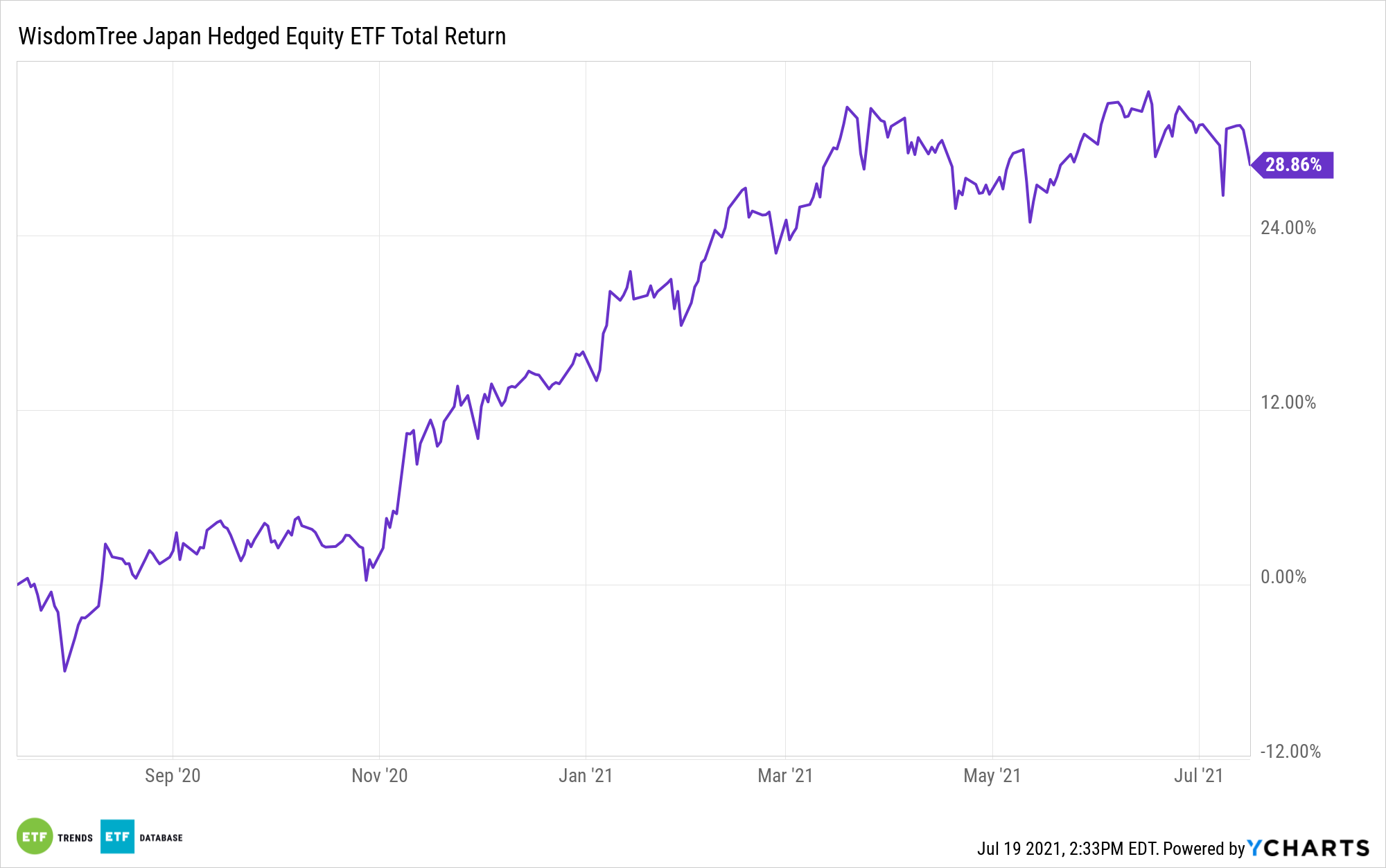

The WisdomTree Japan Hedged Equity Fund (NYSEArca: DXJ) is higher by 11.08% year-to-date, an admirable showing among developed market single-country exchange traded funds.

More upside could be on the way for Japanese equities and DXJ as activist investors increasingly augur for change at companies in the world’s third-largest economy. While Japan doesn’t have a deep history of being home to activist targets, that situation is changing.

“Ten activist campaigns were launched there in the first half of the year, accounting for 26% of non-U.S. campaigns, according to data released by Lazard. The country has rapidly become a hotbed for activism. In 2015, only 6% of non-U.S. campaigns were in Japan,” reports Carelton English for Barron’s.

Activists eyeing Japanese companies may be emboldened by the results Effissimo Capital Management and Farallon Capital Management got at Toshiba, which led to the resignation of the chief executive officer earlier this year. Toshiba is a smaller member of DXJ’s roster.

Seven & I Holdings Co., the parent company of the 7-11 convenience store chain and another DXJ holding, is also the target of activist action.

“ValueAct Capital initiated a stake in 7-Eleven-parent Seven & i Holdings, saying that its sum-of-the parts valuation was steeper than the company’s current market cap. Last month, Seven & i said that it would lower its stake in the parent of retail chain Francfranc,” according to Barron’s.

One reason activists may be targeting Japanese companies is that companies in the Land of the Rising Sun have strong balance sheets and are flush with cash. Only recently, in the past few years, have they started rewarding investors with buybacks and dividends.

Activists often pursue change at cash-rich companies under the auspices of the company not doing right by shareholders and not generating adequate return on that capital.

To date, these activists aren’t displaying sector-level preferences for Japanese firms, but it wouldn’t be surprising to see industrial, consumer discretionary, and technology companies, which combine for nearly 62% of DXJ’s weight, draw more activist attention in Japan. Regardless of sector, the climate looks right for activists in the country.

“Challenges at Japanese companies were once unthinkable. But the country has become more shareholder-friendly following changes made under former Prime Minister Shinzo Abe,” according to Barron’s. “Now, activist wins may become the norm.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.