With interest rates low, it’s tempting to reach for equity yield, but investors may be better served by quality growth strategies such as the WisdomTree U.S. LargeCap Dividend Fund (NYSEArca: DLN).

DLN, which is featured in some of WisdomTree’s model portfolios, seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. LargeCap Dividend Index. The index is a fundamentally weighted index that is comprised of the large-capitalization segment of the U.S. dividend-paying market.

See also: Dividend ETF Investing: An ETFdb.com Guide

DLN offers some value exposure without subjecting investors to elevated volatility, potentially taking some of the risks out of paying up for low volatility stocks.

Dividend “growers typically don’t boast burly yields like yielders do, though they have their advantages. Notably, companies that regularly boost their dividends are usually profitable and financially healthy,” writes Morningstar analyst Susan Dziubinski.

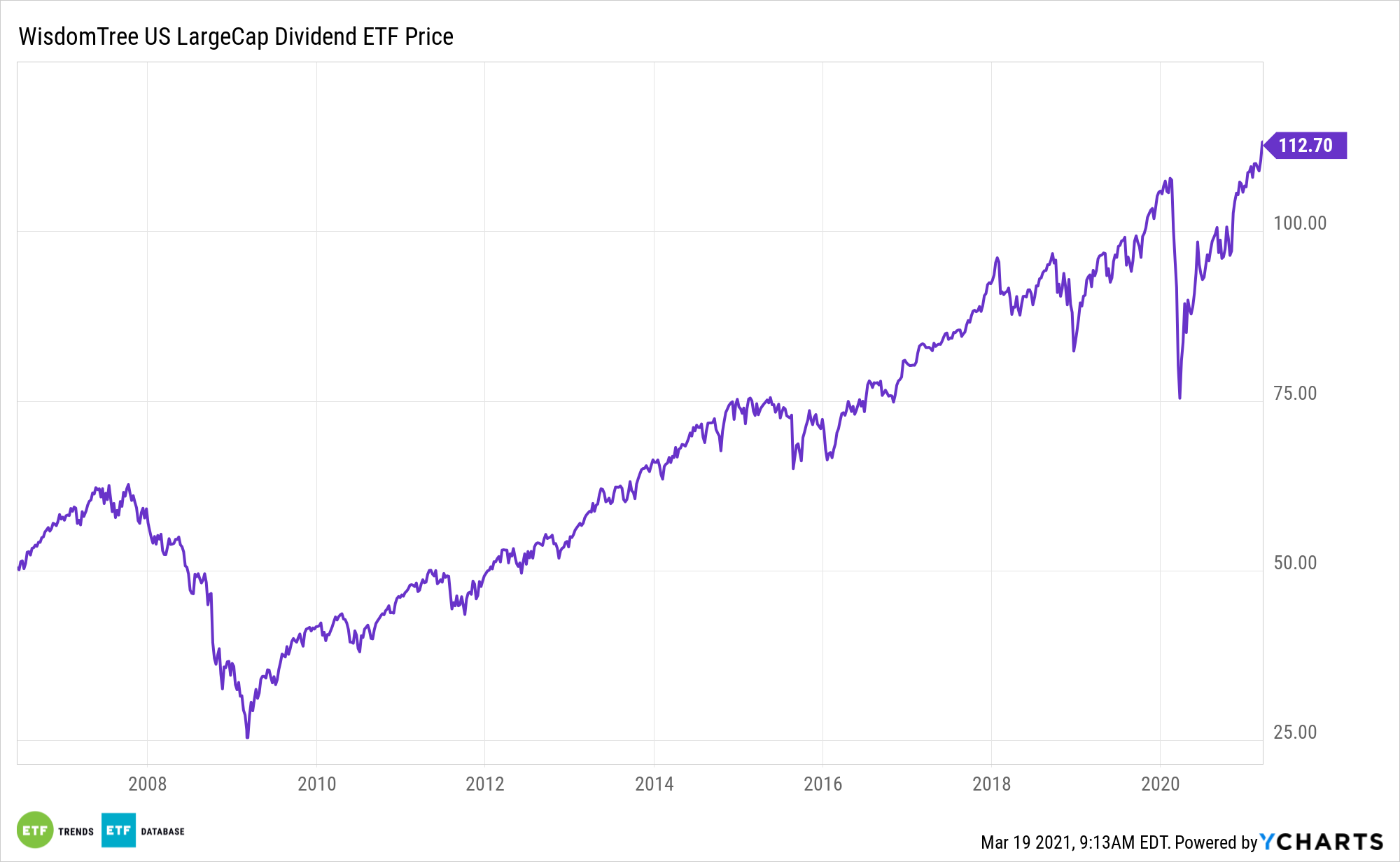

DLN: A Long-Term Income Plan

Investors who are looking for a value-oriented income opportunity may look to a fundamentally weighted dividend-focused exchange traded fund strategy that diversifies risk and rebalances towards those that have become cheaper relative to their dividends.

DLN is dividend weighted annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year, based on the most recently declared dividend per share. In layman’s terms, DLN eschews weighting by dividend increase or yield, the latter of which can lead investors toward stocks vulnerable to dividend cuts.

Dividend growers “generally show some resilience during market downturns. Further, dividend-growth stocks can provide some inflation protection,” adds Dziubinski.

The ETF’s portfolio provides investors with a balanced trade-off between dividend yield and risk. The fund limits its exposure to firm-specific risk and the highest-yielding stocks, which are more apt to cut dividends. While this may be a cause for concern, the strategy has helped the dividend ETF stand out.

Moreover, DLN could be a meaningful near-term consideration.

High “yielders in economically sensitive sectors may be vulnerable during an economic slowdown. Moreover, yielders face some interest-rate risk: When rates trend up, investors may swap high-income-producing stocks, especially in sectors like REITs and utilities, for bonds,” concludes Dziubinski.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.