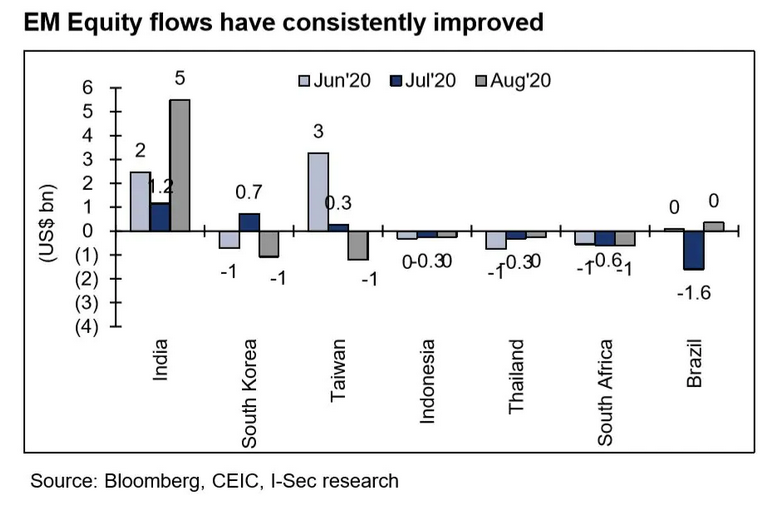

As more economies look to reopen following the economic effects of Covid-19, more investors are turning the risk dial-up ad taking on emerging markets equities. One of the leaders that’s been attracting foreign investors is India.

“India has outperformed other emerging markets in terms of inflows from foreign portfolio investors (FPI). The FPI equity inflows in August 2020 so far stands at $6 billion mark,” Ankit Gohel write in a CNBC TV18 article. “Analysts believe that the recent share sale by many listed companies and reducing interest rates have attracted the foreign investors’ money into Indian equities.”

“Bullish environment to continue and has the potential to swing the market from extreme bearishness in March 2020 into bubble territory (NIFTY50 at above +1 s.d. on forwarding P/E, CAPE at +0.7 s.d. and bond yield exceed earning yield by 120 bps) as momentum in stocks could spread to broader markets hinging on the hope of an economic revival in H2FY21,” ICICI Securities said in a report.

Investors looking broad-based exposure to India can use the iShares MSCI India ETF (CBOE: INDA). INDA seeks to track the investment results of the MSCI India Index composed of Indian equities, which measures the performance of equity securities of companies whose market capitalization, as calculated by the index provider, represents the top 85% of companies in the Indian securities market.

For broad exposure to emerging markets, ETF investors can take a look at the FlexShares Morningstar Emerging Markets Factor Tilt Index Fund (TLTE). The fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Morningstar® Emerging Markets Factor Tilt IndexSM.

The index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to size and value factors relative to the Morningstar Emerging Markets Index, a float-adjusted market-capitalization weighted index of companies incorporated in emerging-market countries. The fund will invest at least 80% of its total assets in the securities of the index and in ADRs and GDRs based on the securities in the index.

Another fund is the FlexShares Emerging Markets Quality Low Volatility Index Fund (QLVE). QLVE seeks investment results that correspond generally to the price and yield performance of the Northern Trust Emerging Markets Quality Low Volatility IndexSM, which is designed to reflect the performance of a selection of companies that, in aggregate, possess lower overall absolute volatility characteristics relative to a broad universe of securities domiciled in emerging market countries.

For more market trends, visit ETF Trends.