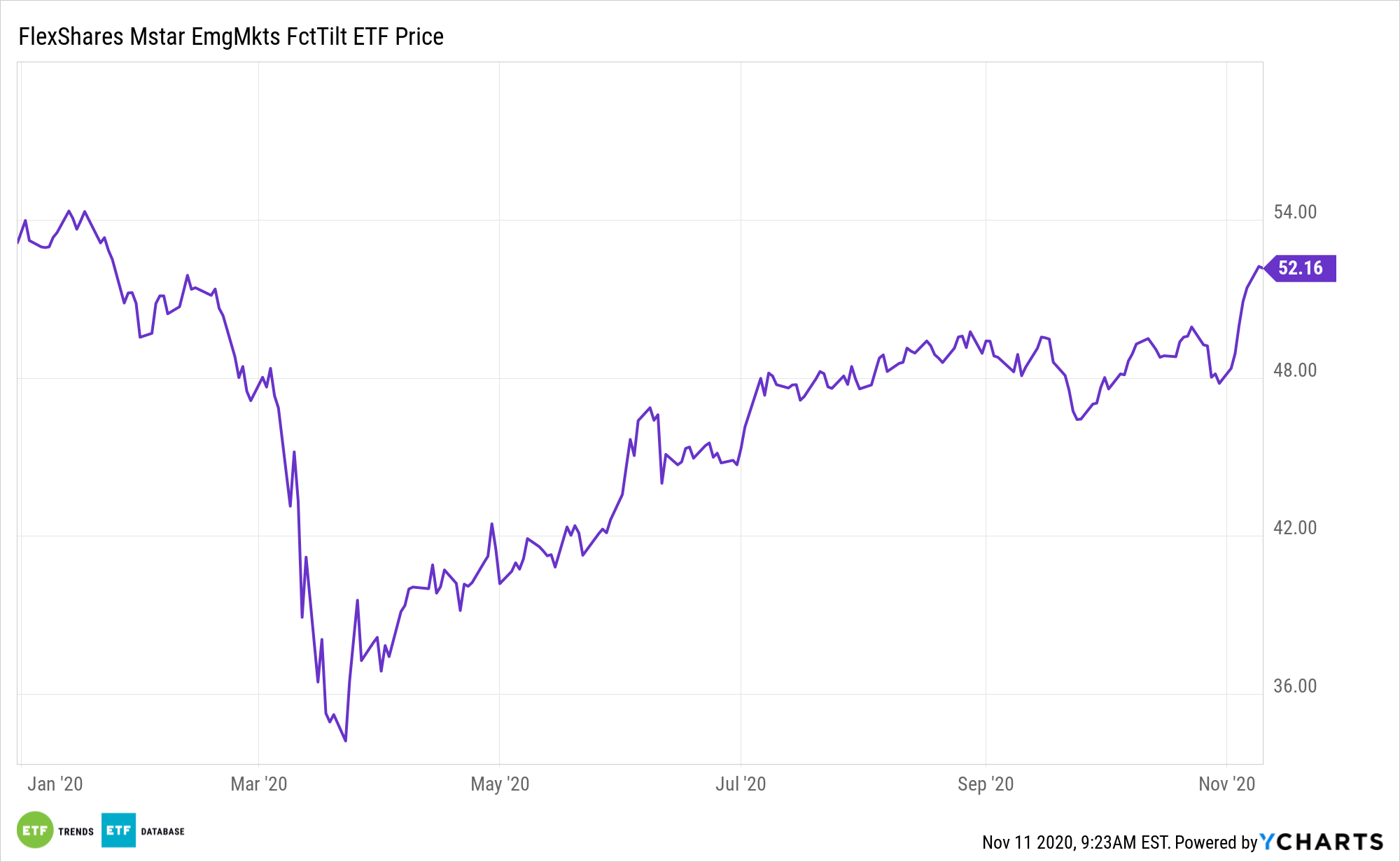

One of most cited talking points in the wake of Joe Biden’s victory in the recent presidential election is that a Biden/Harris Administration will be a positive for emerging markets equities, potentially putting exchange traded funds like the FlexShares Morningstar Emerging Markets Factor Tilt Index Fund (NYSEArca: TLTE) in the spotlight.

TLTE seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Morningstar® Emerging Markets Factor Tilt IndexSM. The index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to size and value factors relative to the Morningstar Emerging Markets Index, a float-adjusted market-capitalization weighted index of companies incorporated in emerging-market countries.

“Emerging markets could benefit from a political environment that looks set to become ‘more benign’ following the victory of Democratic candidate Joe Biden in the U.S. presidential election, predicts Standard Chartered Bank’s Eric Robertsen,” reports Eustance Huang for CNBC.

Getting Strategic with TLTE

Emerging markets can continue to enjoy a recovery if a tailwind of factors can keep blowing in its favor. This should give EM exchange-traded fund (ETF) investors something to cheer about whether they’re focused on equities or bonds.

“Money could ‘potentially be deployed’ into foreign and emerging markets, representing one of the ‘key potential pivots’ following Biden’s election win over incumbent President Donald Trump,” CNBC reports, citing Standard Chartered Robertsen.

TLTE’s Asia-heavy roster is a benefit for investors to consider over the near-term.

“Asia’s markets tend to be a little bit lower beta. In other words, a little bit lower volatility than some of (their) peers … and cousins across other emerging markets,” notes Robersen.

One thing to think about before EM investors decide to jump in is the uneven recovery. While China is leading the way after rebounding from the effects of Covid-19, some countries are left in the rearview mirror.

TLTE’s large weight to China, one of this year’s best-performing major equity markets, could be a boon for patient investors. TLTE helps investors steer clear of frothy valuations. TLTE assigns a value score based on price/book ratio, price/earnings ratio, price/cash flow ratio, price/sales ratio, and dividend yield. Selected securities are then divided by thirds into the following categories: value, core, and growth—all applied to the market cap categories—large cap, mid-cap, and small cap allocations.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.