To say it’s not easy investing in bonds these days is an understatement, but investors can increase their chances of success with the right strategies. The FlexShares Ready Access Variable Income Fund (RAVI) may help with that challenge.

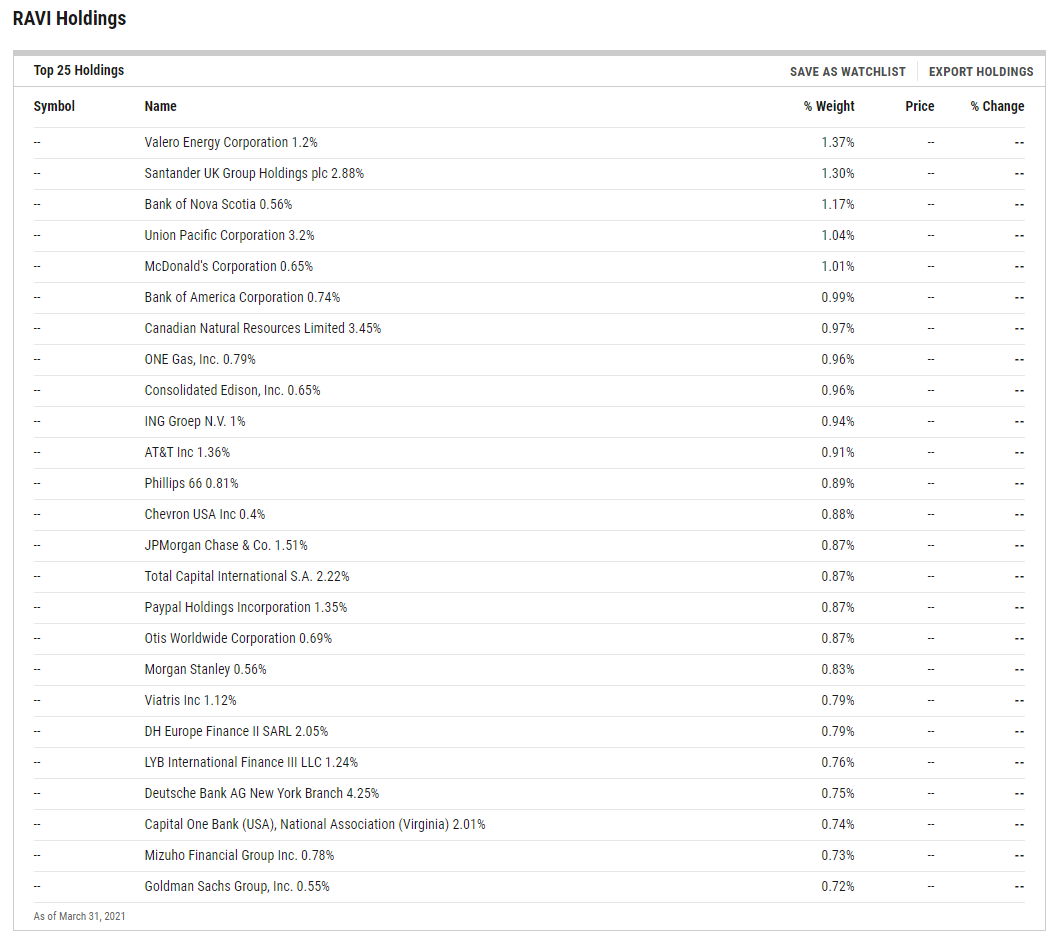

RAVI primarily invests in investment-grade debt securities with a heavy tilt toward U.S. corporate bonds. According to the fund prospectus, the ETF may also invest, without limitation, in fixed income securities and instruments of foreign issuers in developed and emerging markets, including debt securities of foreign governments, and may invest more than 25% of its total assets in securities and instruments of issuers in a single developed market country. RAVI can hold up to 20% of its total assets in fixed income securities and instruments of issuers in emerging markets.

