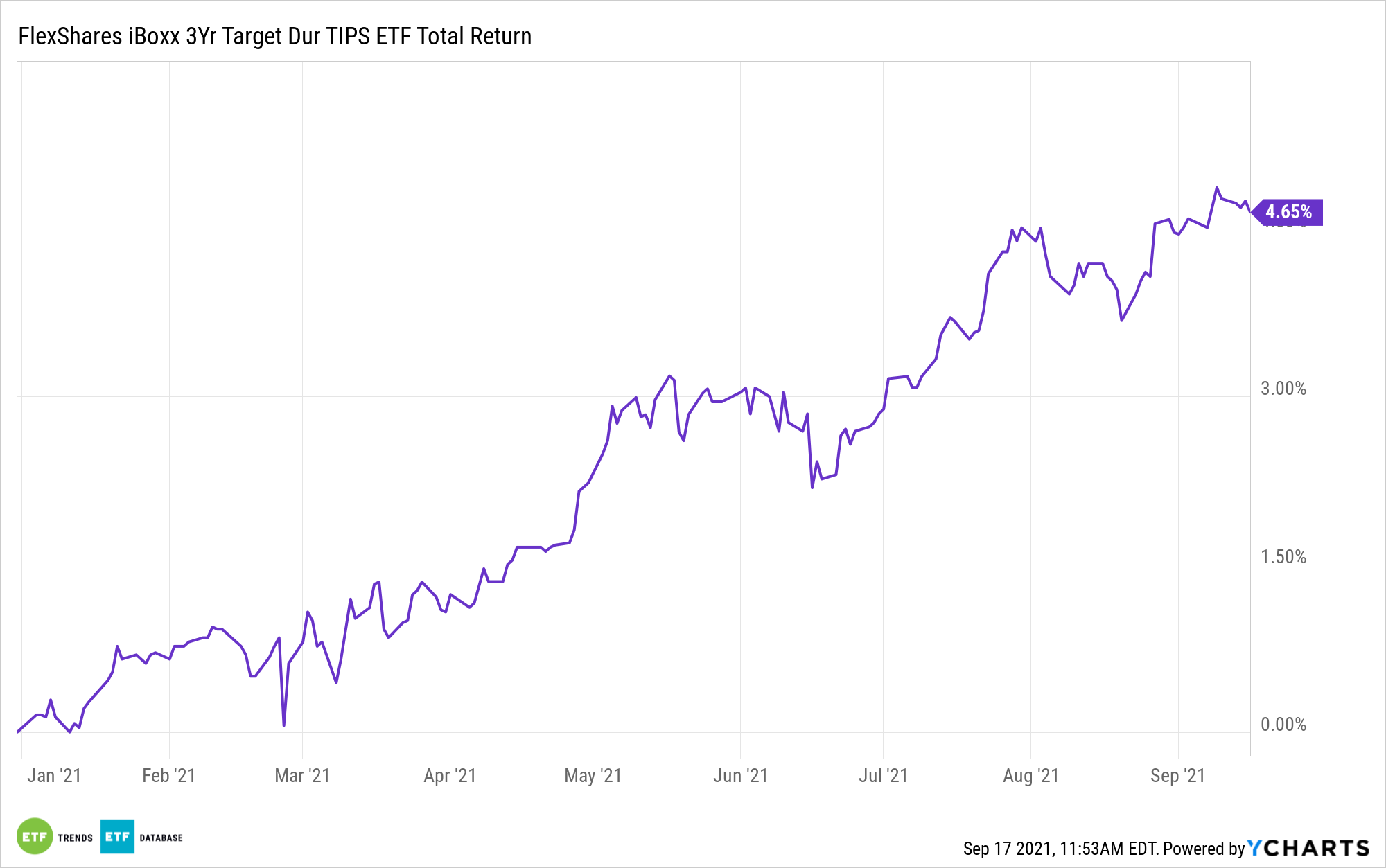

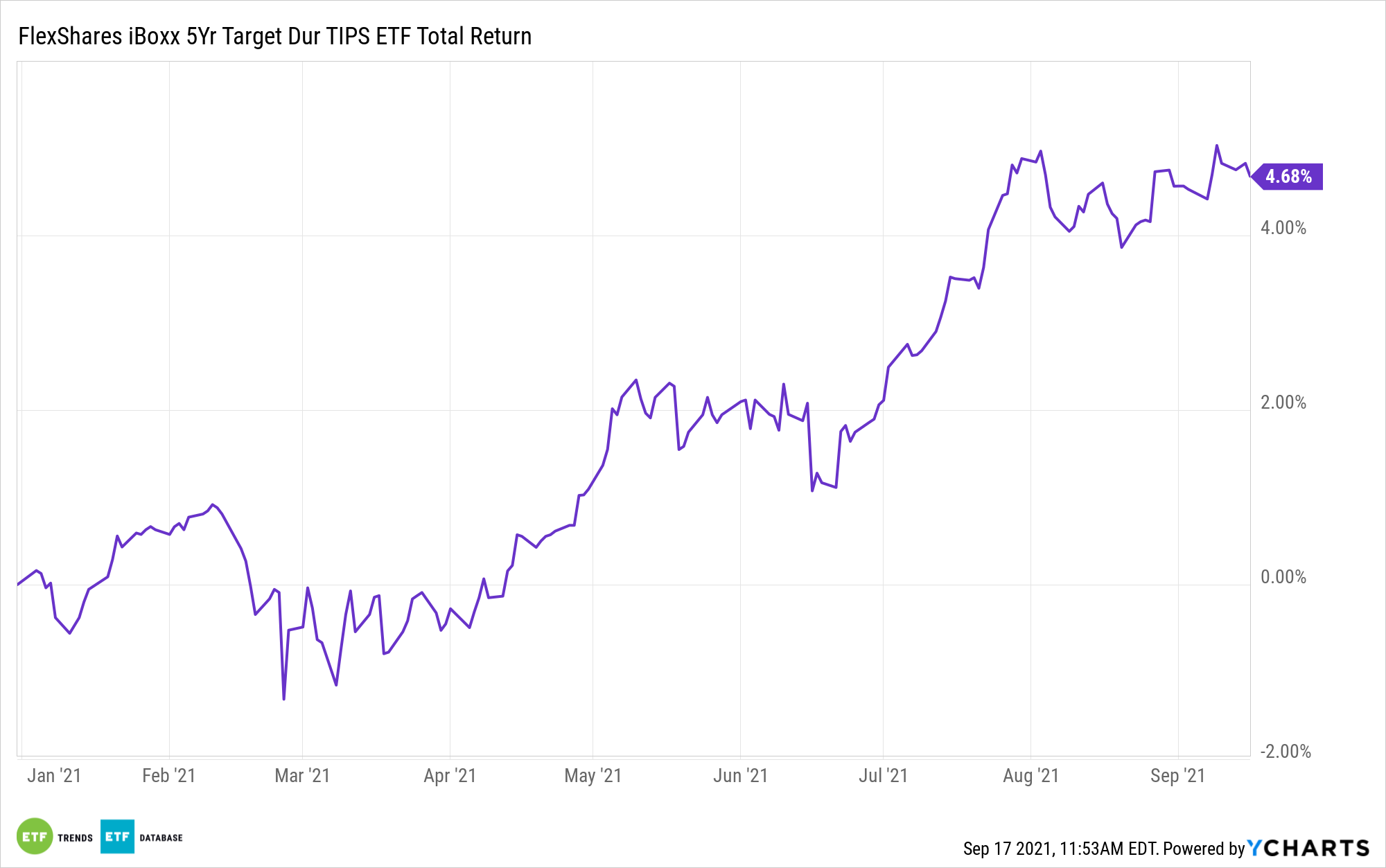

Getting inflation protection is one thing, while targeting duration is another. Both can be accomplished with the FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (TDTT) and the FlexShares iBoxx 5-Year Target Duration TIPS Index Fund (TDTF).

As consumer prices move higher this year, fixed income investors can brace themselves for any further moves with Treasury-inflation protected securities (TIPS). However, for the discerning fixed income investor who wants to limit their duration in TIPS in the event that consumer prices come down, TDTT and TDTF can accomplish just that.

“Protecting against inflation is a popular investment strategy for many investors,” a FlexShares Fund Focus said. “And in their pursuit of inflation-hedging investments, Treasury Inflation-Protected Securities, or TIPS, often are investors’ top choices.”

“However, investors using TIPS must consider these securities’ duration—a key measurement of sensitivity to interest rate movements,” FlexShares said. “We believe that targeting a specific duration based on a portfolio’s interest rate exposure is key to successfully protecting against the threat of inflation. That being said, TIPS present more challenges to managing duration than most other fixed-income investments.”

First up, TDTT seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the iBoxx 3-Year Target Duration TIPS Index. The underlying index reflects the performance of a selection of TIPS with a targeted average modified adjusted duration, as defined by the index provider, of approximately three years.

The second option, TDTF, seeks to provide investment results that correspond generally to the price and yield performance of the iBoxx 5-Year Target Duration TIPS Index. Like TDTT, the underlying index reflects the performance of a selection of TIPS.

Focusing on Modified Adjusted Duration (MAD)

One of the advantages of both ETFs is that they don’t only rely on the inherent benefits of simply holding TIPS. The secret sauce has to do with what FlexShares calls modified adjusted duration (MAD).

“TIPS bonds require a unique duration metric called modified adjusted duration (MAD) in order to judge their performance against the broader market of fixed-income securities,” FlexShares said. “MAD is the market’s estimate of the duration on a TIPS bond based on inflation expectations at that point in time. Since inflation expectations are highly variable, a TIPS bond’s MAD can change quickly.”

For more news, information, and strategy, visit the Multi-Asset Channel.