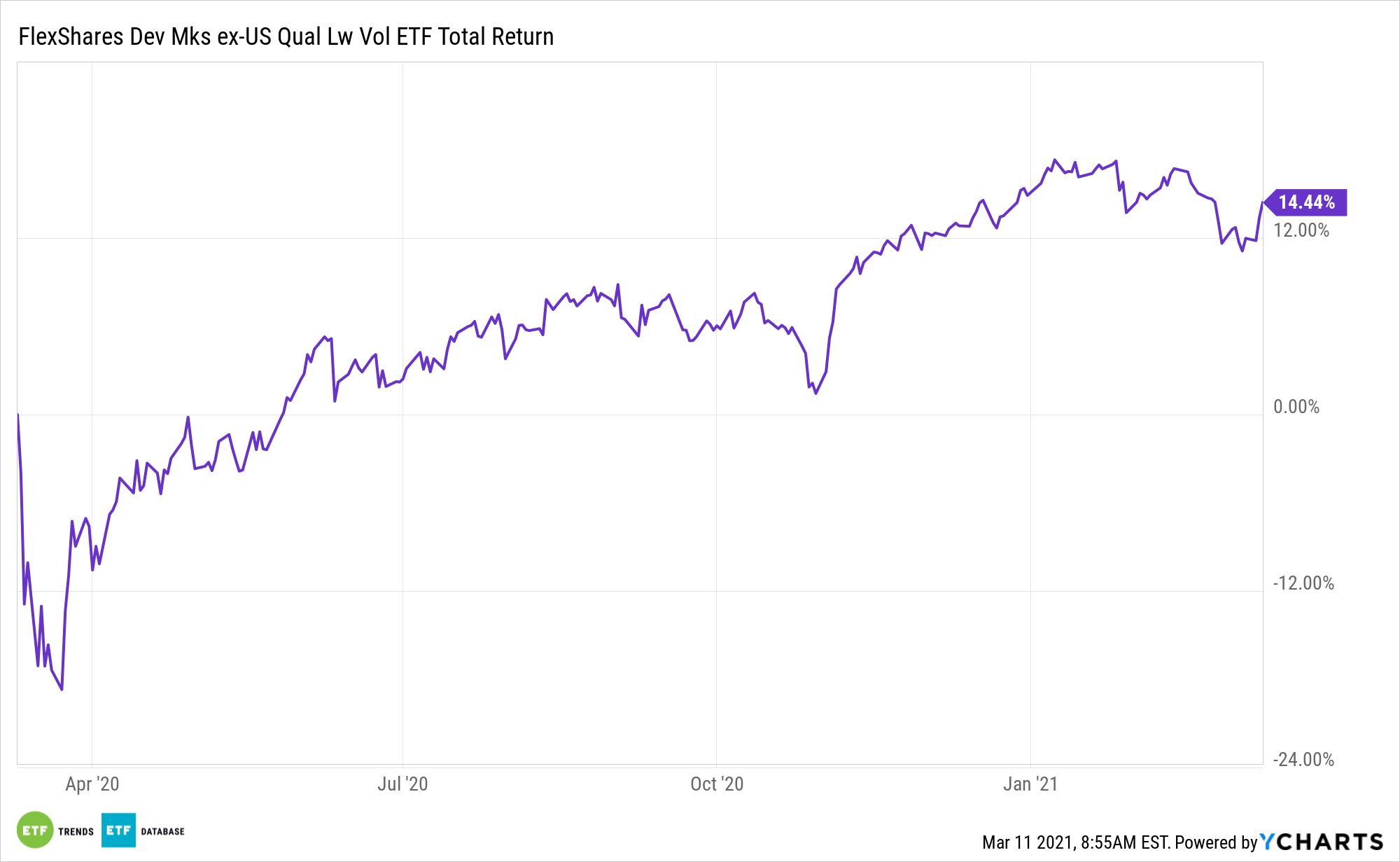

While a strong case is being made for European equities thanks to the cyclical value resurgence, Japanese stocks are another reason for investors to consider the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

Japan is the largest country weight in QLVD at nearly 26%, and that’s important because…

“Japanese stock indices have outperformed those in the U.S. since Nov. 6, when companies began releasing clinical-trial data that led to expectations that vaccines for Covid-19 might soon be approved. Global stocks took off, but the gain since then for the MSCI Japan index has been 15% in local-currency terms, while the has risen just under 10%,” reports Jacob Sonenshine for Barron’s.

QLVD: A Jump for Japanese Allocations

As its name implies, QLVD is a diversified fund, not a dedicated Japan product. But combine geographic diversification with more-than-adequate Japanese exposure, and QLVD begins to look extremely positive for Japanese bulls.

The country shows solid fundamentals. Specifically, the weaker yen, strong corporate fundamentals, bargain valuations, and central bank buying are all positives. Furthermore, Japan’s political temperature is relatively stable. Further still, stocks are inexpensive relative to their U.S. counterparts, bolstering the near-term case for QLVD.

“The outperformance in Japan thus far isn’t a surprise. The country’s stock indices are heavily weighted toward companies that benefit greatly from a global economic recovery. Many of the businesses are in economically-sensitive sectors, and given Japan’s dependence on exports, they bring in revenues from all around the globe,” adds Barron’s.

See also: As Japan Heals, Keep Your ETFs Hedged with ‘DBJP’

Another reason QLVD is worth considering today is that many of its sector and geographic exposures are levered to the aforementioned cyclical value trade.

“Roughly 55% of the market capitalization on the MSCI Japan Index is represented by cyclical sectors, with large weightings in consumer discretionary and manufacturing, according to MSCI. The MSCI U.S. Index, by comparison, has only about a third of its market cap from cyclical sectors,” concludes Barron’s.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.