With the Democrats now controlling the presidency and both chambers of Congress, Wall Street is evaluating strategies poised to benefit from the blue wave. Industrial stocks and exchange traded funds are atop some market observers’ lists.

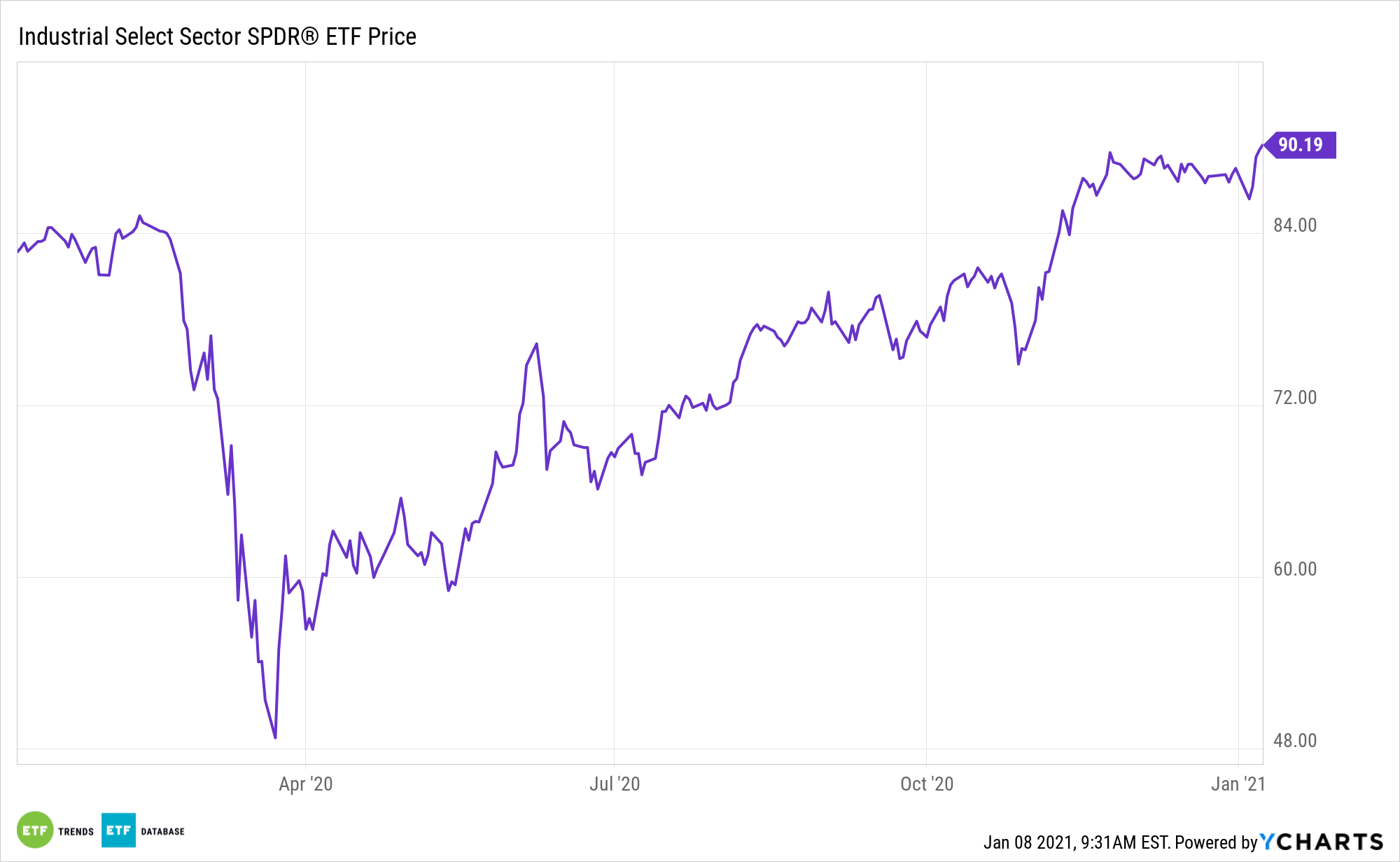

That could be beneficial for the Industrial Select Sector SPDR Fund (NYSEArca: XLI), the largest ETF dedicated to the sector.

XLI seeks to provide precise exposure to companies in the following industries: aerospace and defense; industrial conglomerates; marine; transportation infrastructure; machinery; road and rail; air freight and logistics; commercial services and supplies; professional services; electrical equipment; construction and engineering; trading companies and distributors; airlines; and building products.

“The victories by Democrats in Georgia mean that investors should make a change to their sector allocations as the Biden administration’s policies become more clear, according to Bank of America,” reports Jesse Pound for CNBC. “The firm said in a note to clients Thursday that it was cooling on the tech sector and becoming more bullish on industrials as the Democrats gain control of the Senate.”

What to Expect from Regime Change in D.C.

Bullishness on industrial stocks on the back of a blue wave jibes with expectations that value and cyclical stocks stand to benefit from the incoming Biden Administration.

“Bank of America upgraded industrials to overweight from market weight, and downgraded the tech sector to market weight from overweight, citing the rising rates and President-elect Joe Biden’s tax and spending plans,” according to CNBC.

Incorporating sector-based investment strategies can help investors align and adjust their investment portfolios based on macroeconomic or thematic trends, such as the increased adoption of clean energy and declining interest rates, shifts in stock fundamentals, or technical indicators such as momentum.

XLI is higher by 15% over the past 90 days, confirming that Biden’s Election Day victory is providing some tailwinds for cyclical stocks.

“Potential tax implications for Tech as well as potential for a stronger cyclical recovery could drive institutional investors out of growth and Technology and into deep cyclicals where they are currently underweight,” according to Bank of America.

Part of the thesis for industrials revolves around infrastructure optimism, which is always lurking on Capitol Hill.

“Renewed hopes for an infrastructure bill (considered a non-starter under gridlock) could benefit Industrials, and Industrials is one of the biggest beneficiaries of rising rates,” says Bank of America.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.