When looking at the major stock indexes around the world, the U.S. still stands head and shoulders above most, which is an astounding feat given the economic ramifications that the pandemic has caused. Still, it doesn’t hurt to add international exposure as global economies look to reopen and return to normal–whatever that may look like in the coming months.

One way to do so as opposed to investing in single country funds is to look at exchange-traded funds (ETFs) that offer international exposure. One option is to screen out companies that offer quality options by offering dividends to investors.

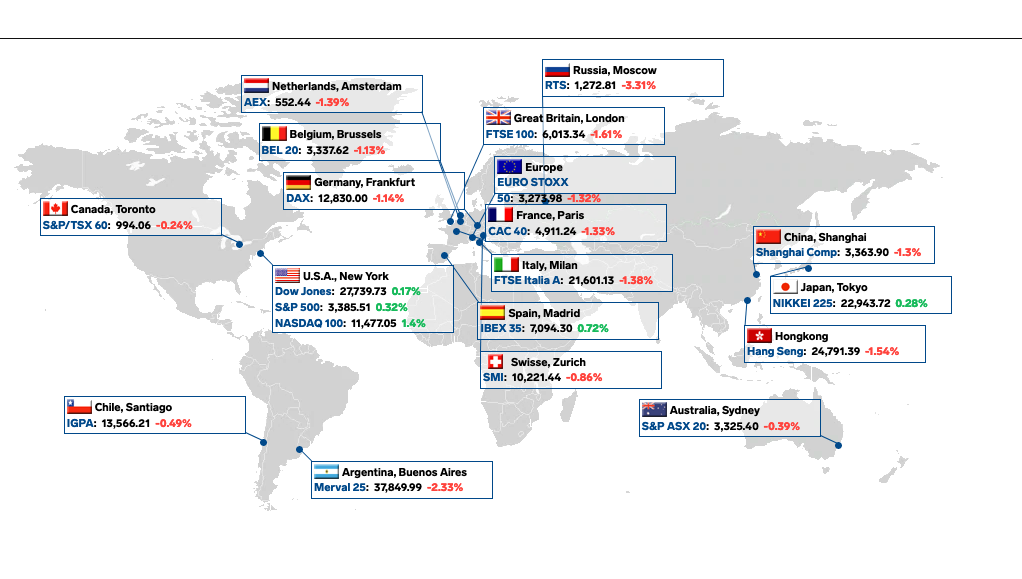

Here’s a Markets Insider snapshot of how the stock market indexes are doing around the world:

There are dividend opportunities overseas for investors who are unable to find the yield they want at home As such, here are a few international funds to consider with an emphasis on dividends:

- FlexShares International Quality Dividend Dynamic Index Fund (IQDY): seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust International Quality Dividend Dynamic IndexSM. The index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater financial strength and stability characteristics relative to the Northern Trust International Large Cap Index. The fund will invest at least 80% of its total assets in the securities of the index and in ADRs and GDRs based on the securities in the index.

- FlexShares International Quality Dividend Index Fund (IQDF): seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust International Quality Dividend IndexSM. The index reflects the performance of a selection of companies that, in aggregate, possess greater financial strength and stability characteristics relative to the Northern Trust International Large Cap Index, a float-adjusted market-capitalization weighted index of non-U.S. domiciled large- and mid-capitalization companies. The fund will invest at least 80% of its total assets in the securities of the index and in ADRs and GDRs based on the securities in the index.

- FlexShares International Quality Dividend Defensive Index Fund (IQDE): seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust International Quality Dividend Defensive IndexSM. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater financial strength and stability characteristics relative to the Northern Trust International Large Cap Index. The fund will invest at least 80% of its total assets in the securities of the underlying index and in ADRs and GDRs based on the securities in the underlying index.

For more market trends, visit ETF Trends.