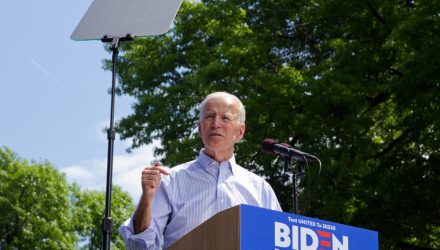

2020 Election candidate and former vice president Joe Biden proposed spending $2 trillion within the next four years for clean energy development, as well as rebuilding the nation’s infrastructure.

“These aren’t pie in the sky dreams. These are actionable policies that we can get to work on right away,” Biden said during a speech in his hometown of Wilmington, Delaware.

“We can live up to our responsibilities, meet the challenges of a world at risk of a climate catastrophe, build more climate resilient communities, put millions of skilled workers on the job, and make life markedly better and safer for the American people all at once and benefit the world in the process,” he added.

Infrastructure ETF Opportunity

Opportunities in infrastructure ETF include the FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEArca: NFRA). NFRA tries to reflect the performance of the STOXX Global Broad Infrastructure Index, which identifies equities that derive the majority of revenue from infrastructure business, providing exposure to not only infrastructure sectors, but non-traditional ones as well.

Investors considering NFRA or any other infrastructure asset are betting this time will be different when it comes to policy execution and implementation. NFRA’s index focuses on long-lived assets in industries with very high barriers to entry, with at least 50% of their revenue from key sectors with a 3-month average daily trending volume of at least $1 million.

The portfolio is weighted based on a free-float market cap with certain constraints to limit exposure in any one security, sub-sector, or country. Additionally, the fund is rebalanced annually.

ESG ETF Exposure

Investors who want ESG exposure via an ETF wrapper can take a look at the Xtrackers MSCI EAFE ESG Leaders Equity ETF (EASG). EASG seeks investment results that correspond generally to the performance of the MSCI EAFE ESG Leaders Index.

The fund will invest at least 80% of its total assets (but typically far more) in component securities (including depositary receipts in respect of such securities) of the underlying index. The underlying index is a capitalization-weighted index that provides exposure to companies with high ESG performance relative to their sector peers.

An additional fund to look at is the Xtrackers MSCI USA ESG Leaders Equity ETF (NYSE Arca: USSG), which has been a popular play for investors seeking exposure to socially responsible investments. USSG was developed in collaboration with Ilmarinen, Finland’s largest pension insurance company. The underlying MSCI USA ESG Leaders Index provides exposure to large- and medium-cap U.S. companies with high ESG performance relative to their sector peers.

For more on multi-asset strategies, please visit our Multi-Asset Channel.