Over the last 20 years, including the onset of the pandemic in 2020, companies with strong dividend payout ratios have outperformed companies that pay smaller percentages of earnings in dividends and companies that engage in buybacks, reported Barron’s.

Investors utilize the dividend payout ratio (the percentage of earnings that are paid in dividends, calculated per share) to determine shareholder payouts.

A recent report from Credit Suisse looked at the dividend payout ratios over the last four quarters and net buybacks for companies in the S&P 500. By subdividing the dividend-paying companies into thirds based on shareholder payout rankings as well as the buyback companies, the authors were able to compare the top third and bottom third, with consideration for sectors.

The dividend-paying companies in the top third between December 31, 1999 to December 31, 2019 had annualized returns of 10.9% while the bottom third has annualized returns of 6.6%. It’s a trend that has continued through the pandemic, too. Between December 31, 2019 and May 20, 2022, the top tier dividend companies outperformed by 11.3% compared to the bottom tier dividend companies at 7.3% on an annualized basis.

Comparing the companies from the top third of dividend payout ratios to the top third of companies utilizing buybacks, dividend companies offered an annualized return of 10.9% versus annualized returns for buyback companies of 9.3% over the 20-year period.

“Companies that are returning more of their excess capital to shareholders in the form of dividends have historically seen — and are continuing to see — incredibly strong performance,” said Patrick Palfrey, co-head of quantitative research at Credit Suisse. “This is in contrast to buybacks, which are often viewed by market participants as a driver of share prices.”

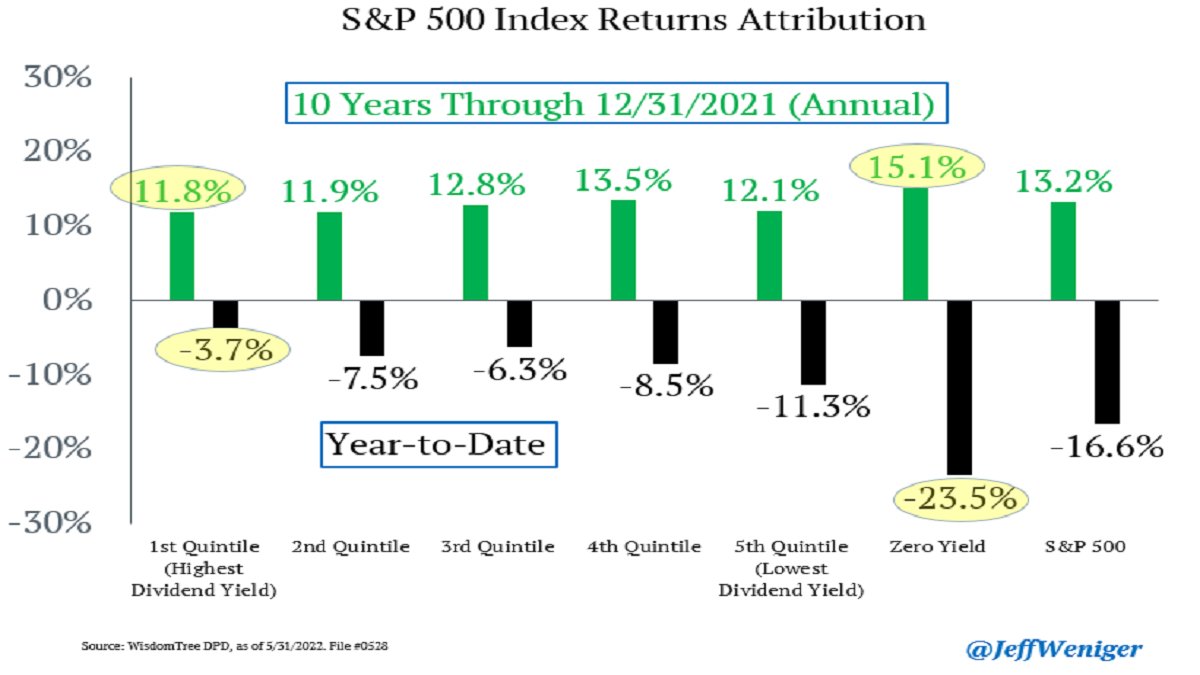

Another angle to consider when investing in the current climate is that while zero dividend-paying companies from the S&P 500 had returns of 15.1% versus high dividend-paying stocks at 11.8% between 2011-2021, that trend has changed drastically.

Image source: Jeff Weniger’s Twitter

Year-to-date, high dividend-paying companies are only down -3.7% while zero dividend-yielding companies are down -23.5%, tweeted Jeff Weniger, CFA and head of equity strategy at WisdomTree.

Investing in Dividend Paying Companies with WisdomTree

WisdomTree offers a suite of dividend ETFs for investors looking for exposure to U.S. equities, whether within core allocations or with a value focus. Options include the WisdomTree US Quality Dividend Growth Fund (DGRW), which invests in large-cap U.S. equity companies that are growing their dividends and applies both quality and growth screens to securities, the WisdomTree U.S. LargeCap Dividend Fund (DLN), which invests in large-cap companies that pay dividends within the U.S. equity market, and the broader WisdomTree U.S. Total Dividend Fund (DTD) that invests in companies from all market caps that pay dividends within the U.S. equity market.

There is also the popular WisdomTree U.S. High Dividend Fund (DHS) which invests in high dividend-yielding U.S. equity companies for investors looking for higher-yielding opportunities.

For more news, information, and strategy, visit the Modern Alpha Channel.