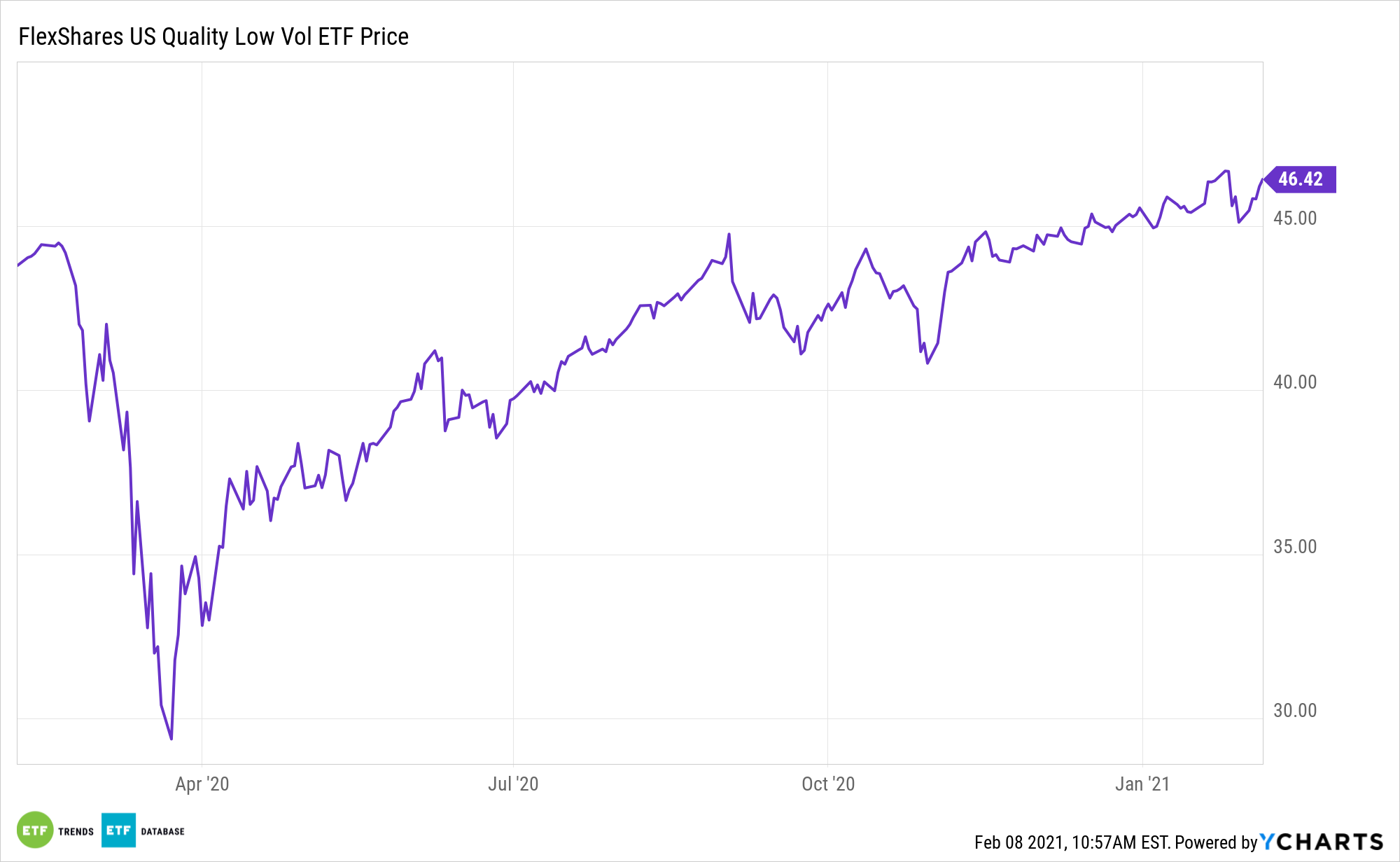

One of the early lessons emerging from the GameStop saga is that for many investors, quality is the way to go in all market environments. The FlexShares US Quality Low Volatility Index Fund (NYSE: QLV) stands ready to help with that objective.

QLV follows the Northern Trust US Quality Low Volatility Index. The ETF’s benchmark employs a quality screen to provide exposure to high-quality companies with lower absolute risk, thereby limiting potential future volatility. The quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints, in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

Quality was steady among the various investment factors last year and while it may not be the outright leader this year, it is positioned to deliver for investors, indicating there’s opportunity afoot with exchange traded funds such as QLV. In fact, the current environment, is particularly conducive to seeking quality.

“Cheap money is also fueling record retail trading activity. We’ve seen this before, when easy money helped drive the dotcom frenzy in the late 1990s and inflate the mortgage bubble, leading to the global financial crisis during 2008–2009,” according to Alliance Bernstein. “We all know that the party rarely ends well, but investor exuberance can persist for a long time. With the Fed fully supportive of low rates for the foreseeable future and more fiscal stimulus on the way, we expect more to come in 2021. The Fed will have to gingerly deflate bubbles that have emerged—a tough task that often causes unexpected collateral damage.”

QLV: A Durable ETF Idea

QLV integrates rigorous fundamental analysis through a quality screen of US-based companies that can be viewed as a means to mitigate future volatility. FlexShares believes this is different than other low volatility funds, which may utilize only historical return and/or correlation data in hopes that the lower volatility will carry forward.

Quality has historically outperformed other investment factors during economic slowdowns, but that thesis could be challenged if quality ETFs amass large positions in cyclical sectors, such as tech.

“Focusing on high-quality companies is a good defense against irrational market moves. And companies that enjoy strong organic growth drivers aren’t beholden to the hypercompetitive M&A market for growth,” adds Alliance Bernstein. “Building an equity portfolio based on businesses with sustainable earnings growth potential is a recipe for consistent outperformance and reduced volatility, even in a world where smaller investors can mount powerful campaigns to shock market leaders.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.