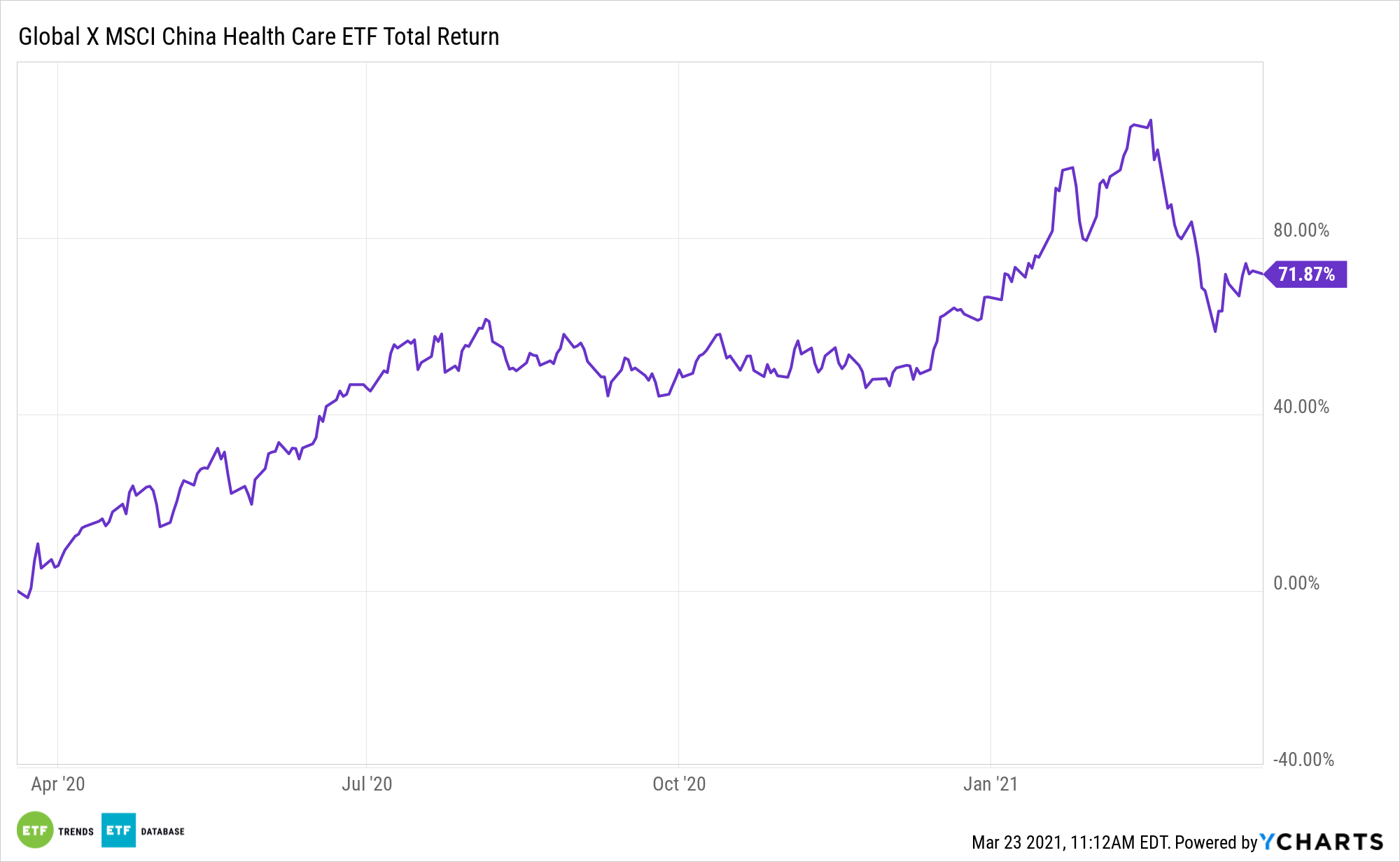

When it comes to healthcare stocks and ETFs, investors typically home in on domestic fare, but the Global X MSCI China Health Care ETF (CHIH) is proving that it can be rewarding to consider the international side of the sector.

CHIH follows the MSCI China Health Care 10/50 Index and provides investors with an avenue to one of the biggest and fastest-growing healthcare markets in the world.

“A confluence of factors all but assures that they will get much bigger: an aging population, bottlenecks in China’s state medical system, surging prowess in drug research, and state support,” reports Craig Mellow for Barron’s.

Predictably, CHIH has benefited from the coronavirus outbreak as some market observers speculated one or more of the fund’s holdings could put an end to the virus. But there’s more to the story.

Write a Prescription for CHIH?

Another advantage of CHIH is that the fund isn’t beholden to the same political pressures – drug prices, Medicare for All, etc. – as U.S. equivalents. Like the U.S. healthcare sector, China’s healthcare industry is largely focused on the domestic economy, reducing its vulnerability to trade tensions.

“Healthcare innovation outside the laboratory is no less vibrant, and potentially lucrative, in China. Communist planners of yore routed all medical needs, from treatment for a lingering cold to brain surgery, through hospital centers, where harried physicians may see 100 patients a day,” according to Barron’s.

The Chinese healthcare industry may be a growth opportunity, especially given China’s large population. The health industry in China is also far less developed than those in Western countries, so the emerging Asian country will have to invest and expand its health care facilities and infrastructure to meet the growing demand from a large population.

A slew of new and established biotech companies in China also bolster the case for CHIH.

“Tom Masi, co-manager of the emerging wealth strategy at GW&K Investment Management, is partial to Jiangsu Hengrui Medicine (600276.China), a veteran generics maker that has upgraded to biotech. It’s battling Innovent (1801.Hong Kong) and BeiGene (BGNE) for supremacy in China’s enormous oncology market,” concludes Barron’s.

With CHIH, investors get unique exposure to a healthcare system that is structurally different from the United States.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.