Investors typically enjoy shareholder rewards, such as dividends and buybacks, but both have a way of sparking debate. That is particularly true of share repurchase programs, many of which are initiated when a company’s stock has already rallied.

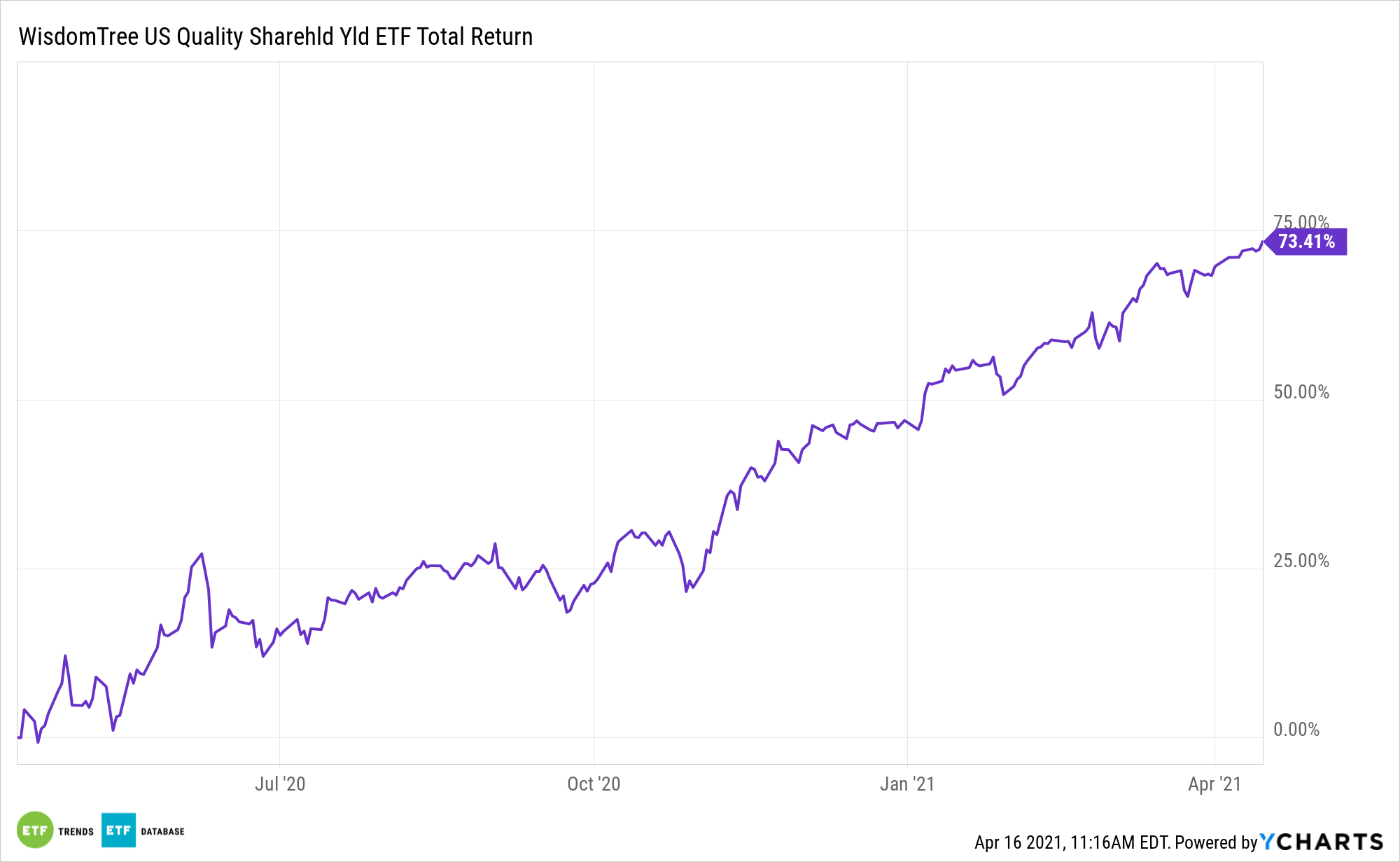

Some exchange traded funds focus solely on dividends while others emphasize buybacks. There are also broader shareholder yield strategies, including the WisdomTree U.S. Quality Shareholder Yield Fund (NYSEArca: QSY). QSY identifies companies with a high total shareholder yield and favorable quality attributes.

Often lost in the shareholder yield conversation is that it’s a value factor, and a potent one at that.

“Despite these recent value factor trends, it would be remiss to neglect the past,” writes WisdomTree analyst Kara Marciscano. “In the last 10 years, shareholder yield was the only value factor that ‘worked’—meaning it was the only effective way to screen the Russell 1000 Index for the least expensive stocks and outperform not only the expensive stocks, but also the benchmark index itself.”

Shareholder Yield as a Better Valuation Metric?

Traditional value funds, many of which have been laggards for substantial portions of the recent U.S. bull market, often focus on price-to-earnings and price-to-book ratios, but shareholder yield can be a more potent valuation metric.

The three components of shareholder yield are good measures for shareholder friendliness. The trifecta helps investors target companies with a history of dividend growth, low debt, and the ability to support equity prices through share buybacks.

“The consistency of shareholder yield in the recent value upturn and over the last 10 years is an important differentiator. At WisdomTree, we view shareholder yield as an effective value factor for both short-term, tactical value investors and long-term, strategic value investors,” adds Marciscano.

While there is an ongoing debate regarding the superior method of shareholder compensation – buybacks or dividends – there is no denying dividend growth stocks have been less volatile while offering superior returns than those that do not grow dividends over the previous three decades. Additionally, there are compelling reasons to consider QSY in the current low yield environment.

“QSY is a quantitative active strategy that combines a methodical approach to ranking stocks on their shareholder yield and quality scores, with the added ability to apply discretion where risks or opportunities to the quantitative model arise,” continues Marciscano. “We recently rebalanced QSY to update the holdings for some notable repurchase activity taking place. Most importantly, we added Berkshire Hathaway to QSY, which repurchased 5% of its shares outstanding in calendar year 2020. In dollar amount and yield terms, Berkshire repurchased $24.7 billion in shares relative to its approximately $580 billion market cap, equating to a 4.2% shareholder yield.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.