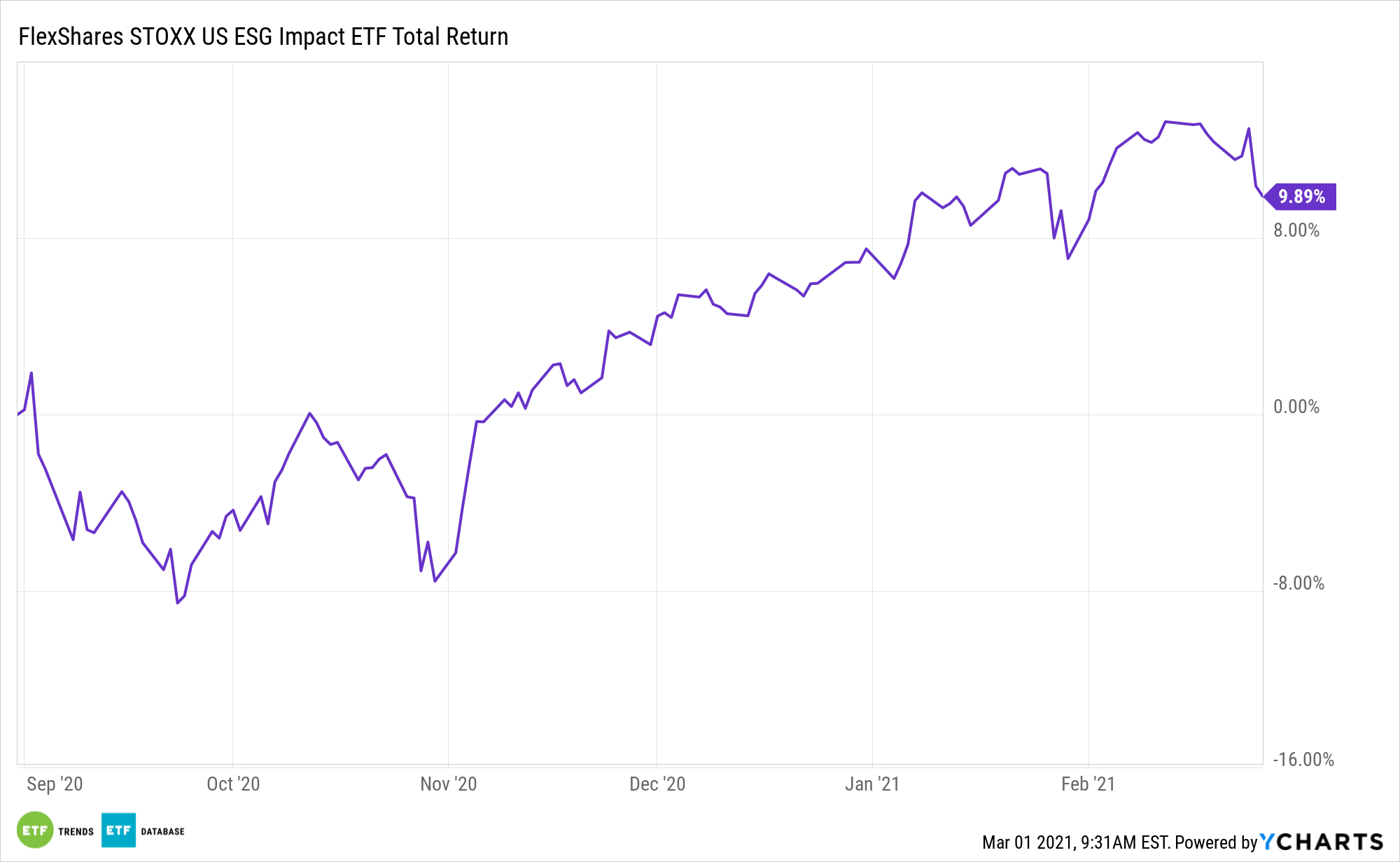

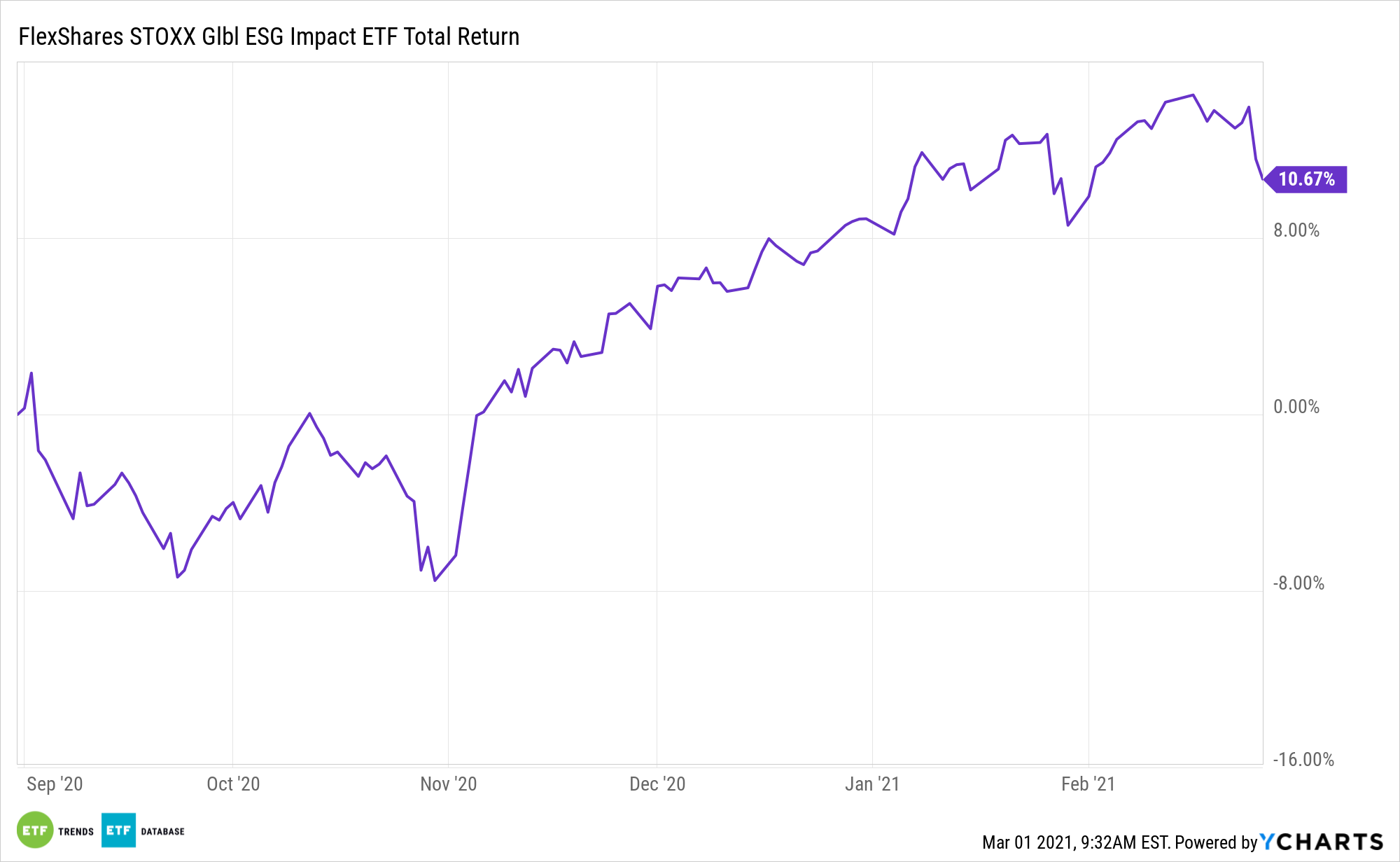

Advisors and investors are increasingly focusing on sustainability, and that momentum will keep powering exchange traded funds like the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

Data confirm asset allocators’ rising affinity for sustainable investments.

“At the end of 2020, the group of sustainable open-end funds and exchange-traded funds available to U.S. investors numbered 392, up 30% from 2019. The group has experienced a nearly fourfold increase over the past 10 years, with significant growth beginning in 2015,” writes Morningstar analyst Jon Hale.

Investors Prioritizing Sustainability

There is growing demand for socially responsible investing that will not only help investors post strong results, but do so in a way that does not negatively impact the world.

“In 2020, sustainable funds were more attractive than ever for U.S. fund investors. For the fifth calendar year in a row, sustainable funds set an annual record for net flows: Flows reached $51.1 billion, with $20.5 billion of that coming in the fourth quarter,” says Hale.

Investors should consider the diversification benefits of socially responsible investments and how they might enhance a core portfolio position through ESG exchange traded fund strategies.

Experts believe socially responsible investing covers more than just environmental aspects like climate change, protection of natural resources, pollution, and ecological opportunities. It also includes social and governance factors as well.

Fund issuers are rushing to meet the demand, and investors should expect more new launches on this front.

“Sustainable fund launches continued a multiyear growth trend that began in 2015 when 24 new funds were launched, a record at the time. At least 30 funds have been launched each year since. In 2020, the 71 new funds that were launched easily topped the previous high-water mark of 44 set in 2017,” concludes Hale.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.