By Matt Wagner, CFA, Associate, Research

Last August, Warren Buffett’s Berkshire Hathaway made a surprising investment in five Japanese general trading firms, known as “sogo shosha.”

For a company the size of Berkshire Hathaway, with nearly $900 billion in assets, the $6 billion investment was relatively modest.

Perhaps because the amount is just a rounding error for Berkshire, the investment garnered little public attention. There was initial optimism from some—like one article from the Financial Times titled “Why Warren Buffett could lead other money managers into overlooked Japan”—but that attention has waned.

And equity flows from international money managers certainly haven’t followed Buffett’s lead. While there’s been a pickup in recent weeks, the cumulative ¥1.4 trillion (about $13 bn) pales in comparison to the nearly ¥16 trillion in investments made in 2013, the last year of significant foreign investor flows into Japan.

Cumulative Foreign Net Equity Investment (¥ bn)

Beneath the radar, these investments have performed spectacularly. The average return on these investments has been nearly 38% since they were made public—well above the broad Japanese benchmark, the Topix, and the S&P 500.

Total Return, 8/28/20–4/30/21

Rising Cases and Slow Vaccine Rollout

As we noted in a recent post, Japanese equities have had a strong stretch of performance since the end of August. While this outperformance has largely been driven by its tilts to more economically sensitive sectors like Financials, Industrials and Consumer Discretionary, the government’s robust fiscal and monetary response has also been a tailwind.

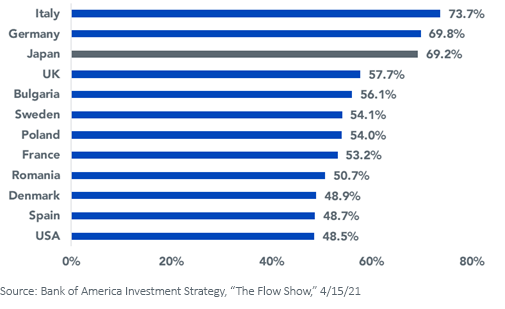

Combined Fiscal and Monetary Response as % of GDP

But in the past few weeks, the Japanese stock market’s reflection of optimism for a global economic rebound has met challenges.

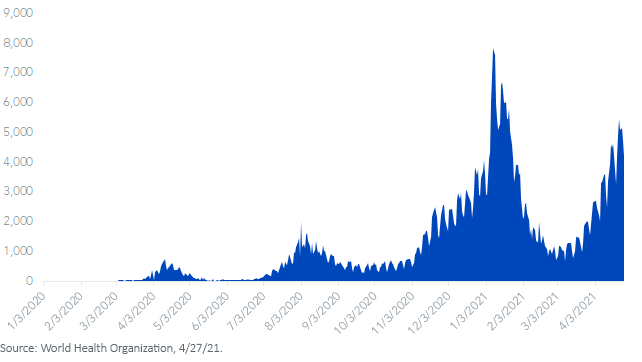

The country’s largest cities again entered lockdown phases to control the spread of the coronavirus. This was done to prevent a rapid spread of the virus during the “Golden Week” holiday from April 29 to May 5.

Japan Daily New Cases of COVID-19

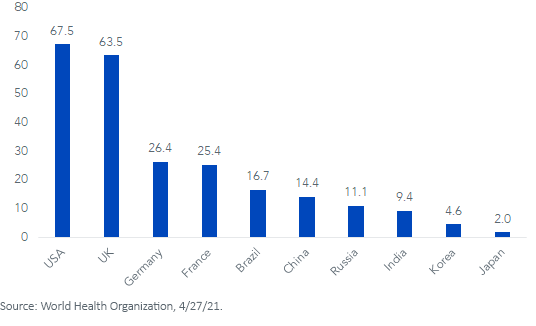

The virus is taking hold while the government has been among the slowest in the world to roll out vaccinations.

Cumulative Vaccination Doses Administered per 100 People

The double whammy of rising cases and a slow vaccination campaign have combined to pump the brakes on the recent outperformance of Japanese equities.

Index Cumulative Total Returns

If the past year has taught investors anything, it is that current trends in virus case counts can be wildly disconnected from stock market performance. For investors worried about low forward returns from high valuations in U.S. markets, Japanese valuations continue to present attractive relative discounts.

Index Forward Price-to-Earnings

While valuations tell us little about the prospects of relative performance over the next six-to-12 months, they tend to matter greatly over time horizons of five-to-10 years.

And Japan’s recent challenges on the virus front—which we all hope swiftly reverse—have created opportunity for investors. As Warren Buffet is famously quoted as saying: “Be fearful when others are greedy and greedy when others are fearful.”

While there are any number of markets to point to in the world today that look downright greedy, Japanese equities have signaled at least a touch of fear.

Originally published by WisdomTree, 5/5/21

Japan Securities Risks:

There are risks that are involved when investing in Japanese securities. Japanese economy has only recently emerged from a prolonged economic downturn. Economic growth is heavily dependent on international trade, government support of the financial services sector and other troubled sectors, and consistent government policy supporting its export market. Slowdowns in the economies of key trading partners such as the United States, China and/or countries in Southeast Asia, including economic, political or social instability in such countries, could also have a negative impact on the Japanese economy as a whole. Currency fluctuations may also adversely impact the Japanese economy and its export market. In addition, Japan’s labor market is adapting to an aging workforce, declining population, and demand for increased labor mobility. These demographic shifts and fundamental structural changes to the labor market may negatively impact Japan’s economic competitiveness.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.

_updated.png)