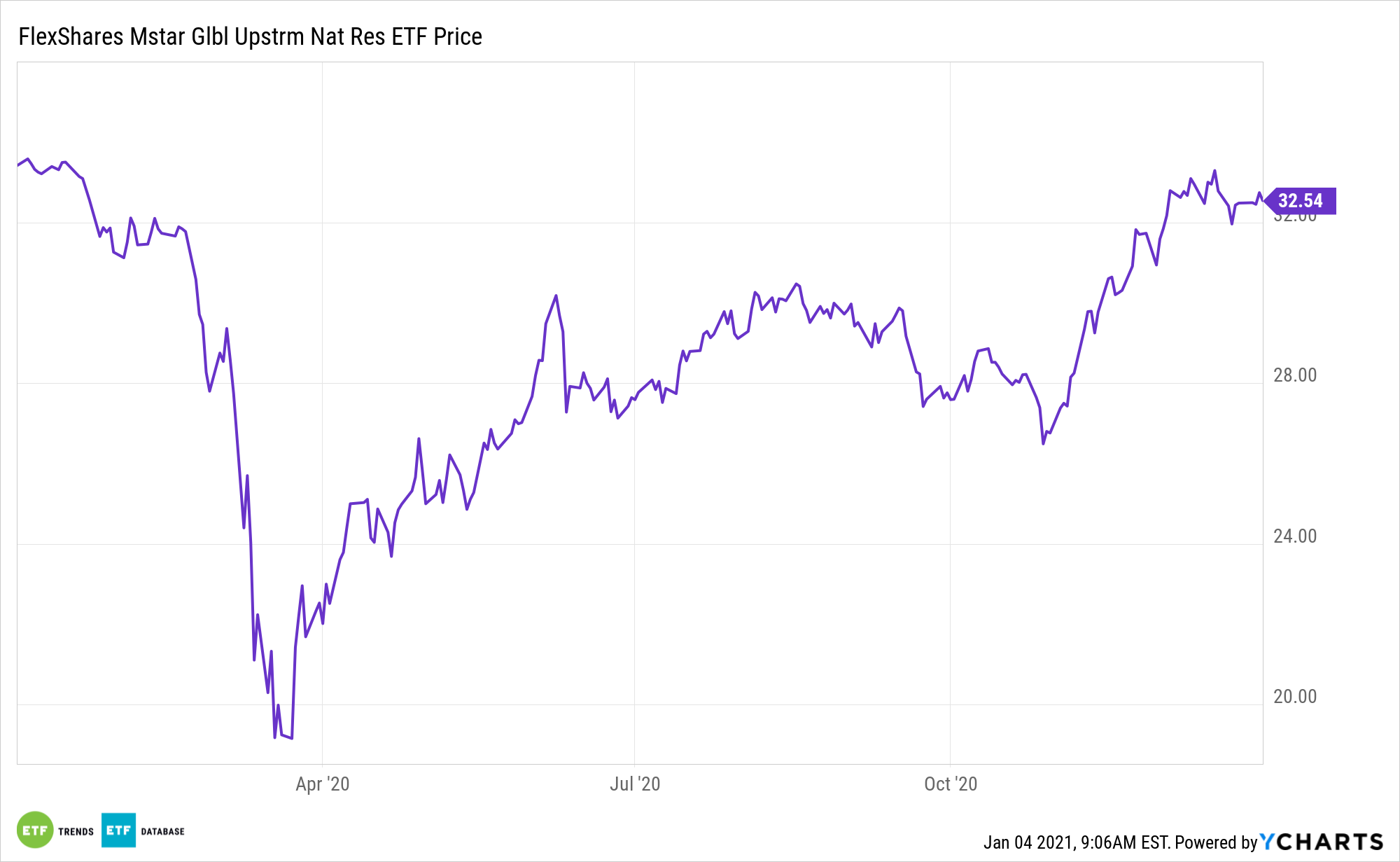

The S&P 500 Energy Index lost 37% last year, making the sector the worst-performing group in the index. Yet there are encouraging signs for the sector entering 2021, and that could pave the way for upside with exchange traded funds such as the FlexShares Morningstar Global Upstream Natural Resource Index Fund (NYSEArca: GUNR).

GUNR provides exposure to the rising demand for natural resources and tracks global companies in the energy, metals, and agriculture sectors, while maintaining a core exposure to the timberlands and water resources sectors, part of its risk management theme.

Energy’s late 2020 resurgence is widely attributable to success on the coronavirus vaccine front. The faster a vaccine comes to market, the more rapidly demand will increase as industry ramps up and Americans unleash pent-up travel demand.

“I think 2021 would be better than 2020. That said, if you look globally, the coronavirus pandemic is still raging,” notes Morningstar analyst Allen Good. “We do have some vaccine announcements, but they should take some time to roll out. We anticipate a continued economic recovery as we move through 2021. We’d estimate that this results in an improvement in commodity prices throughout the year.”

The GUNR ETF and an Energy Outlook

GUNR specifically identifies upstream natural resources equities based on a Morningstar industry classification system, with a balanced exposure to three traditional natural resource sectors, including agriculture, energy, and metals. With some wild moves in downtrodden energy stocks, the gambling element of energy investing is back, but investors can take some risk out of the equation with GUNR.

“So, just as these resources are ramping up in the next few years, you could have a situation where demand is returning back to normal levels and then you have a dearth of supply as investment is falling off. And so, ultimately, you could be looking at a situation where you get much higher prices as supply is insufficient to meet demand,” according to Good.

Some data points indicate sell-side analysts remain bullish on energy stocks, including some GUNR components. Valuation may be one reason why. The recent sell-off may have opened up a potential buying opportunity for bargain hunters, especially in the oversold energy sector. For example, Exxon Mobil (NYSE: XOM), a 2020 laggard, is now considered cheap on valuation.

Exxon “sold off in response to its greater investment plans and its investments in oil and gas. However, as I mentioned, I think this actually creates an opportunity then for differentiation a few years down the road as the underinvestment does ultimately lead to higher oil and gas prices as well as refining margins,” adds Good.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.