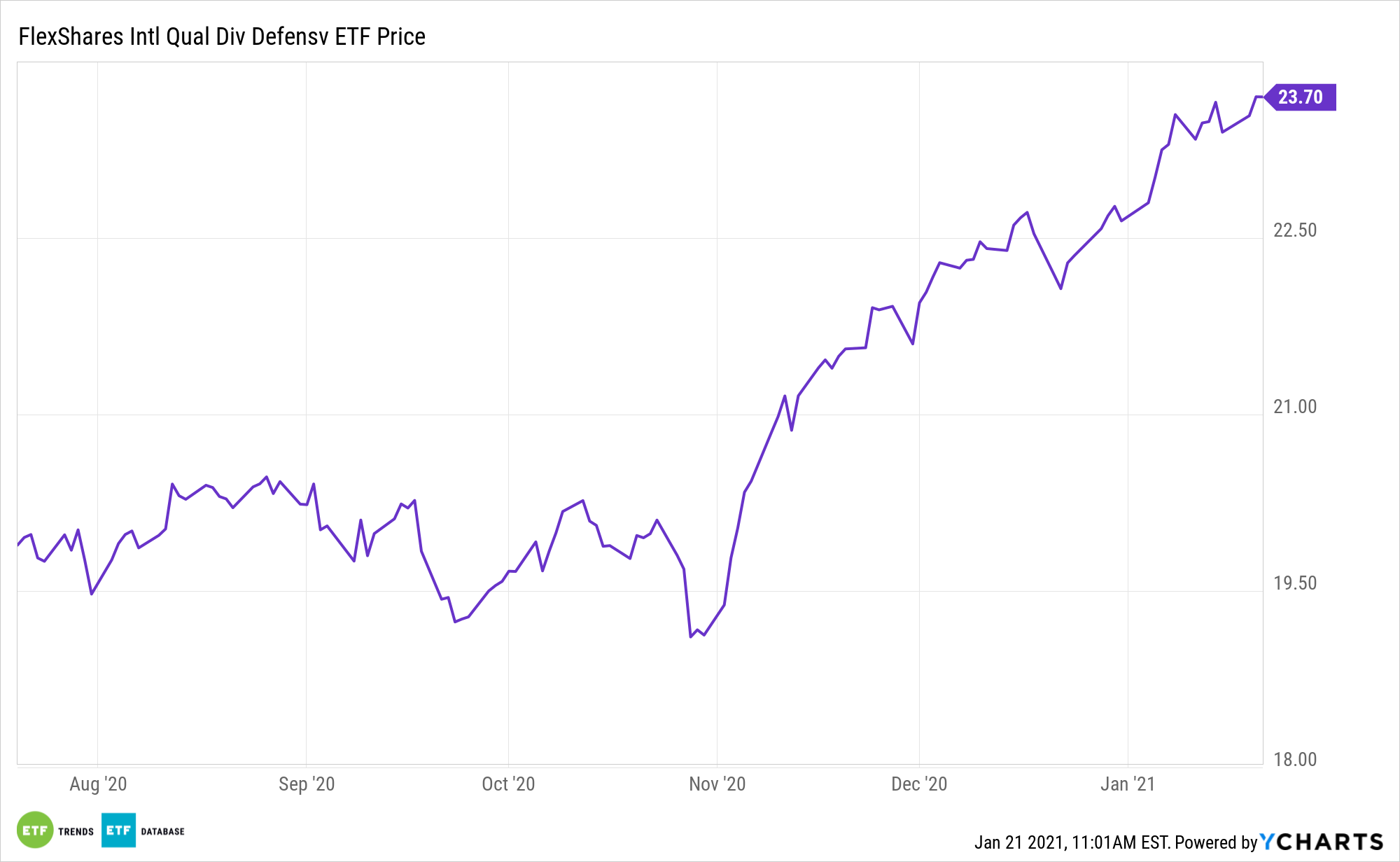

Global dividends are poised to increase this year. Investors can tap into that positive trend with some quality exposure via the FlexShares International Quality Dividend Defensive Index Fund (NYSEArca: IQDE).

IQDE, which is seven years old, follows the Northern Trust International Quality Dividend Defensive Index. The index provides exposure to high-quality, income-monitored portfolios of non-U.S. international equities that are weighted by targeted overall beta between 0.5 and 1.0 times that of the Parent Index, dividend yield, quality factors, and lower total risk.

“IHS Markit expects dividends declared this year to approach $1.78 trillion, up about 7% from $1.67 trillion in 2020. In compiling the report, IHS Markit relied on dividend forecasts for more than 12,500 global firms, including the constituents of all the major equity indexes,” reports Lawrence Strauss for Barron’s.

IQDE Intrigue: The ETF’s Methodology

IQDE screens for management efficiency, profitability, and cash flow. Each company has to show management efficiency, firms that efficiently deploy capital and make smart financing decisions. Companies with wider profit margins are in better positions to grow and maintain dividends than those with slimmer margins. Additionally, firms that can meet debt obligations and day-to-day liquidity needs are better capable of maintaining dividends.

“We expect the Brexit deal, the conclusion of US elections and the availability of the vaccine to reduce uncertainty and encourage more companies to resume payments or grow dividends in 2021,” said Markit.

Adding to the case for IQDE, Ex-U.S. developed market dividend payers often feature larger yields than their U.S. counterparts, an assertion proven by comparing large- and mega-cap dividend stocks from familiar dividend sectors such as consumer staples, energy, financial services, and telecommunications.

The recurring narrative is that yield is hard to come by nowadays, but fixed income investors still have options. One of those is looking overseas, and these three exchange-traded funds (ETFs) do just that while offering investors the yield options they desire.

“IHS Markit forecasts that technology and health care, which have held up relatively well versus many other sectors during the pandemic, will be the top contributors to U.S. dividends,” adds Barron’s.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.