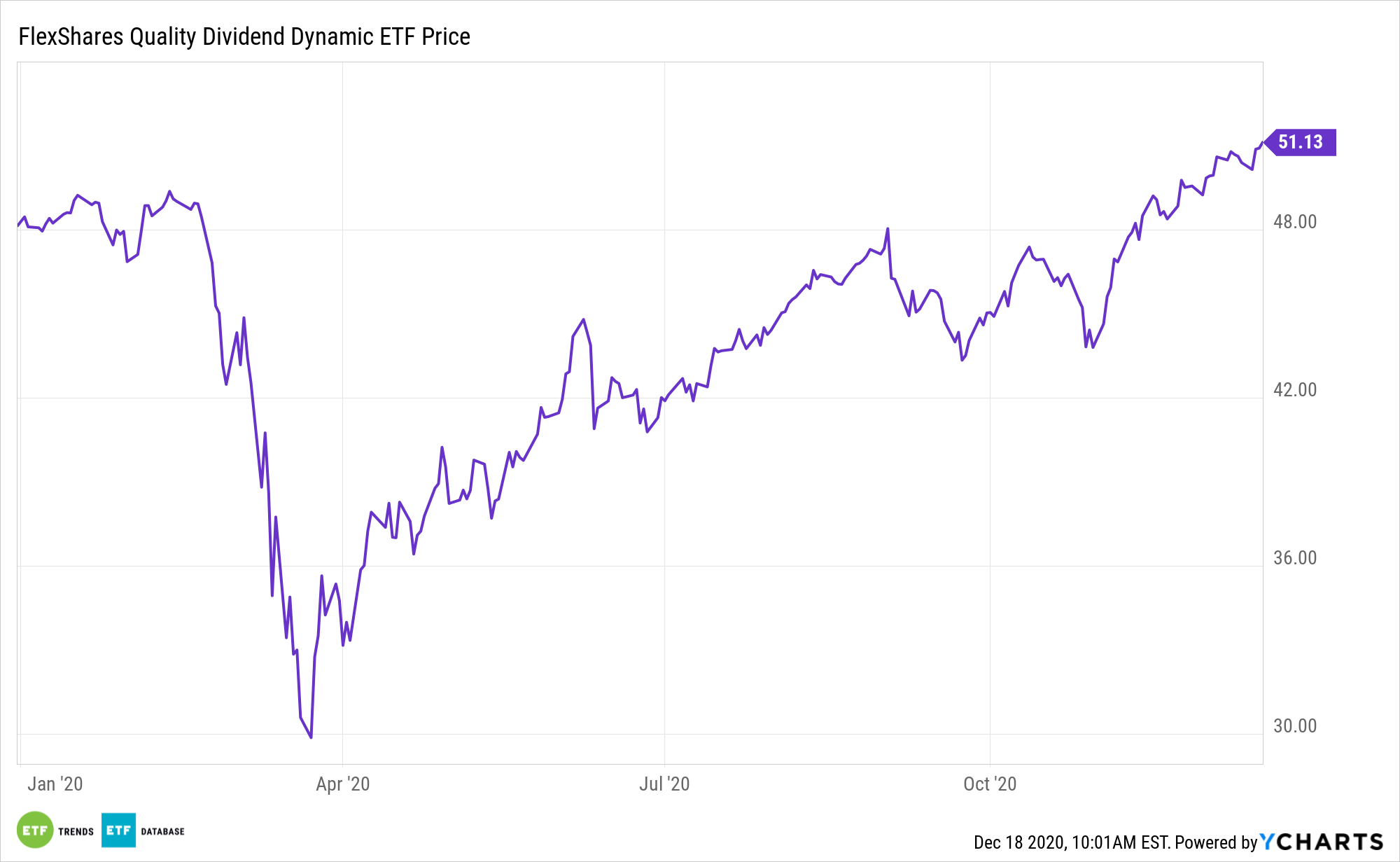

Expectations are in place that 2021 will be far kinder to dividends and payout growth than this year has been. Investors can position for that improving outlook with exchange traded funds such as the FlexShares Quality Dividend Dynamic Index Fund (NYSEArca: QDYN).

QDYN’s underlying index targets management efficiency or quantitative evaluation of a firm’s deployment of capital and its financing decisions. By using a management efficiency screen, the index can screen out firms that aggressively pursue capital expenditures and additional financing, which typically lose flexibility in both advantageous and challenging partitions of the market cycle.

“Considering how bad things looked for dividends earlier in the pandemic, 2020 has turned out to be a serviceable year for equity income investors, after all. Even better: 2021 should get back on track and bring rising dividends—and more stock buybacks,” reports Lawrence Strauss for Barron’s.

With QDYN, profitability score is also taken based on a firm’s relative competitive advantage across several metrics. Firms with wider margins typically are better-positioned to expand compared to those with tighter margins. Importantly, QDYN is reliant on backward-looking dividend growth streaks.

QDYN Benefits: Tech Weighting, Dividend Optimism, and More

An obvious benefit of QDYN and one that highlights the ETF’s quality purview is a 28.1% weight to technology stocks, an overweight allocation relative to many traditional dividend funds. That trait sets up QDYN to capitalize on an improving dividend growth outlook for 2021.

Companies are increasingly confident in growing dividends again, even as another surge in Covid-19 cases threatens earnings. According to FactSet estimates, S&P 500 per-share earnings are expected to bounce 22% in 2021—to above 2019 levels.

As a result, companies are feeling better about returning more of their capital to shareholders. S&P 500 dividends are expected to grow 3% in 2021 from 2020, according to FactSet. The payout ratio—the percent of earnings companies use to pay dividends — is expected to fall to about 35% from 42%, but the pure growth in dividend dollars still provides an attractive yield opportunity at current prices.

“Looking ahead, Goldman expects dividends paid out by S&P 500 companies to increase by about 5% in 2021 to $534 billion,” according to Barron’s. “What’s more, the company says that next year should also be better for buybacks, which took an even bigger hit this year as companies tried to preserve capital. Goldman Sachs expects S&P 500 share repurchases to total $602 billion in 2021, up 15% from $524 billion this year—but still well below 2019’s level of about $750 billion. The firm has forecast a 30% drop in share repurchases this year to $524 billion.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.