Developing economies remain a profit/peril proposition, but with the right strategies advisors can improve client outcomes in this asset class.

WisdomTree’s Emerging Markets Multi-Factor Model Portfolio is one such idea.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs,” according to WisdomTree. “The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETFs.”

This model portfolio largely eschews exposure to disappointing state-owned enterprises (SOEs), which weigh on the returns of traditional emerging markets benchmarks.

“Twenty-five percent of the MSCI Emerging Markets Index’s value is in state-owned enterprises. You know what I think? I think most investors have no clue that that is the case,” writes Jeff Weniger, Director of Asset Allocation at WisdomTree.

Emerging Market SOEs

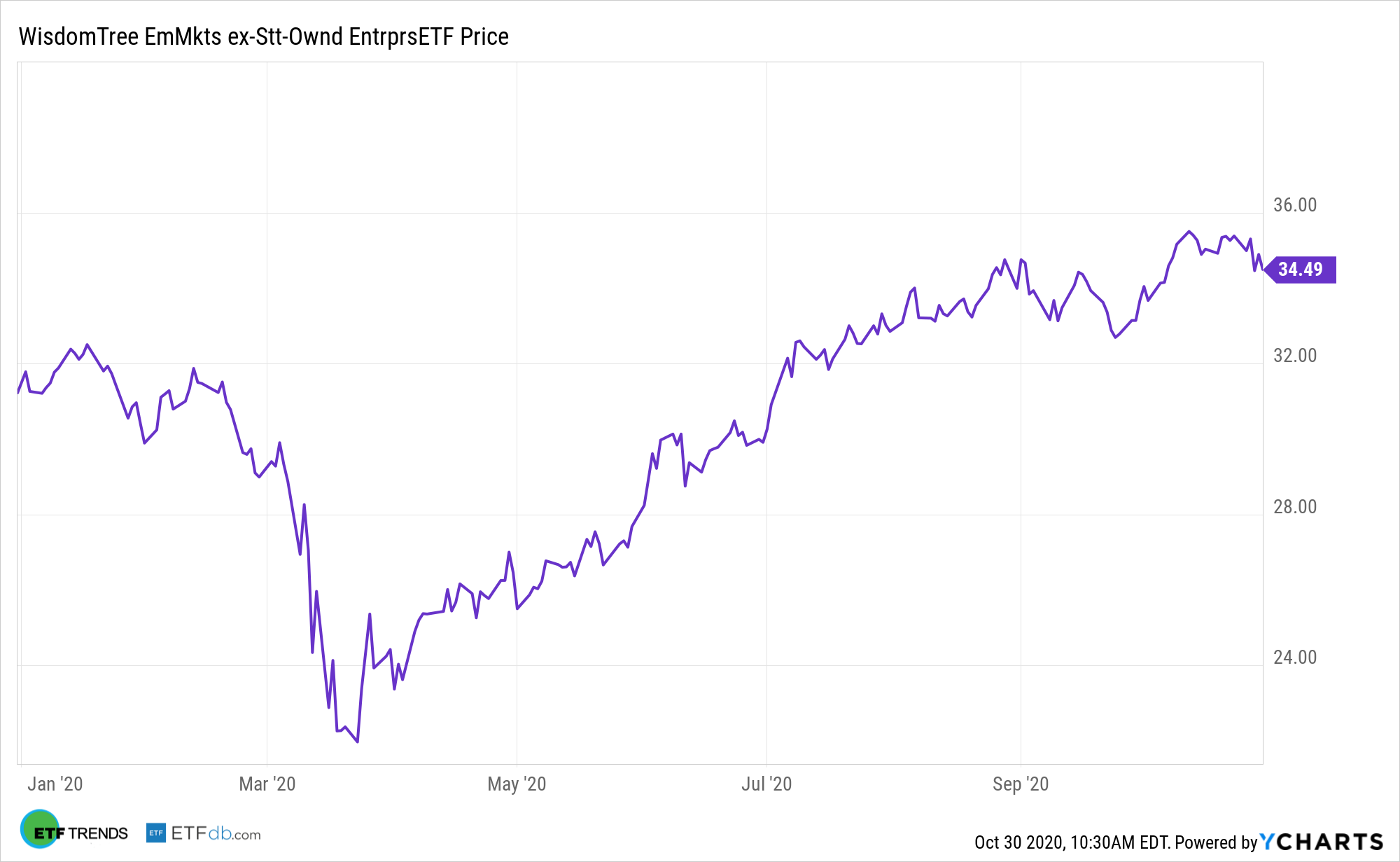

This WisdomTree model portfolio taps the the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE), among other exchange traded funds, to avoid state-controlled companies.

XSOE seeks to track the price and yield performance of the WisdomTree Emerging Markets ex-State-Owned Enterprises Index. Under normal circumstances, at least 80% of the fund’s total assets will be invested in component securities of the index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities. The index is a modified float-adjusted market cap weighted index that consists of common stocks in emerging markets, excluding common stocks of “state-owned enterprises.”

Avoiding SOEs has its benefits, including missing out on scandals that lead to massive equity drawdowns. Consider the case of Brazil’s Petrobras (NYSE: PBR) and the bribery scandal “Operation Car Wash.”

“Name someone in Brazilian high society and there is a good chance they were implicated in that money-laundering scheme, which used the large oil company for ill-gotten gains,” notes Weniger. “Imagine if ExxonMobil pulled a stunt that roped in the president and half the legislature.”

Emerging markets (EM) was already a slippery slope to climb, but with Covid-19, that slope gets slipperier. Recent data however has shown that EM outperformance could be tied to avoiding state-owned enterprises (SOEs).

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.