Timing investment factors is difficult, but that doesn’t mean the growth-to-value rotation is getting less attention.

While growth may currently be lagging, the future outlook is far less certain. Advisors can cover both bases while positioning for the expansion phase in the economic cycle with WisdomTree’s series of growth model portfolios.

“These U.S.-focused model portfolios allocate to multi-factor equity and fixed income ETFs across multiple risk profiles leveraging our Modern Alpha® approach,” according to the issuer.

The suite of model portfolios is available with four varying degrees of risk ranging from conservative to aggressive growth. The further up the risk spectrum an advisor goes with these model portfolios, the more equity exposure clients get.

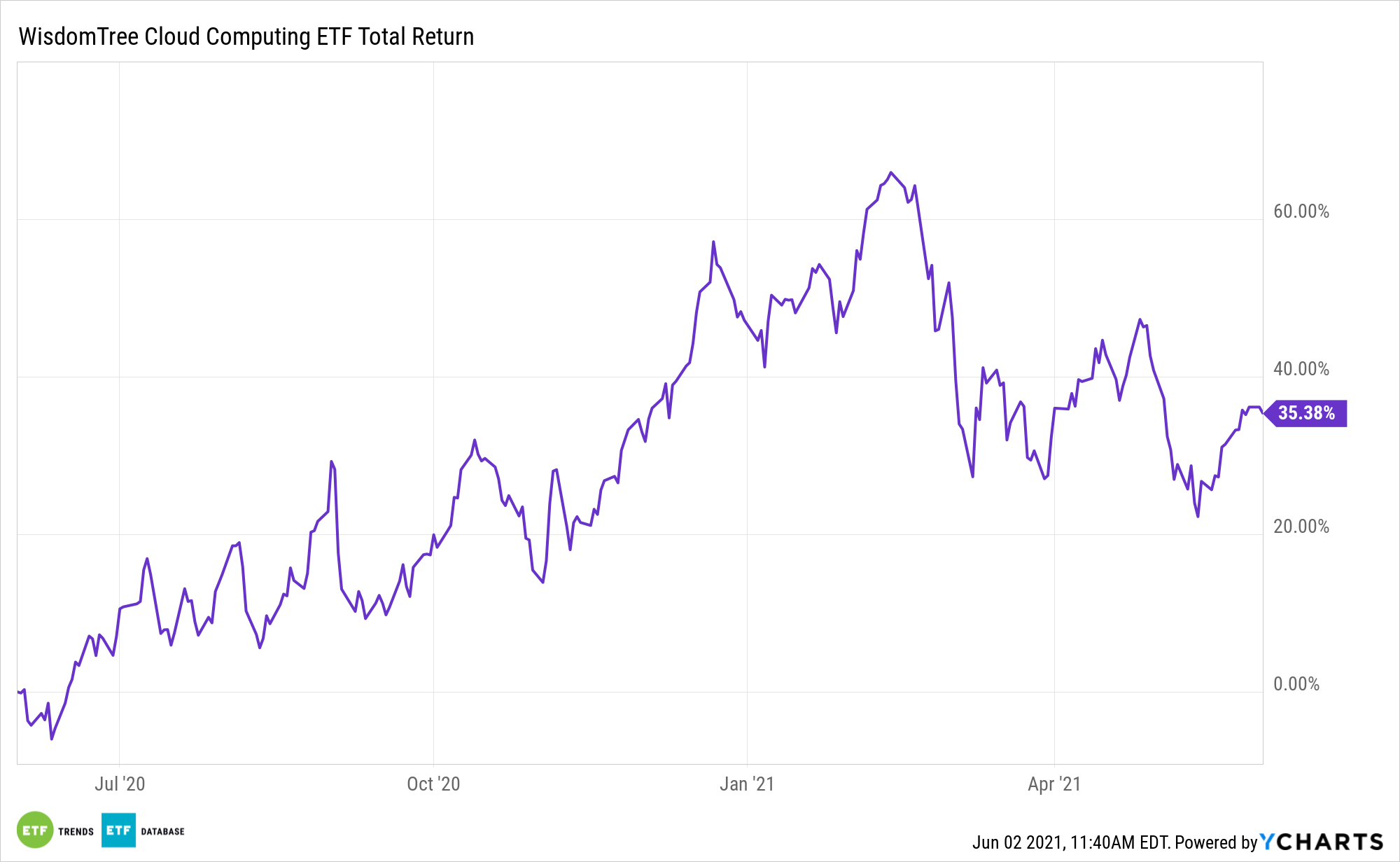

In the case of the aggressive portfolio, the strategy features an 80/20 equity/fixed income split. Despite allocations to a dedicated growth exchange traded fund and the WisdomTree Cloud Computing Fund (WCLD), the aggressive model portfolio isn’t excessively risky, nor is it over-allocated to the growth factor.

