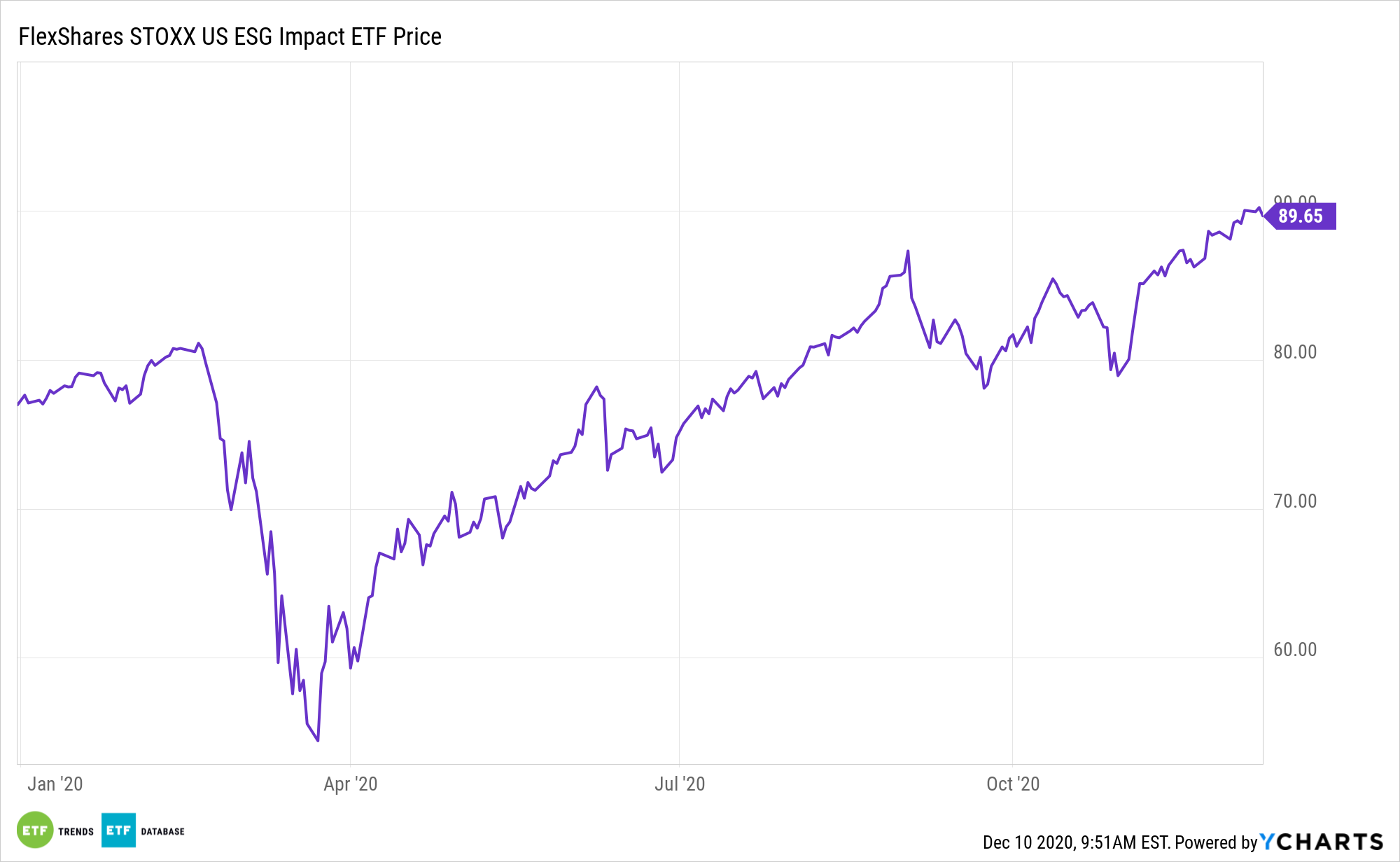

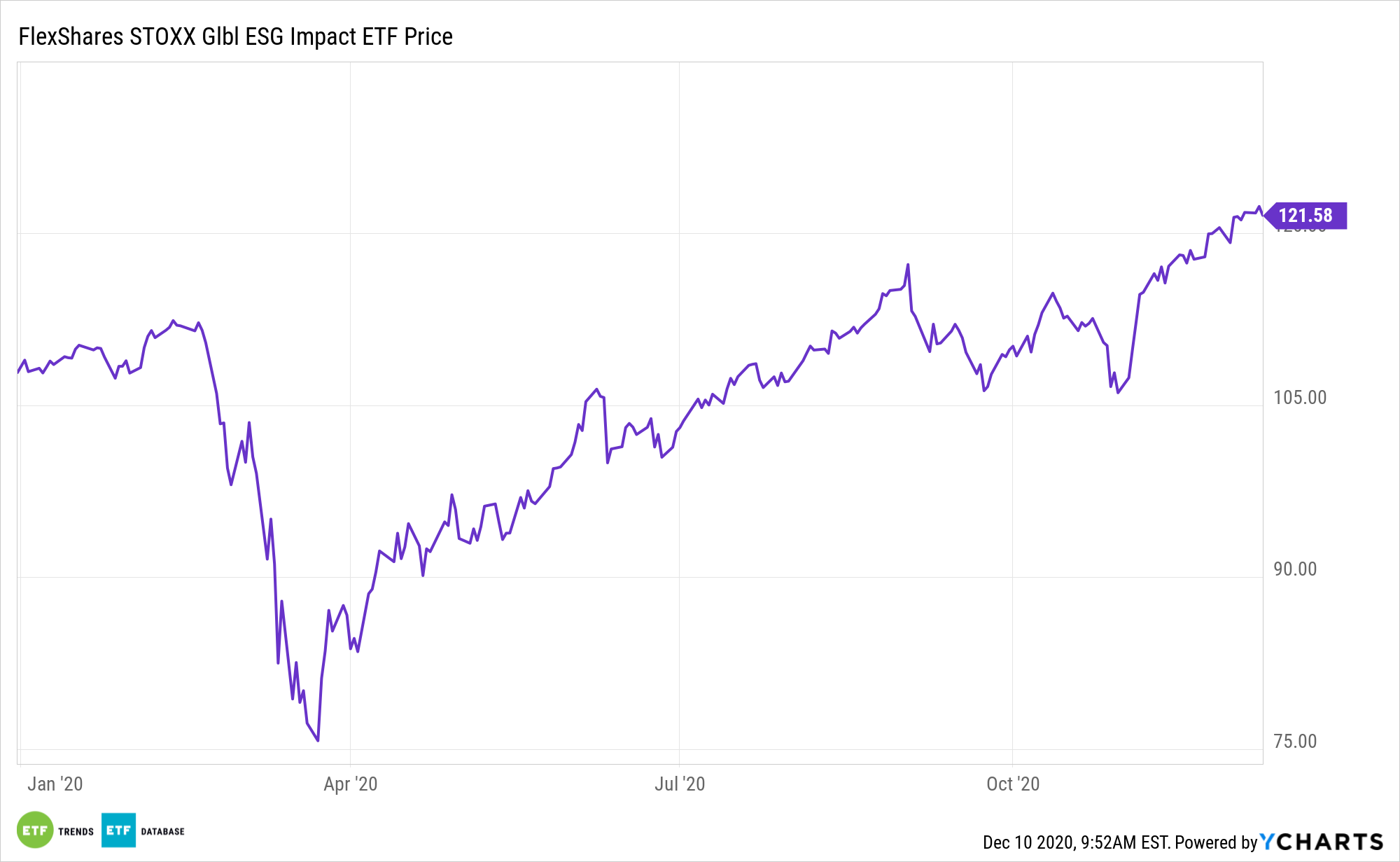

There’s been plenty of enthusiasm for environmental, social and governance (ESG) exchange traded funds, including the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

That enthusiasm is being met with impressive returns and data confirming that companies that take environmental responsibility do reward investors.

“The number of major companies who’ve disclosed their environmental impact and aggressively committed to reducing it has increased 46% from last year, according to a new analysis by a leading environmental-disclosure platform,” reports Todd Gillespie for Bloomberg.

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.- incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

“E” Is for Excellence

Data confirm there’s something to environmental stewardship in terms of returns, a trend highlighting benefits with ETFs such as ESG and ESGG.

“Climate action also pays off. An index which tracks CDP’s A List saw an average annual return that was 5.3% higher than competitors over the past seven years. The Stoxx Global Climate Change Leaders, which measures the performance of companies on CDP’s A List Index relative to the Stoxx Global 1800, has climbed about 13% since the start of 2020,” according to Bloomberg.

Investing in the socially responsible theme is more than a feel-good investment strategy. The S&P 500 ESG Index has outperformed the S&P 500 this year, rising 15.21% year-to-date, compared to 13.49% for the large-cap benchmark. Cliff Feigenbaum, the founder and publisher of GreenMoney Journal, argued that this outperformance in ESG investing is more than a short-term blimp and is backed by good long-term financials.

Regime change in the nation’s capitol also brings opportunity with ESG and ESGG. With a highly volatile political environment, investors are re-evaluating their portfolios, and rightfully so. But nowhere does this re-evaluation make more sense than in ESG. Strategies focused on environmental, social, and governance factors are likely to be affected not just by short-term economic implications, but the longer-term policy goals of a Biden administration.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.