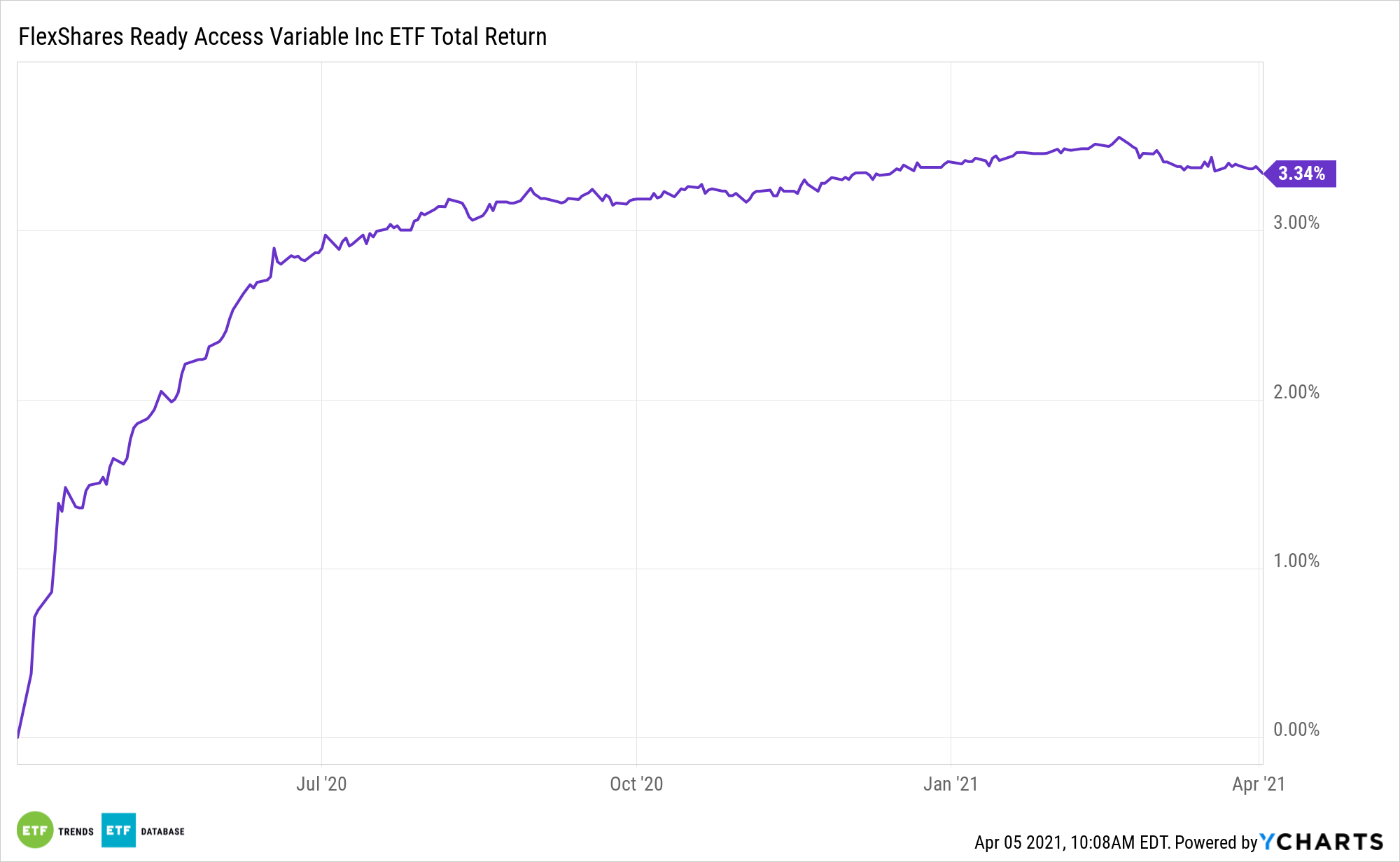

RAVI may be something for investors looking for a little more yield than what’s provided by money market funds, but don’t want to move too far out of the short-duration end of the yield curve. Additionally, RAVI’s recent performance has been solid.

A Changing Money Market Landscape

The ongoing low-yield environment and improving economic sentiment has helped push investors toward corporate debt. However, potential investors should be aware that corporate bonds have historically exhibited greater volatility than U.S. Treasuries due to the increased volatility in corporate cash flows and credit risks, along with greater liquidity risks.

The traditional money market fund landscape has changed since the financial crisis, as regulatory hurdles previously fettered this fixed income segment. RAVI was born out of the pending regulations following the financial crisis that many money market funds faced.

RAVI is actively managed and tries to generate maximum current income consistent with the preservation of capital and liquidity through short-term investment-grade debt securities and cash equivalents.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.