In fact, this sleeve of the portfolio features robust allocations to an array of factors, confirming it’s a solid idea for those looking to eschew the factor timing burden as well.

For example, the portfolio features size factor exposure by way of the WisdomTree U.S. SmallCap Dividend Growth Fund (NasdaqGM: DGRS) and the WisdomTree U.S. MidCap Dividend Fund (NYSEARCA: DON). DON is beating the S&P MidCap 400 Index by more than 500 basis points year-to-date.

DON and DGRS are two of three dedicated dividend ETFs in the model portfolio, indicating it also offers clients ample quality exposure too.

The model portfolio allocates 20% of its weight to bonds, which is sourced via eight ETFs featuring a variety of maturities, credit qualities, and geographic exposures.

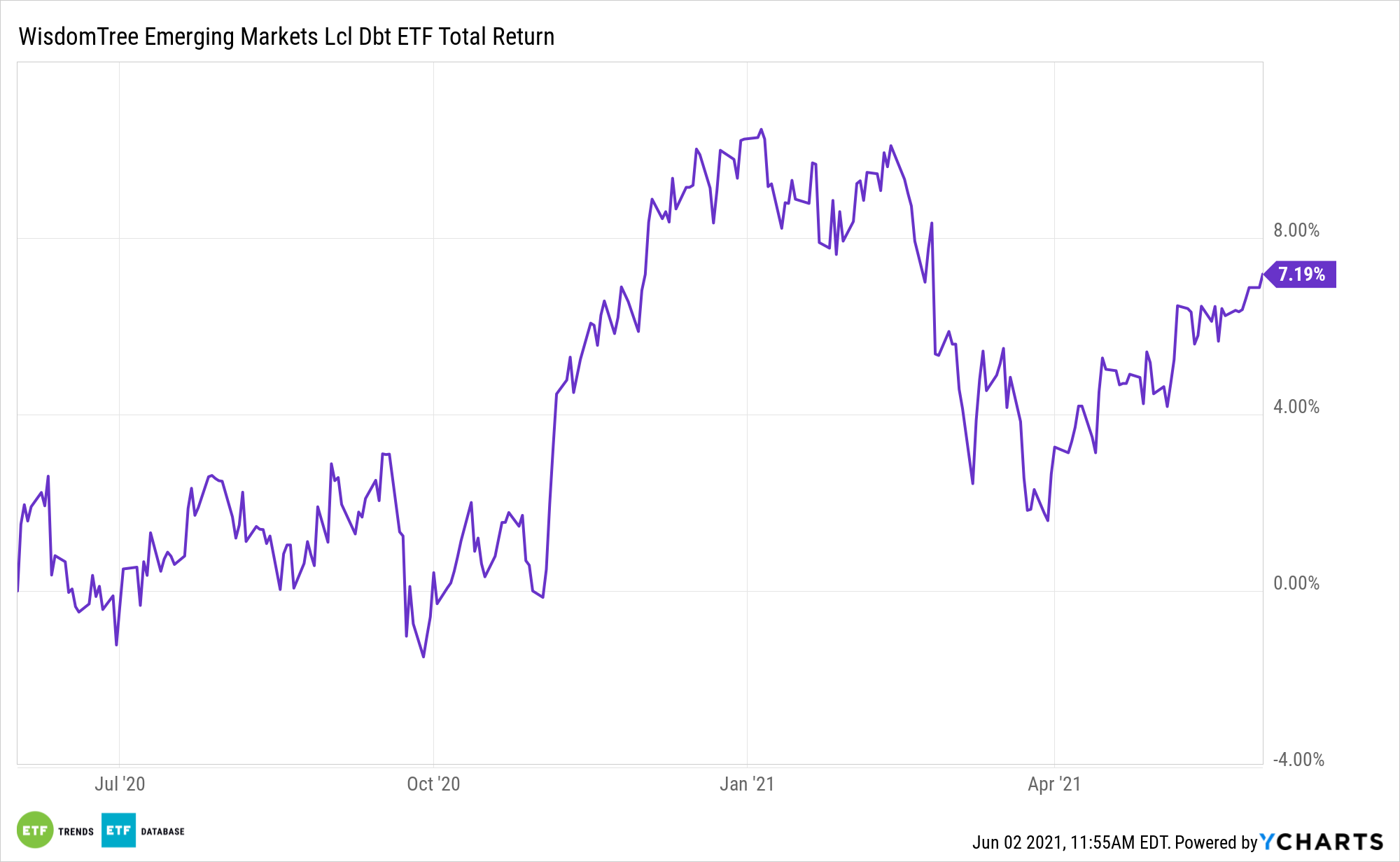

Like its equity counterpart, the fixed income portion isn’t overly risky, but it goes beyond domestic sovereign debt. Junk and investment-grade corporate bond ETFs are part of the mix, as is the actively managed WisdomTree Emerging Markets Local Debt Fund (NYSEArca: ELD).

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.