In the realm of disruptive growth investments, there are a slew of platform-driven companies spanning an array of high octane segments and technologies.

Predictably, stock picking in these spaces is difficult, but advisors can ease that burden with WisdomTree’s new Disruptive Growth Model Portfolio.

“The WisdomTree Disruptive Growth ETF Model Portfolio targets structural growth themes that are believed to drive innovation across different industries and segments of society in the future,” according to the issuer. “The themes and affiliated ETFs selected for inclusion will typically have above-market growth projections. The model portfolio seeks maximum long-term capital appreciation and may include both WisdomTree and non-WisdomTree ETFs.”

How WisdomTree’s PLAT ETF Embodies the Changing Landscape

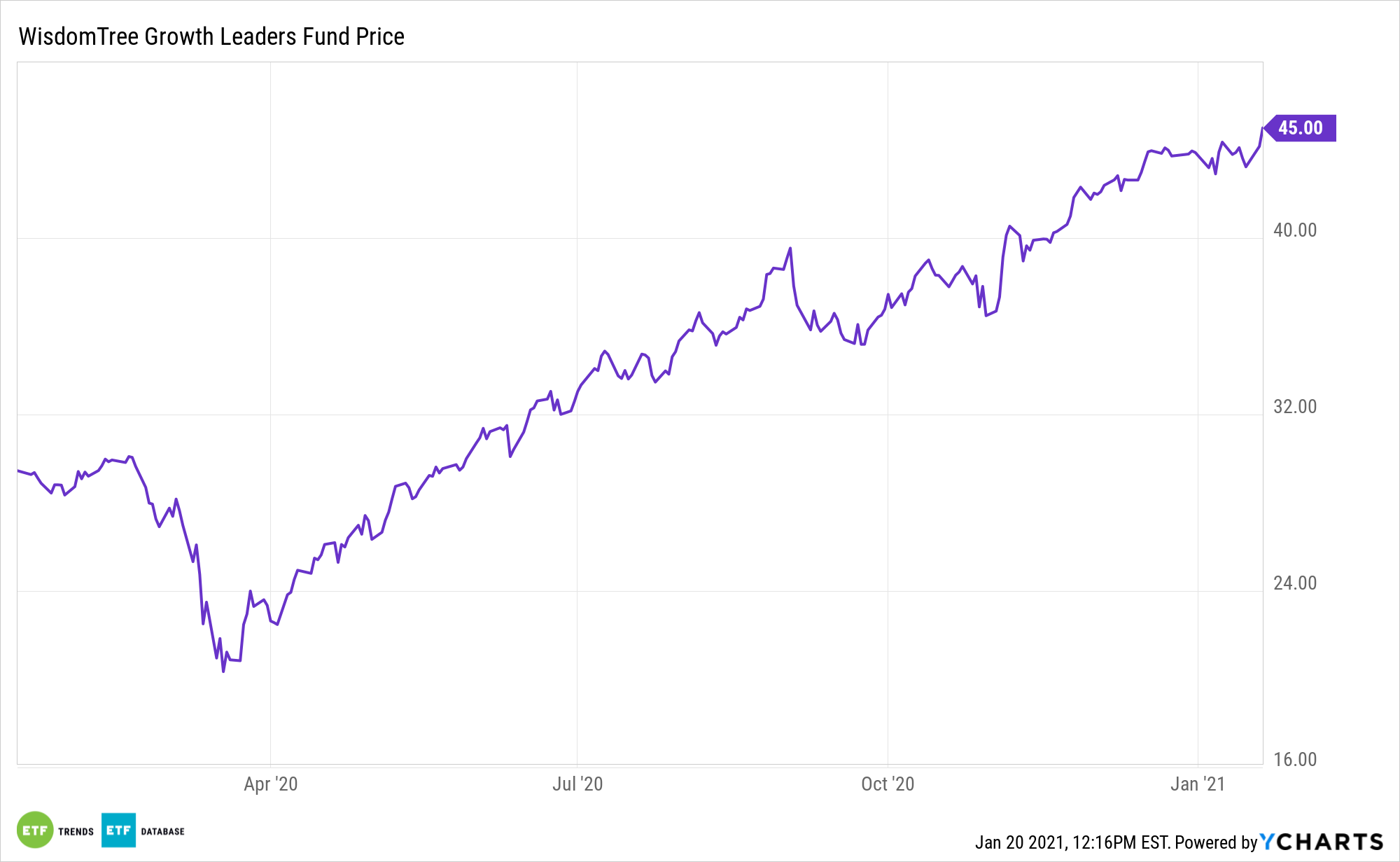

The WisdomTree Growth Leaders Fund (PLAT), part of the aforementioned model portfolio, is the first exchange traded fund dedicated to platform-based investments.

PLAT offers investors access to companies that are generating revenue from platform business models – companies with non-linear business models focused on creating value by facilitating interactions between two or more groups through technology.

“The technology platform has emerged as the preeminent business model after many years in ascent,” according to Sparkline Capital. “We use natural language processing to identify platform companies and show that they have significantly outperformed the stock market. Platforms’ powerful network effects generate positive feedback and monopoly dynamics, which are disrupting traditional valuation approaches.”

Platform-based businesses are gaining market share at the expense of traditional, linear businesses. They do so with better scale economics and long-term profitability figures.

There’s big future growth potential for platform businesses. These firms don’t own the means of production, they own the means of connection.

“The “platformization” of the stock market is not just about splashy IPOs and tech giants. The number of platforms in the top 500 US stocks has steadily grown from 40 to 100,” notes Sparkline. “We expect this trend to continue. There are 500 private companies valued over $1 billion. Many of these ‘unicorns’ are platform businesses ripe to join the public markets in the next several years.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.