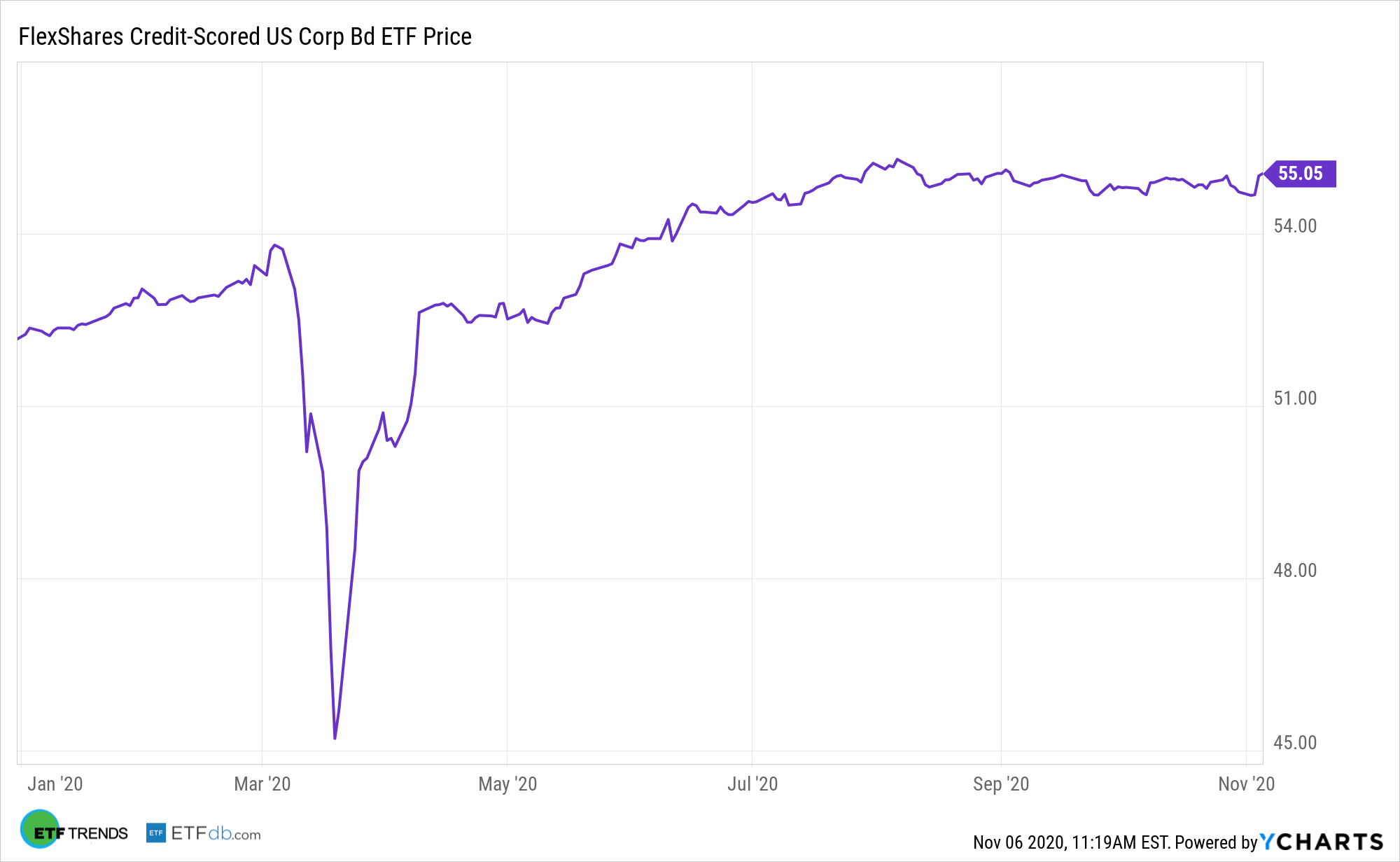

Votes are still being counted in several states, but it’s clear that regardless of the presidential victor, Congress is likely to be divided. That could be useful for exchange traded funds, such as the FlexShares Credit‐Scored US Corporate Bond Index Fund (NasdaqGM: SKOR).

SKOR tracks the Northern Trust Credit-Scored US Corporate Bond Index, which focuses on issues from companies with quality characteristics such as strength in management efficiency, profitability, and solvency, according to FlexShares.

“Republican control of the U.S. Senate and Democrat control of the House effectively precludes radical changes in the U.S. tax and regulatory framework,” according to Moody’s Investors Service. “Moreover, the Supreme Court is unlikely to consist of more than nine justices for the time being. With the elections out of the way, a relief package for those adversely affected by COVID-19 is likely to be forthcoming. Nevertheless, whoever occupies the White House may issue directives pertaining to tariffs and regulations that may not always please businesses and investors.”

Bond funds hold a collection of debt with varying maturities, buying and selling debt securities to maintain their short-, intermediate- or long-term strategy. When it comes to bond ETFs, investors should look at the duration, or a bond fund’s measure of sensitivity to gauge their investment’s exposure to changes in interest rates – a higher duration means higher sensitivity to shifts in rates.

When Division Is a Good Thing

Low Treasury yields are also factoring into the SKOR equation.

“Investment-grade corporate bond yield spreads are likely to extend their now declining trend,” notes Moody’s. “Compared with each median spread’s June 2020 average for the 10-year maturity, Baa1 has narrowed from 203 bp to November 4’s 170 bp, Baa2 has dropped from 251 bp to 208 bp, and Baa3 has plunged from 323 bp to 269 bp. If the business cycle upturn conforms to current expectations, each 10-year median spread might approach its respective average of 2017-2019 by late 2021. These averages are 151 bp for Baa1, 185 bp for Baa2, and 226 bp for Baa3.”

On Thursday, the Federal Reserve left its low rate policy unchanged.

SKOR’s scoring methodology indicates the fund is appropriate for a broad swath of investors, including those looking to reduce risk.

“The FlexShares Credit Scoring Model addresses the corporate bond liquidity challenge by optimizing a carefully selected subset of all credit issuers of which illiquid, orphaned and small lot names have been removed,” according to FlexShares. “The model also takes into account multiple factors to aid in developing improved corporate bond indexes, including the characteristics of issuers’ total debt structure, minimum exposure percentages, and odd-lot trade restrictions.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.