realize stout upside with strategies such as IUSV.

“Despite the recent runup, there may be good reason for some investors to explore value-oriented mutual funds and exchange-traded funds today,” writes Morningstar’s Susan Dziubinski. “If you’ve been using discrete funds for your growth and value exposures, for instance, you may find that your once-balanced style portfolio is still woefully out of whack: Specifically, it may be light on value given growth’s extended run. Or you may be among those who think that value stocks are, in fact, staging a comeback, and you’d like to tilt your portfolio toward that style.”

IUSV: Inexpensive and Effective

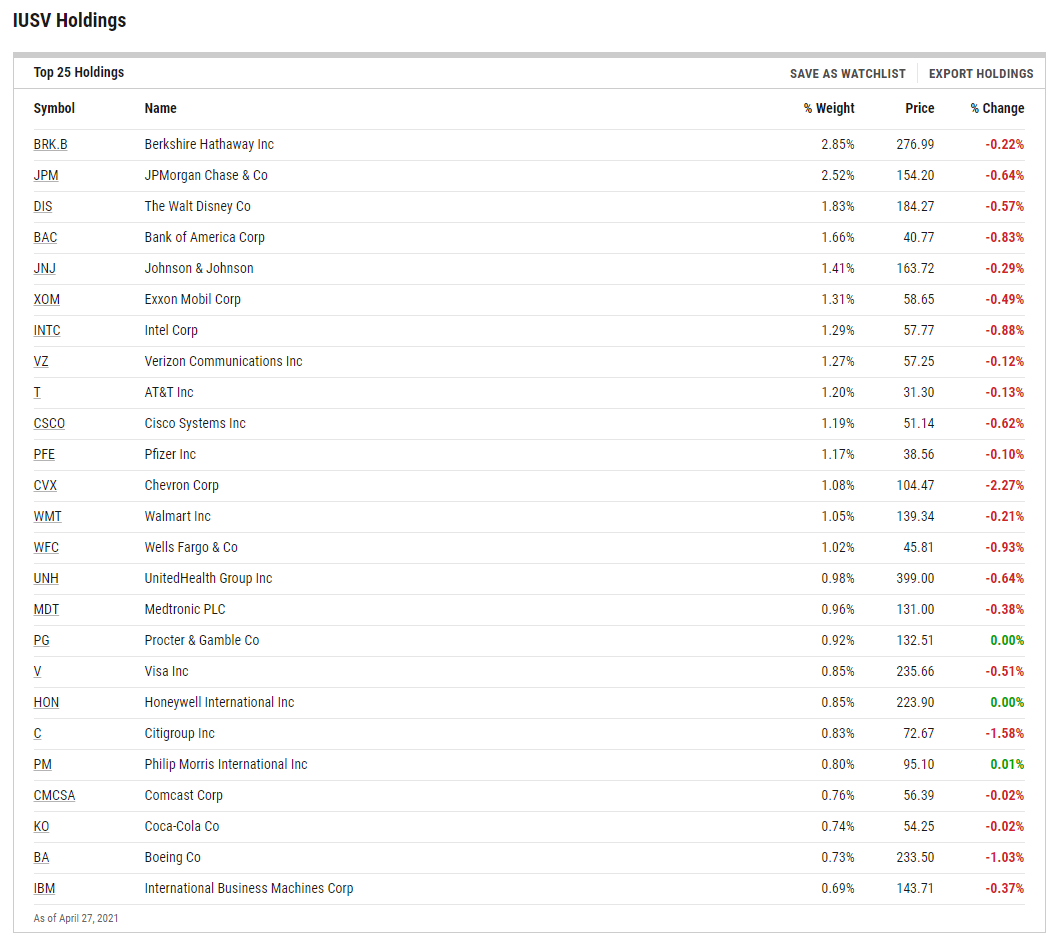

The $9.79 billion IUSV holds 743 stocks. That broad-based exposure comes cheap as the iShares fund charges just 0.04% per year, or $4 on a $10,000 investment, making it one of the least expensive funds in the value category.

IUSV also does an admirable job of mixing devoted dividend companies and some that are only recently starting to embrace payouts.

See also: Top 103 Value ETFs

“Some value funds, for instance, place a greater emphasis on dividend-paying stocks than others. (And not all dividend-seekers are alike,” adds Dziubinski. “Several favor high-yielding stocks, while many prefer dividend growers carrying lower yields.) Other large-value funds don’t have dividends on the brain–income is secondary, if it’s considered at all. Those preferences can lead to different performance and risk profiles.”

IUSV is up 15.22% year-to-date.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.