Whether it’s growth, quality, value, or some other factor, factor-based strategies are popular with advisors and investors, particularly when in ETF form.

Even still, there are alternative ways of deploying factors in finance. Consider the VanEck Vectors Morningstar Wide Moat ETF (CBOE: MOAT).

The Morningstar Economic Moat Rating methodology assigns an economic moat rating to companies, but in addition, it focuses on companies exhibiting attractive valuations relative to their prices. Furthermore, the indexing methodology uses five sources of economic moats, including intangible assets with brand recognition and pricing power, switching costs, a strong network effect, cost advantages helping companies undercut competitors on pricing, and strong scale.

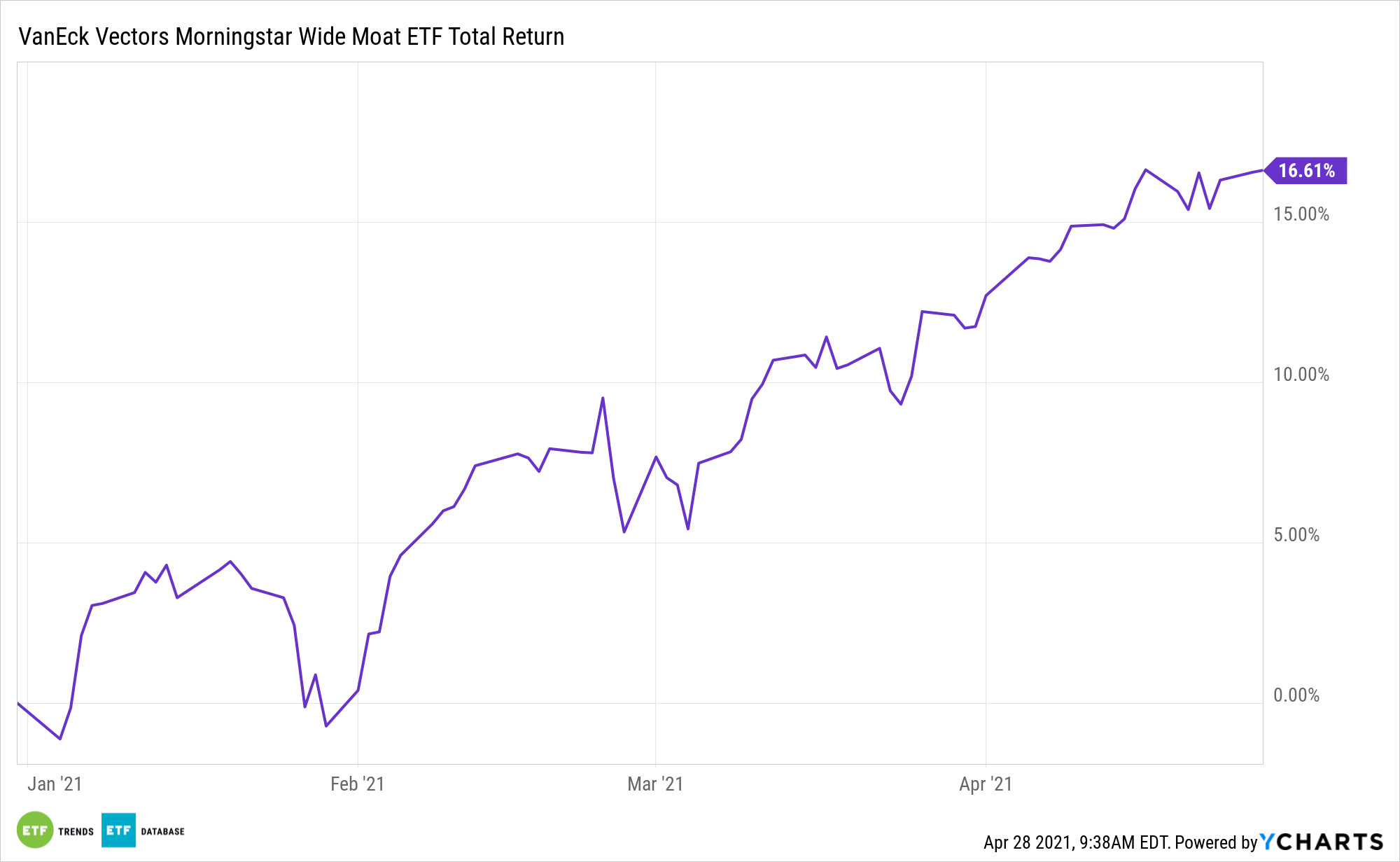

Past performance isn’t guaranteed to repeat, but the track record of MOAT’s underlying index is enviable, especially for long-term investors.

