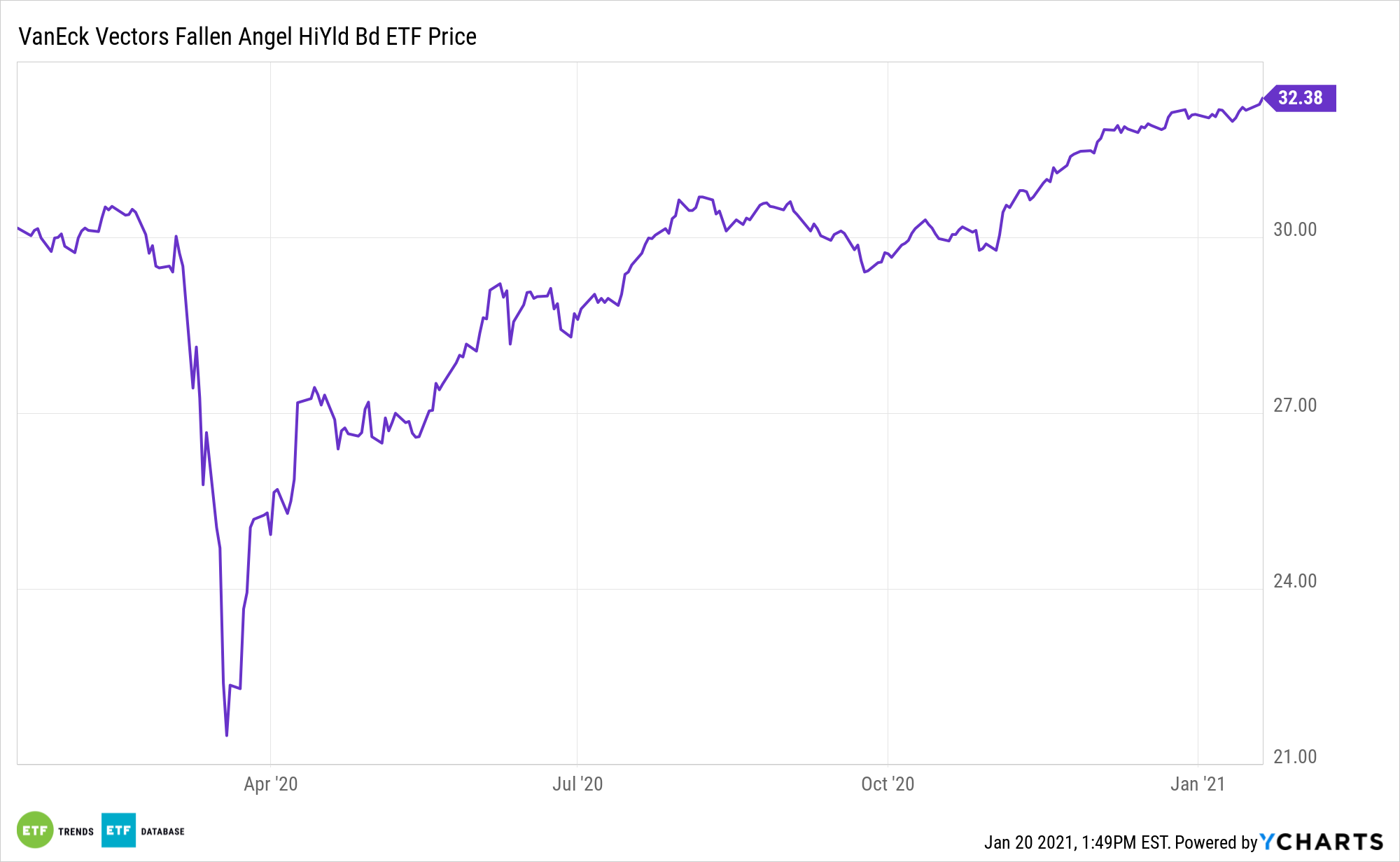

High-yield bonds encountered some rough spots in 2020, but by the time the year drew to a close, the VanEck Vectors Fallen Angel High Yield Bond ETF (NASDAQ: ANGL) proved to be a steady performer for income investors.

ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index. The index is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance.

“2020 was a roller-coaster year for the high yield market. In March, we saw massive spread widening followed by downgrades from severe economic disruptions due to Covid, and the U.S. Federal Reserve (Fed) stepping in to purchase individuals bonds and ETFs, which marked the beginning of a significant spread tightening cycle,” writes VanEck analyst Nicholas Fonseca. “Fallen angels outperformed the broad high yield index by 0.72% in December and by 7.89% in 2020 (14.06% vs 6.17%). December was a relatively quiet month in terms of downgrades, but strong from a return perspective (2.63% vs 1.91%) as spreads continued to tighten and ended the year slightly lower than where they started.”

Fallen Angels in 2021

Fallen angels, high yield bonds originally issued as investment grade corporate bonds, have had historically higher average credit quality than the broad high yield bond universe. ANGL is off to a strong start in 2021, confirming its importance to yield-seeking bond investors this year.

“We believe fallen angels can continue to provide outperformance potential versus the broad high yield market, as they have through various credit cycles,” notes Fonseca. “Long-term historical returns have been explained by three primary drivers, which can have differing impacts depending on the market environment: a fallen angel technical effect, contrarian sector exposures and higher average credit quality.”

Fallen angels have outperformed the broad high yield bond market in 12 of the last 16 calendar years and that out-performance has often been accrued with a better risk/reward profile than is found with traditional junk bonds.

“Throughout 2020, the fallen angel index increased its exposure to higher quality bonds from 77% in the beginning of January to 95% at the end of the year,” adds Fonseca. “The increase in higher quality bonds was due to the record number of issuers downgraded as the economy shut down in the early part of the year. As expected, all of the issuers joined the index with BB credit ratings.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.