As just one example of small cap strength this year, the Russell 2000 Index is higher by 17.49%. Yet as is often the case with strength in smaller companies, valuations are always a concern.

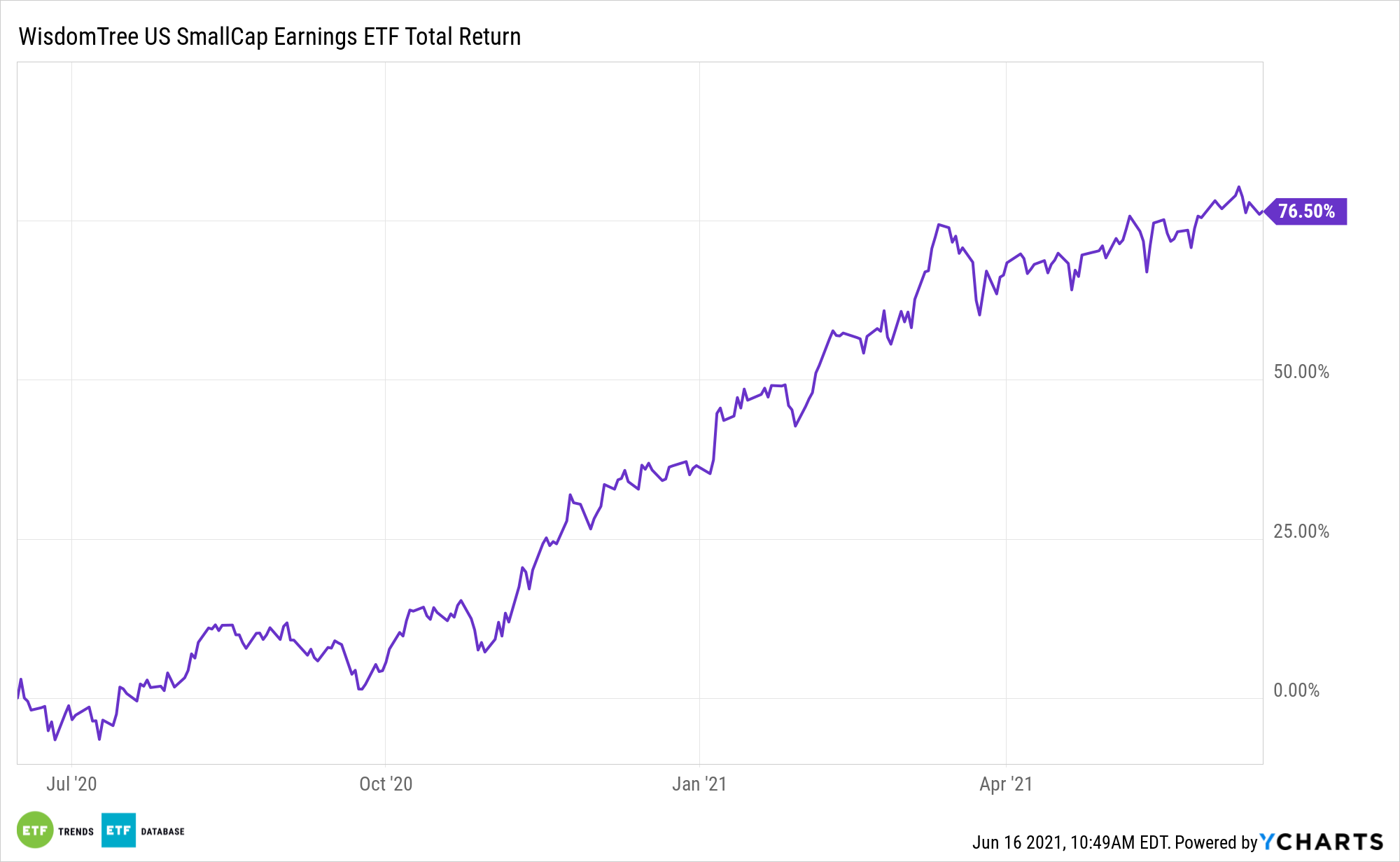

Investors can mitigate some of the valuation risk tied to small caps via the WisdomTree U.S. SmallCap Fund (NYSEArca: EES). The fundamental approach used by EES sets it apart from prosaic small cap strategies. EES tracks the WisdomTree U.S. SmallCap Index, which is an earnings weighted index. In plain English, companies with larger earnings command bigger percentages in the index.

That’s a quality trait to be sure, particularly in the small-cap universe where plenty of indices are chock-full of companies that aren’t yet profitable. That advantage for EES could imply the fund is richly valued, but the opposite is true.

“It’s currently trading at an 11% discount to its historical average on a forward P/E basis since inception in February 2007. It also remains attractively priced by historical standards, ranking in the 26th percentile by the same measure,” writes WisdomTree analyst Brian Manby. “Similarly, EES is also trading at a historically deep discount to the Russell 2000. Its forward P/E is 58% less than that of the broader small-cap Index as of May.”

The ‘EES’ Value Opportunity

With EES trading at a discount relative to historical norms and the Russell 2000, it’s not a stretch to call the product a value fund. That status is cemented by a combined 60% weight to three cyclical sectors – financial services, industrials, and consumer discretionary. Those cyclical exposures are pivotal today because they intimately lever EES to the rebounding U.S. economy.

“Likewise, small caps tend to operate in cyclical economic sectors versus larger market benchmarks such as the S&P 500 Index,” adds Manby. “Cyclicals have already started to enjoy the benefits of the reopening trade this year, and if they have more room to rally, then there’s reason to believe they may outperform.”

EES is proving the combination of value stocks and profitable companies is meaningful. Additionally, EES could provide investors with a buffer against small cap retrenchment if that pullback is caused by riskier, less profitable companies that experienced rapid expansions since the start of 2021. Ultimately, EES covers a lot of bases for investors.

“Whether you’re a bull or bear, there are direct implications for small-cap allocations. No matter your economic forecast for the near future, we think the WisdomTree U.S. SmallCap Fund can be a part of it,” concludes Manby.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.