Is the bank crisis really over? As quickly as it burst onto the scene, the bank discourse has quieted down following concerted government and financial sector action to halt the contagion that spread from the likes of Silicon Valley Bank (SVB) and First Republic Bank (FRC). As markets shudder awaiting a looming recession, moving from news story to news story, the case for gold ETFs is strengthening, with all kinds of variations on a traditional gold commodity exposure available in the wrapper.

According to research from WisdomTree Investments, when markets face financial stress, gold tends to be sold off to help investors raise cash for short-term needs like margin calls on futures positions. That panic gold selling hasn’t taken hold over the last two weeks, however, suggesting that investors may be more interested in holding their gold as a hedge against volatility that could still be on the horizon.

Gold is set to benefit from either a recession incited by the Fed’s hawkish tightening campaign or from an end to quantitative tightening, WisdomTree suggests, as gold’s rival, fixed income yields, would dip in a rate cut scenario compared to the precious metal’s ongoing strength.

See more: “Siegel: Bank Crisis Equal to ‘One or Two Tightenings’ by Fed“

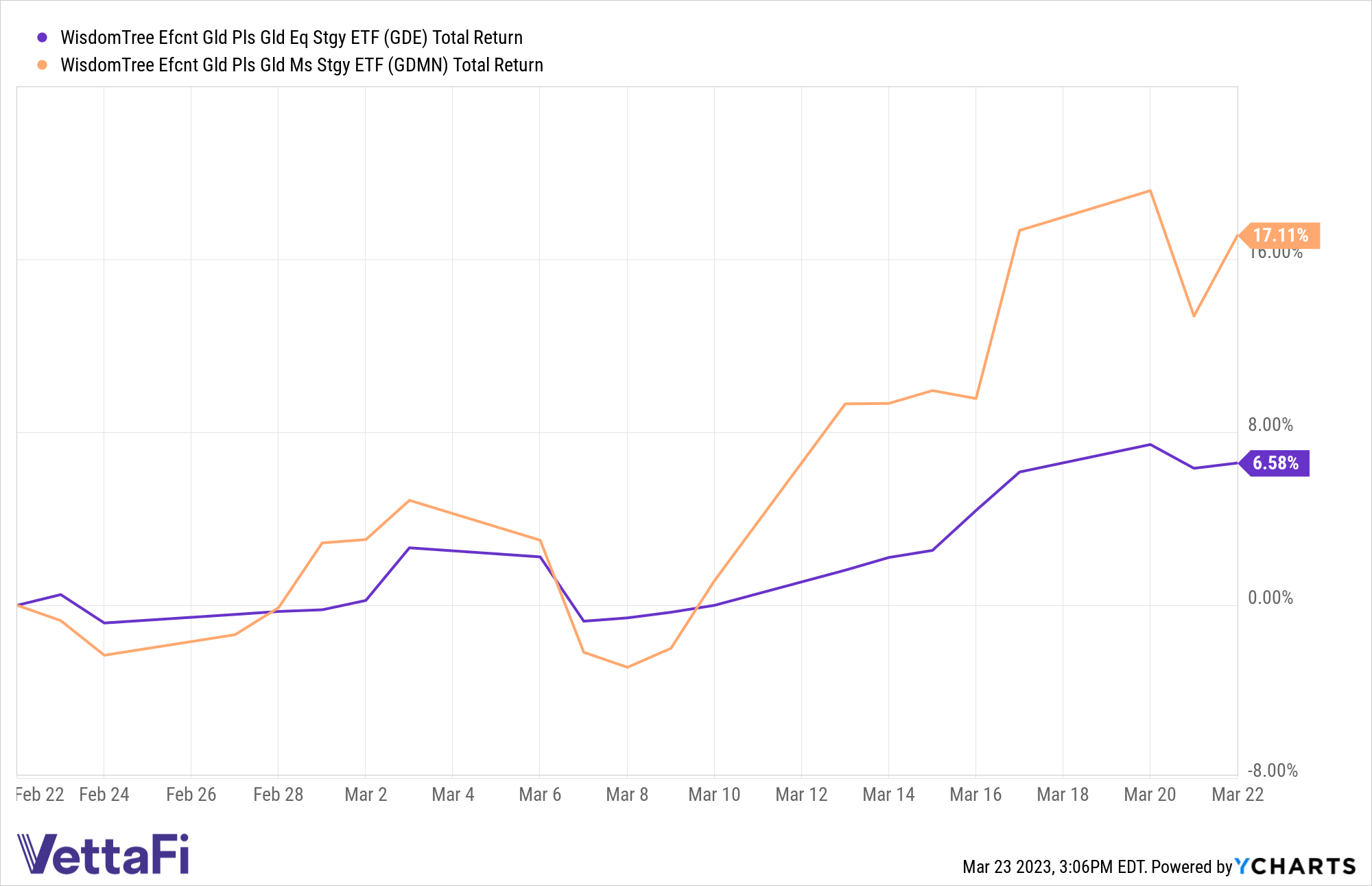

The case for gold ETFs is boosted by the availability of a variety of ways to play the gold space, like the duo of the WisdomTree Efficient Gold Plus Equity Strategy Fund (GDE), which combines U.S.-based gold futures contracts and solid, large-cap equity securities, and the WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN), which invests in gold mining equities as well as futures.

GDE has returned 6.6% over the last month, while GDMN has more than doubled up on that performance, returning 17.1% in that time. Charging 20 basis points, GDE is actively managed as it attempts to combine those gold futures contracts and equities, while GDMN charges 45 basis points for its combination of gold mining equities and commodities exposures.

Whether gold or a fixed income-type safe haven like floating-rate notes (FRN), investors are on the lookout for options when it comes to dealing with uncertainty. Gold has been a solid option for investors for a long time, and with market volatility settling in for the long haul, it’s an asset class to watch in the weeks and months ahead.

For more news, information, and analysis, visit the Modern Alpha Channel.