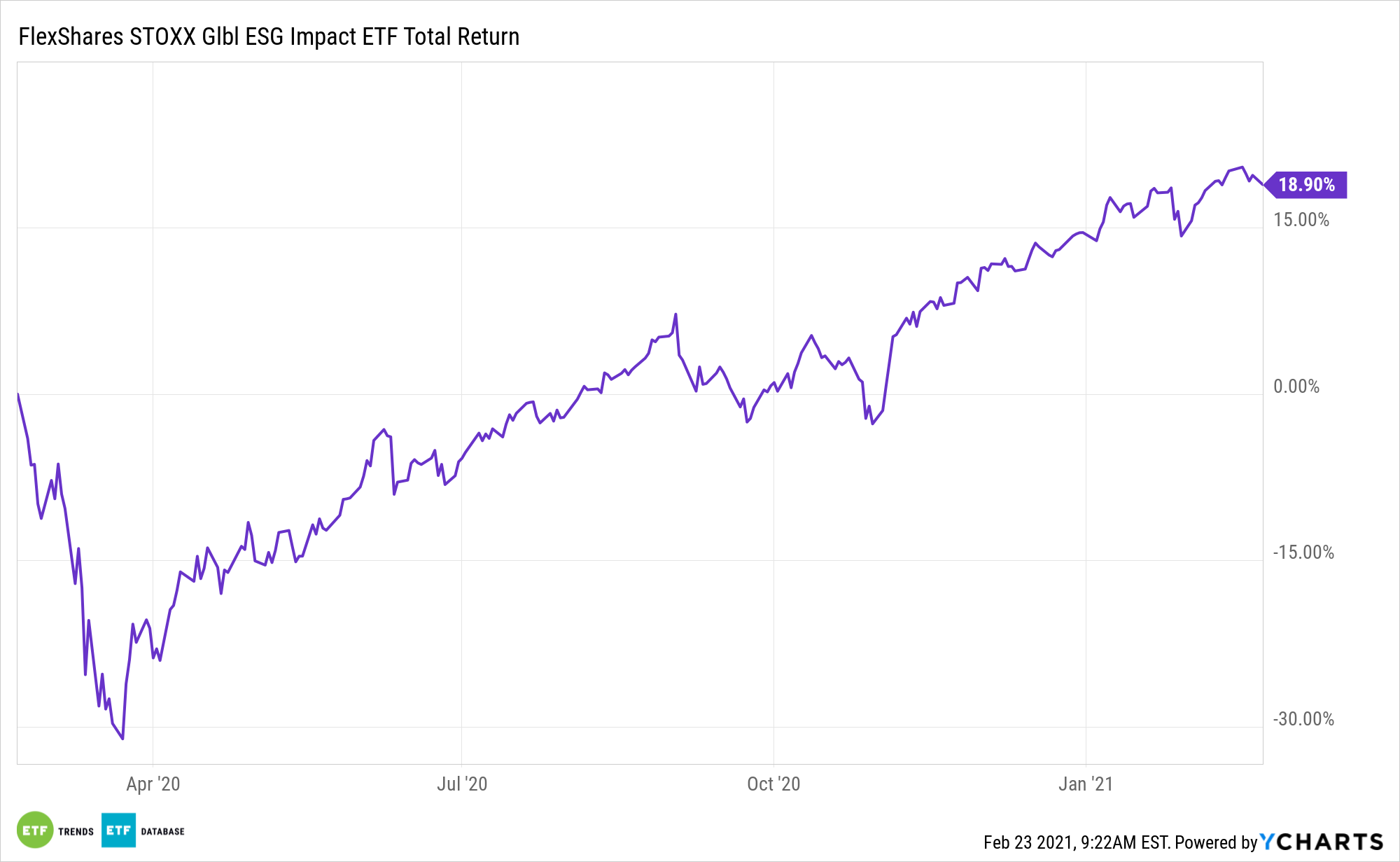

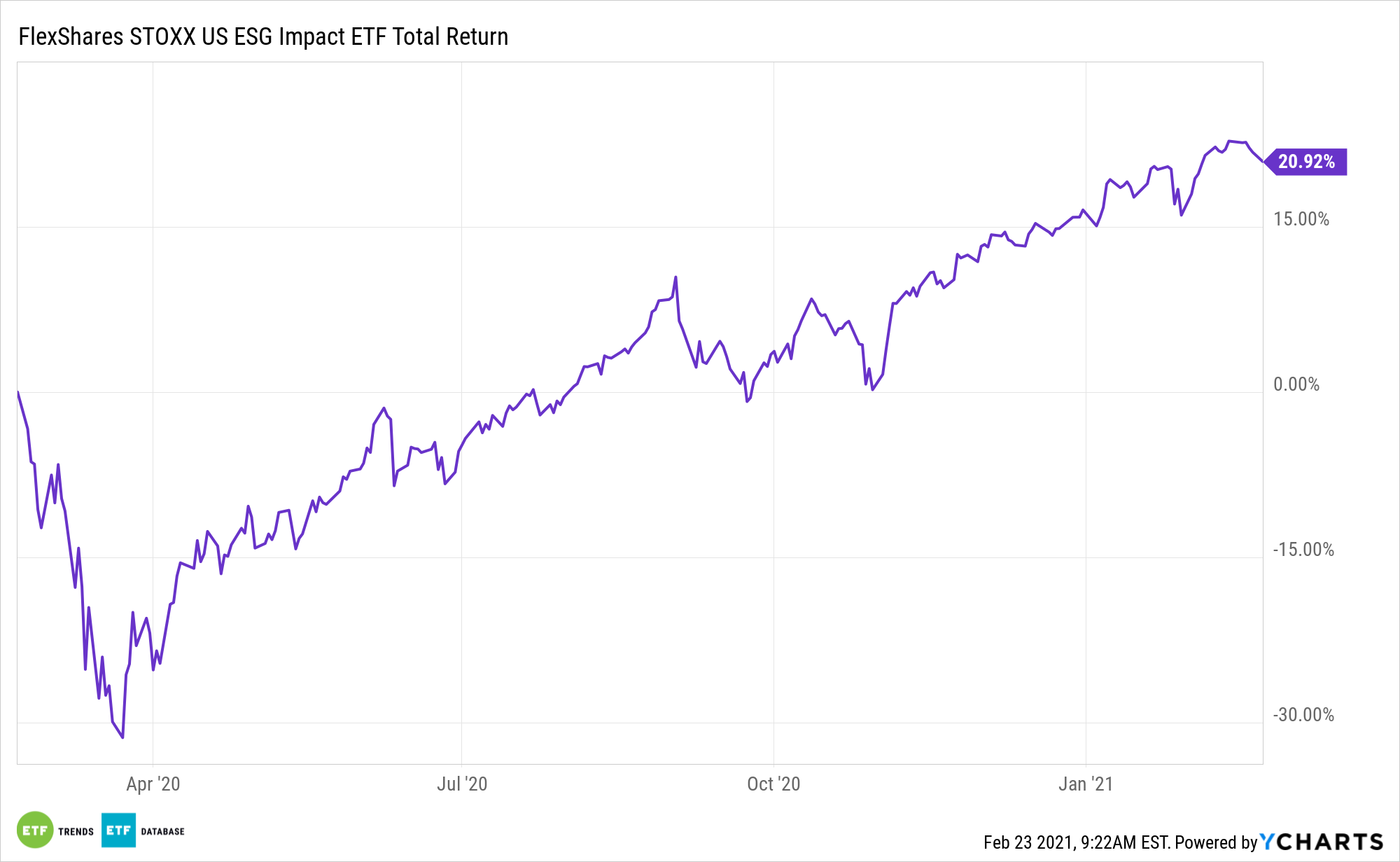

Investors continue matriculating to to environmental, social, and governance (ESG) exchange traded funds, including the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

The current market environment is growing extremely supportive of ESG investing.

“Within his first month in office, Joe Biden signed climate change executive orders, rejoined the Paris Agreement, and nominated ESG investment allies like Marty Walsh for higher-ranking government positions,” reports Business Insider.

The FlexShares ETFs have other tailwinds too. Environmental, social, and governance activities may help drive better financial performance and improve risk management. The NYU Stern Center for Sustainable Business suggested it does through a meta-study examining the relationship between ESG activities at organizations and their financial performance in more than 1,000 research papers over the last five years, Environment + Energy Leader reports.

ESG and ESGG Are Having Their Moment

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

“Integrating ESG principles into financial analysis while focusing on large-weight companies that are, from an ESG perspective, the best of the top 50% names in each sector. By doing that, one gets ‘good core equity exposure,’ as ESG principles are front and center of the investing process without a large tracking error (or without deviating too much from the benchmark),” according to Business Insider.

Bolstering the case for ESG and ESGG is big name money managers prioritizing the trend. Pension funds and insurers are now looking for more socially responsible money managers.

According to a recent global poll conducted by Bfinance, over 60% of pension funds and insurers said they were unlikely to hire an equity manager who is not a signatory of the Principles for Responsible Investment, the world’s biggest industry body for sustainable investing, Bloomberg reports.

The survey also showed that about a third of respondents wouldn’t appoint a hedge fund manager that lacked gender or ethnic diversity on staff. A fifth of those surveyed even highlighted environmental, social, and governance concerns as the main reason for having fired managers.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.