Part of the allure of fallen angel bonds and the VanEck Vectors Fallen Angel High Yield Bond ETF (NASDAQ: ANGL) is that this form of debt usually sports better quality than bonds born with junk ratings.

ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index. The index is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance.

“Credit ratings upgrades from high yield to investment grade (“rising stars”) may provide a more meaningful source of value for high yield investors this year compared to 2020, given expectations for US economic growth to accelerate this year,” writes VanEck analyst Nicholas Fonseca.

Another ANGL Perk

Another benefit of ANGL relative to traditional junk bond exchange traded funds is that fallen angels historically have better chances of returning to investment-grade status, whereas corporate debt originating in junk territory struggle to get to investment-grade territory.

“On average, 5.5% of fallen angels per year have historically regained investment grade status per year vs 2.8% of the broad high yield market (since 2003),” notes Fonseca. “After a dearth of rising stars in 2020 amid a wave of downgrades, rising stars could emerge again in 2021.”

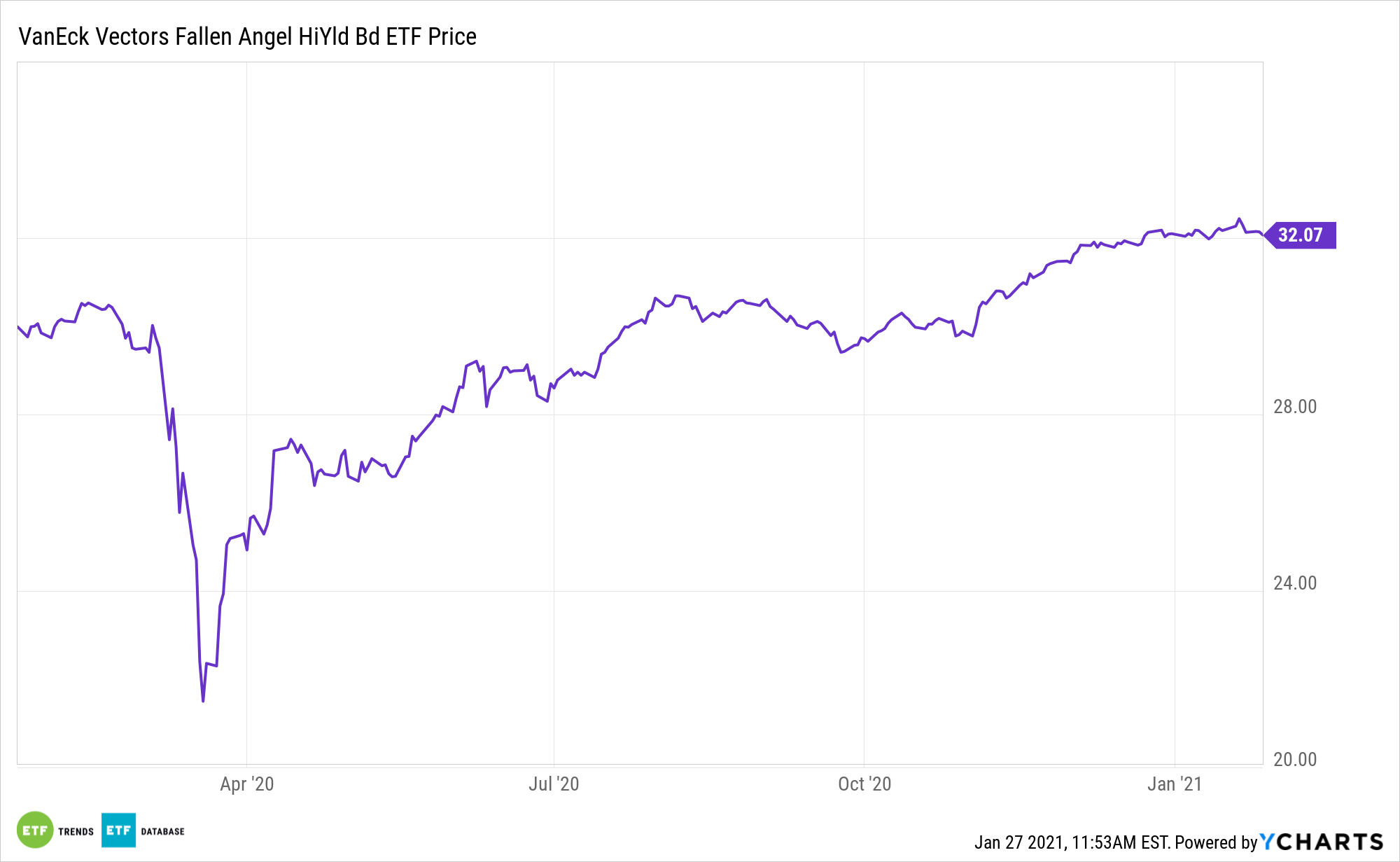

Fallen angels, high yield bonds originally issued as investment grade corporate bonds, have had historically higher average credit quality than the broad high yield bond universe. ANGL is off to a strong start in 2021, confirming its importance to yield-seeking bond investors this year.

Investors are returning back into areas of the market that suffered the brunt of last year’s blow, which includes junk bonds and fallen angels. Fallen angels experienced mechanical selling after being downgraded from high-grade indexes.

With the vaccine rollout picking up, investors are returning to the reflation trade and the hunt for more attractive yields in a low-rate environment. Wells Fargo Investment Institute argues that this has increased the appeal of recently downgraded debt.

“The structural distinction between the high yield and investment grade corporate bond markets results in forced selling of fallen angels, while a lag in credit ratings actions results in this forced selling occurring ahead of the actual downgrade. Historically, fallen angels experienced an average price decline of about ~6-7% in the 6 months prior to being downgraded, followed by a complete price recovery over the following 6 months,” concludes VanEck.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.