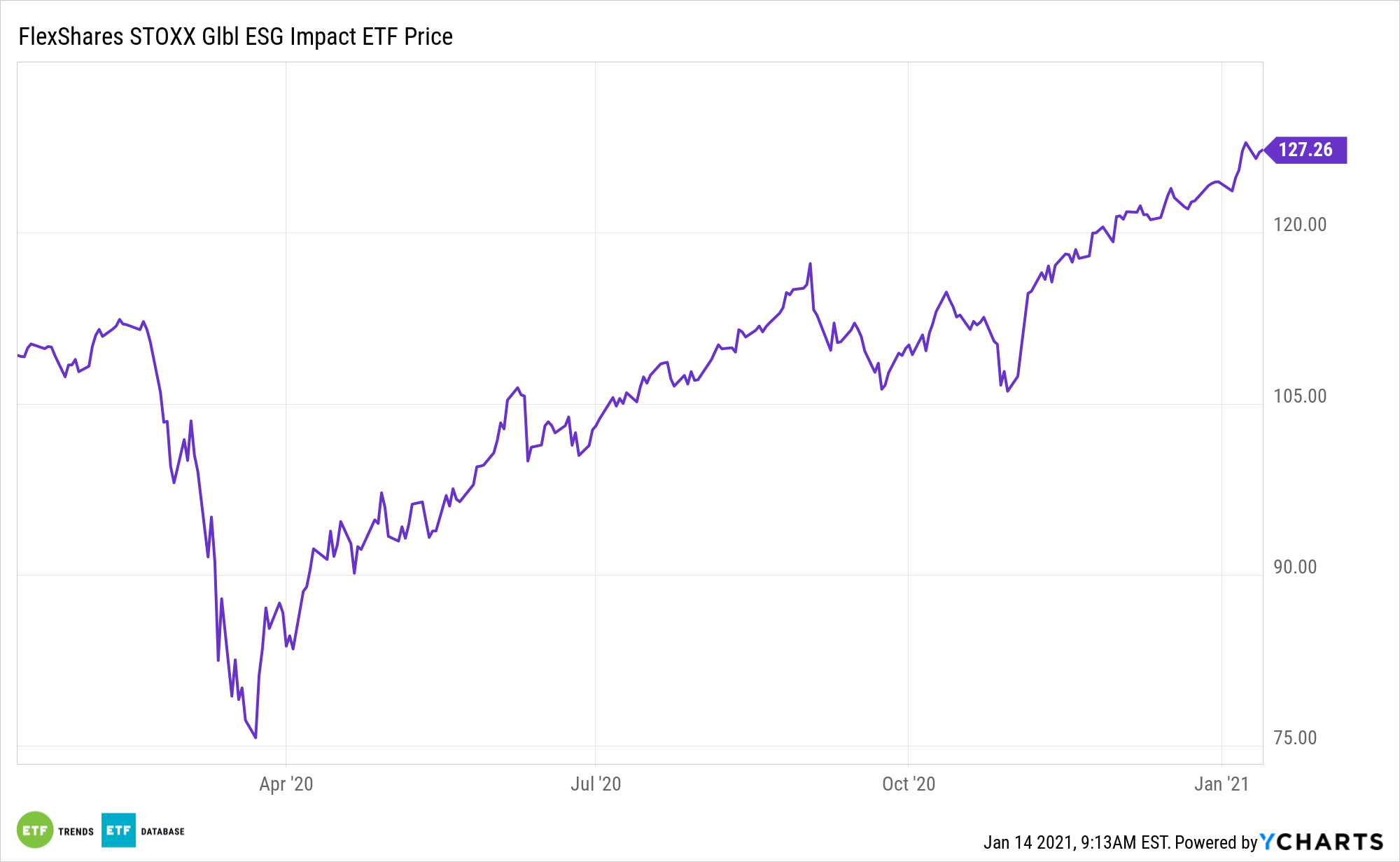

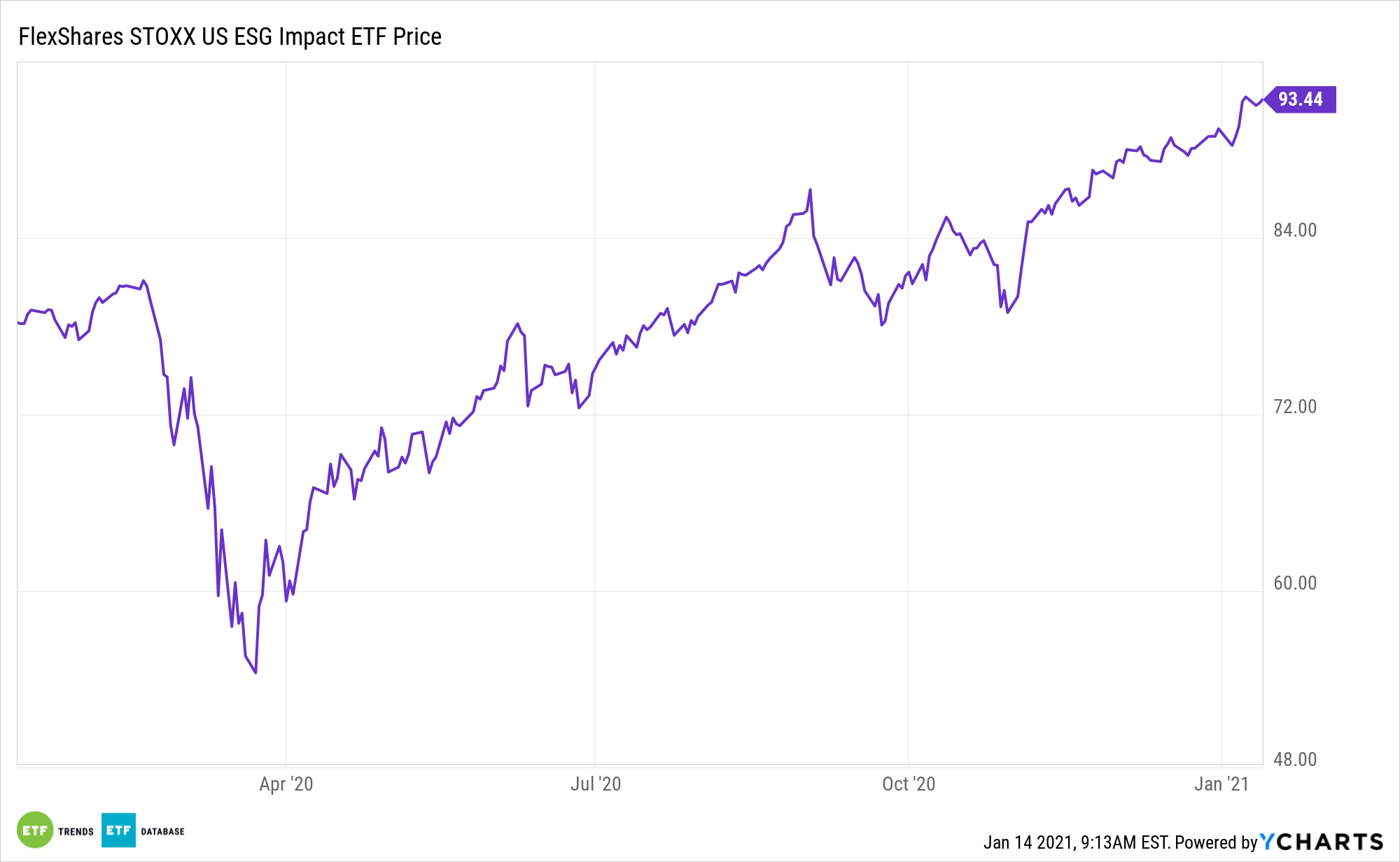

Environmental, social, and governance (ESG) exchange traded funds, including the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG), delivered the goods in terms of performance last year.

While it’s just one year, 2020 went a long way toward disproving the notion that sustainable investments don’t deliver over the long haul.

“After holding their own in the fourth quarter, sustainable equity funds finished 2020 with a clear performance advantage relative to traditional equity funds,” writes Morningstar analyst Jon Hale. “Sustainable funds are those that emphasize the use of environmental, social, and governance criteria to generate financial return and broader societal impact. For most of the year, the kinds of stocks that sustainable equity funds prefer–those of companies with better ESG profiles and that are aligned with the transition to a low-carbon economy–outperformed.”

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

The Rise of ESG ETFs

ESG-focused ETFs have been the beneficiaries of investor interest in ETFs as a whole. With a more socially conscious investor, getting access to the issues they care about can be had via the convenience of an ETF wrapper.

“Overall, it was an impressive year for sustainable funds. In 2020, three out of four sustainable equity funds beat their Morningstar Category average, and 25 of 26 ESG equity index funds that I’ve been following this year beat index funds tracking the most common traditional benchmarks in their categories,” according to Hale.

Meanwhile, investors are putting pressure on companies to address racial and gender diversity, along with climate change. For instance, BlackRock Inc., the world’s biggest money manager, is supporting more shareholder proposals that hold directors accountable on these issues. The company also said it will focus on issues that affect biodiversity and the natural environment.

Lastly, the budding ESG industry is branching out of a purely environmental or climate change focus and looking through a broader lens. For instance, a growing number of investors are focusing on the threat of biodiversity loss, which has a wide reaching economic effect since more than half of the world’s total gross domestic product is dependent on natural resources, from food to ingredients for medicine.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.