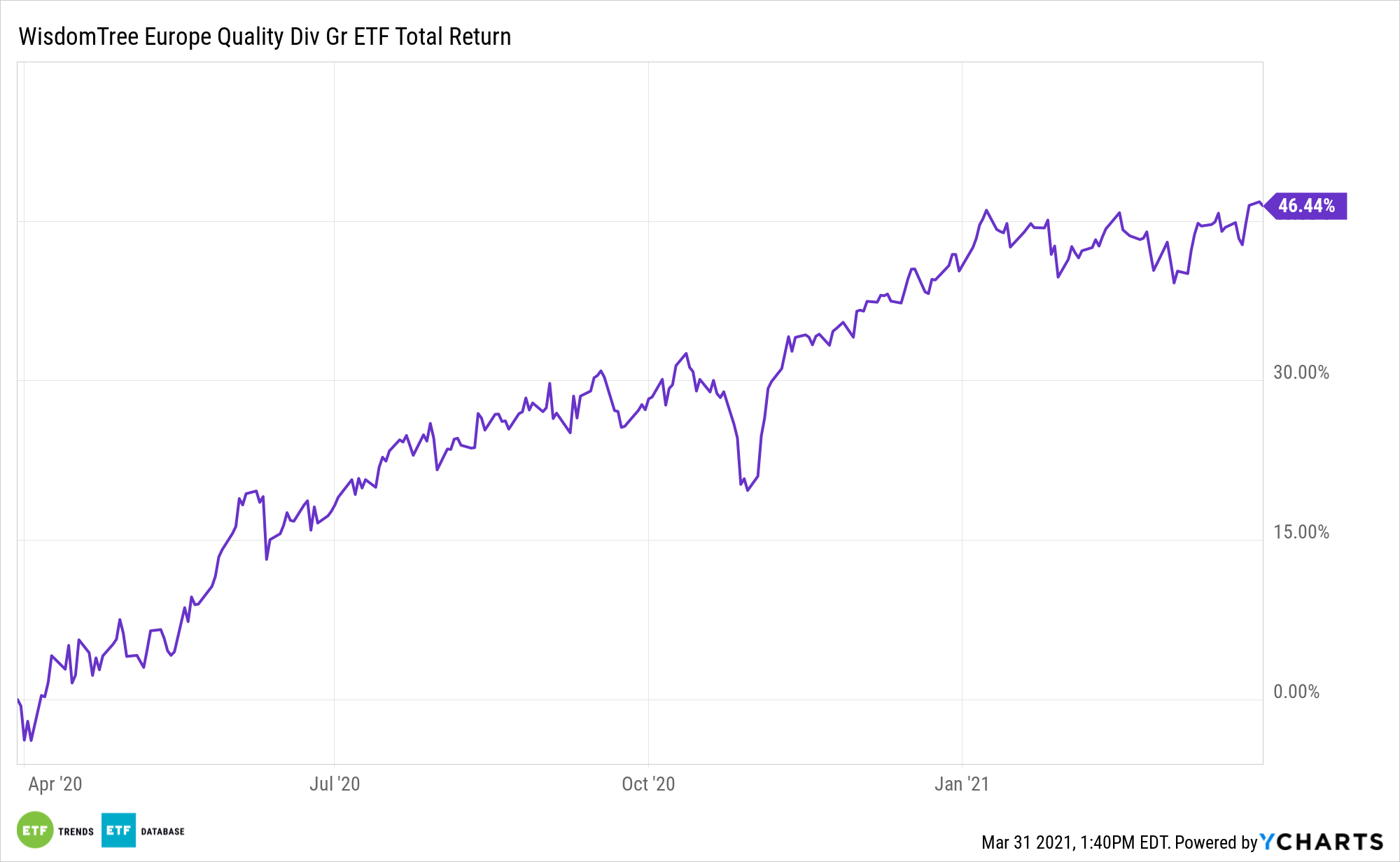

Value stocks in the U.S. are generating plenty of buzz, and rightfully so, but investors shouldn’t sleep on their European counterparts. One way to look across the Atlantic is the WisdomTree Europe Quality Dividend Growth Fund (NYSEArca: EUDG).

EUDG tracks the WisdomTree Europe Dividend Growth Index, “a fundamentally weighted index that measures the performance of dividend-paying common stocks with growth characteristics selected from the WisdomTree DEFA Index,” according to WisdomTree.

Making EUDG all the more appealing is the notion that the European value recovery is still in its early innings.

“Value stocks aren’t just going strong on Wall Street, as Europe’s own cycle has been up and running with some miles of performance to go yet for investors,” reports Barbara Kollmeyer for Barron’s. “That is according to asset manager Amundi, whose strategists believe European value names affected by the Covid-19 crisis are moving through a three-stage recovery.”

Examining the EUDG ETF

European equities are showing noticeable signs of life, but some investors remain skittish of investing in the Eurozone. After years of disappointing returns, that outlook is understandable, but investors can participate in some of the upside with quality via EUDG.

Like other developed markets, many European markets are home to major equity benchmarks with higher dividend yields than the S&P 500. The yield disparity between European stocks and bonds has been widening as recent global uncertainty pushed investors out of the equities market and into safe-haven fixed income assets.

“Since the start of this year, the acceleration on the vaccine front has changed market expectations with regards to timings for the reopening of economies, moving inflation and real yield expectations higher, a natural tailwind for value as style,” said Kasper Elmgreen, head of equities, and Andreas Wosol, head of European equity values at Amundi.

EUDG’s components are weighed by paid dividends, explaining the fund’s emphasis on return on assets, It boasts ample exposure to healthcare, consumer discretionary, and industrial names.

Up 3.35% year-to-date, EUDG yields 1.88%.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.