By Jeff Weniger, CFA, Head of Equity Strategy

GameStop may be out of the news cycle, but it is not out of portfolios. The stock was on offer for as little as $3.85 per share last July, before Reddit’s “Wall Street Bets” message board got its hands on the heavily shorted stock, creating a squeeze that sent its price up several hundred points. That made GameStop a sudden heavyweight in many indexes, a condition that lasts to this day.

Posting Internet memes on it and other troubled companies like AMC Entertainment, the movie theater chain, a cultural phenomenon was whipped into such a frenzy that it became the lead story in the Wall Street Journal and in Twitter finance circles. This was especially so as the phenomenon rode a wave of anti-Wall Street sentiment, bringing down an obscure hedge fund—Melvin Capital—that was short the shares.

In a classic case of the Greater Fool Theory, dubbed “YOLO” in social media parlance (“You Only Live Once”), a swarm of retail investors sent GameStop straight up through $100 on January 25. By January 28, it nearly quintupled again; some unlucky soul shelled out $483 at the peak.

What does the Street make of GameStop? The consensus has the firm losing $2.14 per share in 2021 and 55 cents again in 2022. Will it make money in 2023, or ever again? Unless your kids start agitating for you to drop them off in front of Sears, the way I did it in ’92, it seems like a business model that has a bumpy road ahead.

And yes, I mentioned Sears specifically. I imagine my children have never heard of it.

The problem with watching GameStop “from the outside” is that you probably own it and a handful of other meme stocks1 in any small-cap index fund that is market capitalization-weighted, such as those that track the Russell 2000 Index.

Sure, GameStop is no longer dominating your Twitter feed, but the stock is still $138 per share. That makes it a potential $10 billion play on physical video game cartridges sold next door to an empty J.C. Penney.

Like Sears, the kids do not know “Penneys” either.

The Russell 2000 Value Index still has 0.54% in GameStop. Not a lot, indeed, but it matters if this stock decides to “round trip” this whole episode, back to $4 per share. It means that one holding would drag 52–53 basis points (bps) off the Index’s performance. Add more red ink to small caps in general if Bed, Bath & Beyond, Ligand Pharmaceuticals or National Beverage Corp—just three of many Reddit meme stocks—decide to follow GameStop down.

Another Index that we think could be ripe for a “GameStopping” is the Russell Microcap Index, which tracks the 1,000 smallest companies in the Russell 2000. Can you believe that GameStop is still its number one holding, at 1.72% of the Index? Again, the stock was $3.85 last summer and is still in the sky, at $138.

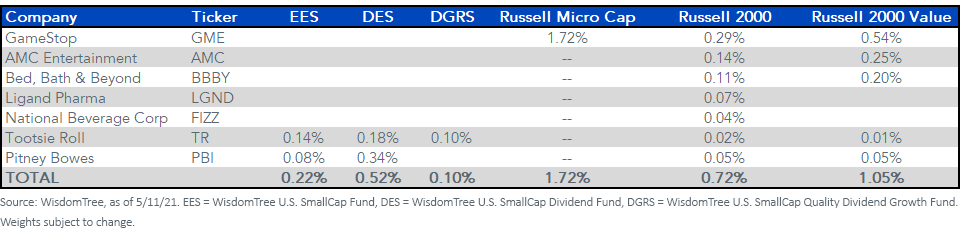

I looked inside our U.S. small-cap Funds to see which of the major meme stocks are in our ETFs. I think I captured most of the main ones from the frenzy in figure 1. Looks like Tootsie Roll, the candy company, and Pitney Bowes, whose business is in integrated mail and document management systems, found their way into some combination of EES, DES and DGRS.2

Figure 1: Weights in Reddit Meme Stocks

Let’s see how the meme stocks were included or excluded from our mandates.

To start, EES is earnings weighted, so the first five companies, which showed losses in the four quarters prior to our Index rebalancing in December, did not gain entry. Though they are meme stocks, both Tootsie Roll and Pitney Bowes did turn a profit.

Admittedly, I know as much about Tootsie Roll as the common investor. In addition to positive profits, it pays a dividend, which has been increased for several years running. In data I have to 2011, the firm has increased the dividend every year. Halloween candy turned out to be a good business, I suppose. Along with its ability to pass our quant scores, it carves out a sliver for itself in both DES and DGRS, mandates that require a dividend for entry.

As for Pitney Bowes, its positive earnings also gave it a tiny place in EES, while its nickel-per-quarter dividend (the stock is around $7) placed it into the DES holdings list too. Because it did not pass some combination of our quality and/or future earnings growth screens, it is not in the more “growthy” DGRS.

Importantly, I cannot say whether GameStop or the other meme stocks will get their businesses back on their feet. I do not cover the stocks. What I can say is that, if you are tracking various small-cap indexes, you just might own them, like it or not. Only you can decide if you think these stocks’ prospects are helpful to your tracker funds.

But if you want to watch GameStop with a bucket of popcorn instead of with your own capital, fundamental weighting may get you there.

Originally published by WisdomTree, 5/13/21

1 A stock that has seen an increase in volume not because of the company’s performance, but rather because of hype on social media and online forums like Reddit. For this reason, these stocks often become overvalued, seeing drastic price increases in just a short amount of time.

2 EES = WisdomTree U.S. SmallCap Fund, DES = WisdomTree U.S. SmallCap Dividend Fund, DGRS = WisdomTree U.S. SmallCap Quality Dividend Growth Fund.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.