Timing individual investment factors is difficult, but some advisors and clients still try to do it. There are easier ways of deploying factor-based strategies.

Consider the U.S. Multi-Factor Model Portfolio, which is part of WisdomTree’s Modern Alpha series of model portfolios.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of U.S. equities primarily using factor focused ETFs. The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods,” according to WisdomTree.

Multi-factor strategies are beneficial to both advisors and clients.

“Multifactor funds are sound in theory. They target stocks with characteristics that have historically been associated with market-beating performance, also known as factors,” notes Morningstar analyst Alex Bryan. “Just as it’s prudent to diversify across asset classes, sectors, regions, and securities, it’s a good idea to spread bets across factors that have a good chance of long-term success. Doing so can reduce risk and make it easier to stick with these factors through their inevitable rough patches.”

Multiple Factors across Multiple Countries

The WisdomTree model portfolio can potentially provide investors efficient access to international developed stocks with relatively low tracking error to the domestic and international developed equity markets. Its innovative factor definitions and combinations may enhance the risk/return profile without significantly differing from the targeted index holdings.

Multi-factor ETFs are increasingly prominent options for advisors looking for broad-based, diversified allocations for clients, but the application of multi-factor strategies isn’t getting enough attention.

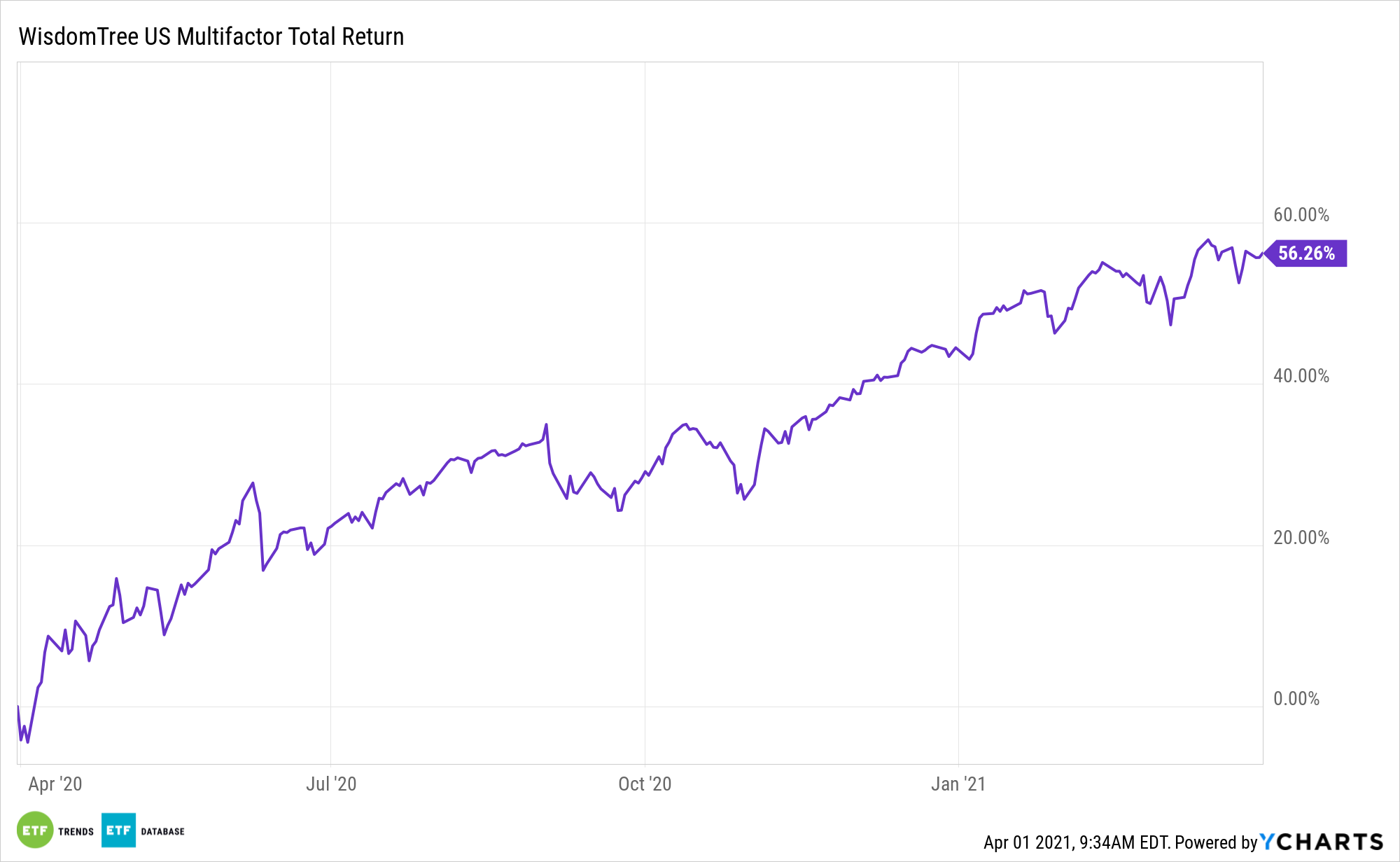

One stalwart of this model portfolio is the WisdomTree U.S. Multifactor Fund (CBOE: USMF). USMF, which is a holding in several of WisdomTree’s Modern Alpha Model Portfolios, isn’t an ordinary multi-factor approach.

USMF tracks the WisdomTree U.S. Multifactor Index, which is generally comprised of 200 U.S. companies with the highest composite scores based on two fundamental factors (value and quality measures) and two technical factors (momentum and correlation).

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.