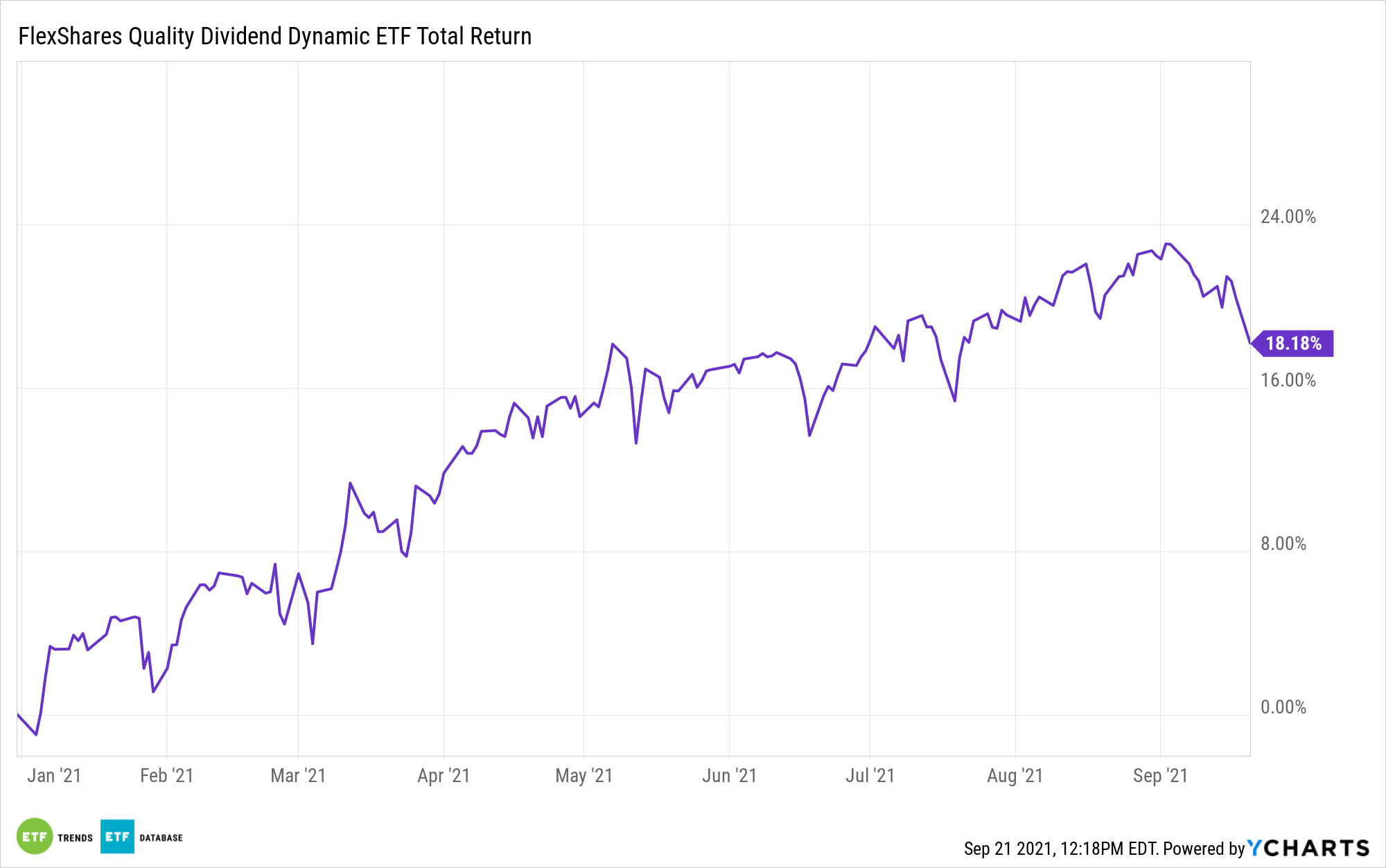

Dividend investing isn’t just about finding the highest payout. Focusing on quality is also important. This is inherent in ETFs such as the FlexShares Quality Dividend Dynamic Index Fund (QDYN).

This ETF essentially dives into a multiverse of dividend-paying stocks and extracts the best options with a quality screener. This is accomplished via the index it follows.

QDYN’s underlying index targets management efficiency or quantitative evaluation of a firm’s deployment of capital and its financing decisions. By using a management efficiency screen, the index can screen out firms that aggressively pursue capital expenditures and additional financing, which typically lose flexibility in both advantageous and challenging partitions of the market cycle.

“Starting with the Parent Index, the Northern Trust 1250 Index4, which represents 1,250 large and mid-capitalization U.S. public companies, NTI first eliminates all non-dividend paying stocks,” a FlexShares Fund Focus said. “Then, they apply a multi-faceted Dividend Quality Score (DQS) to measure a company’s core financial health and evaluate whether it may increase (or decrease) its future dividends.”

As mentioned, QDYN essentially plays the long game when it comes to dividend investing. The fund’s strategy uses a quality filter to extract the holdings that can sustain their dividend payouts over time.

“The DQS approach to underlying index construction recognizes the real-world goals behind dividend investing strategies—namely, to generate sustainable income from a portfolio and to harness the long-term return potential of dividend-paying stocks,” the Fund Focus said.

Focused on Drivers of Return

According to a recent FlexShares article, Insights From A Decade of ETF Investing, a singular focus on drivers of return is one of the recipes for success in the FlexShares ETF lineup. Which strategy is the flavor of the month is less important than drivers of return that have stood the test of time.

“Why do investors invest? To try to reach their goals,” the article said. “So when we build our ETFs, we emphasize specific attributes that historically have been rewarded with risk-adjusted returns. Focusing on those underlying drivers of investment results, rather than weighting by market capitalization, is intended to produce more stable and reliable returns through a variety of economic and market environments.”

“Take 2020, when many companies that traditionally paid high dividends suddenly couldn’t sustain their payments,” the article added. “Our quality scoring methodology, which takes cash flow(1) metrics into account, helped to support our strategies’ results.”

For more on multi-asset strategies, visit our Multi-Asset Channel.