“The Morningstar® Wide Moat Focus IndexSM (the ‘Index’) has outperformed the Morningstar US Market Index by more than 300 basis points annually through March 2021 since its inception on February 14, 2007 (13.30% vs. 9.86%, respectfully),” notes Brandon Rakszawski, VanEck senior ETF product manager. “While the Index focuses on wide moat companies with sustainable competitive advantages (i.e., ‘quality’ companies) that are also trading at attractive valuations relative to Morningstar’s assessment of fair value (i.e., value), the Index is certainly not a multi-factor strategy.”

MOAT’s Marvelous Potential

MOAT’s recipe for success resides mainly with effective risk management, not factor dependence. In fact, MOAT’s benchmark has been lightly allocated to two big factors over the course of its history.

“Two prevalent style risk factors throughout the Index’s history—low exposure to momentum and (somewhat counterintuitively) a low exposure to quality—have actually proven a headwind to Index performance over time,” adds Rakszawski. “The overwhelming majority of the Index’s excess returns since inception cannot be explained by traditional factor risks. Instead, the risk factors contributing to excess returns are attributable to stock selection over value, momentum, quality, size, etc.”

That’s one way of saying stock selection is the primary driver of MOAT’s performance.

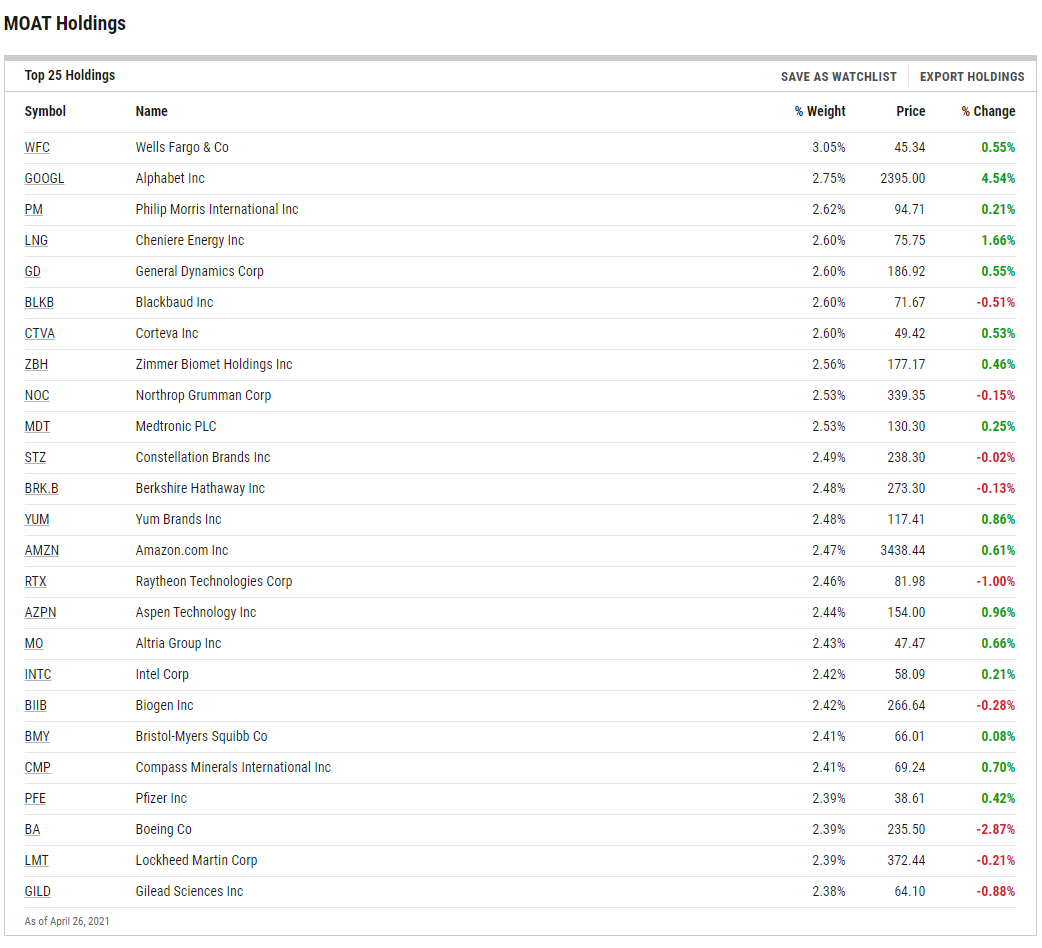

MOAT holds 49 stocks. At the end of the first quarter, the ETF allocated over 38% of its combined weight to tech and healthcare stocks. Industrial and financial services names combined for 27.6% of MOAT’s roster.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.