With so much talk about the return of dividend growth in the U.S., it can be easy for investors to overlook the payout potency of international stocks.

Indeed, there’s ample room for payouts in developing economies to grow. As of May 20, the dividend yield on the widely followed MSCI Emerging Markets Index was 1.40%. That’s just one basis point below the comparable metric on the S&P 500.

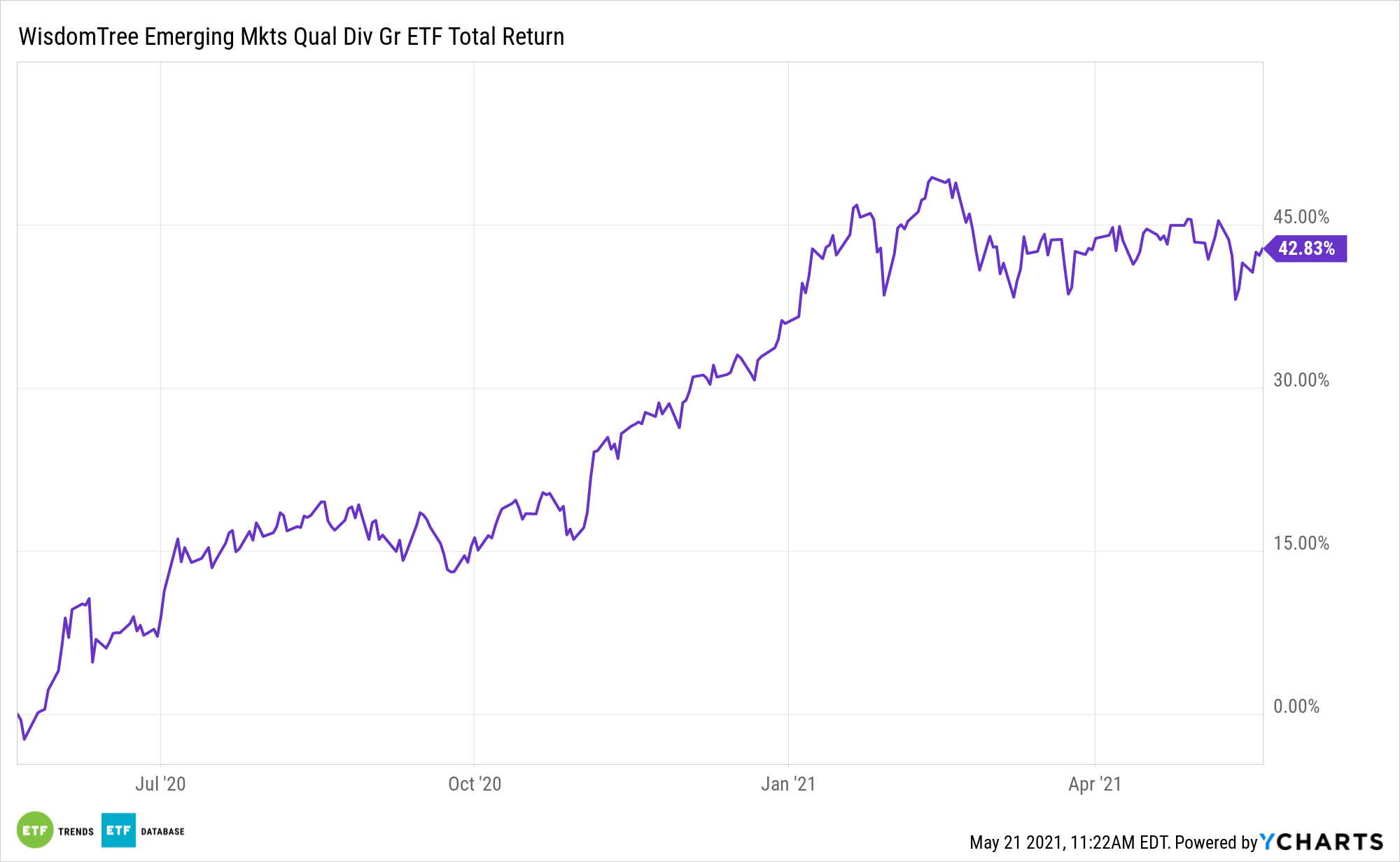

Indeed, 1.40% qualifies as a low yield, but that’s not a license for investors to embrace risky high dividend fare. Quality is essential when it comes to dividend growth investing, and that’s particularly true in emerging markets. On that front, the WisdomTree Emerging Markets Dividend Growth Fund (DGRE) is valid consideration for investors.

DGRE, which turns eight years old in August, can be used as an alternative or complement to high dividend strategies because the WisdomTree fund focuses on quality and growth metrics.

Future Dividends Growth

DGRE’s relevance as an income consideration in 2021 is cemented by the notion that dividends the world over are forecasted to grow. However, investors can be confined by home country bias. While the U.S. accounts for a massive percentage of dividends paid annually, the country will represent just a small percentage of payout growth this year.

“The U.S. accounts for nearly a third of this year’s projected dividends but is expected to see only 3% growth. Europe and emerging markets are projected to post the strongest dividend gains this year—up 23% and 22%, respectively—as the regions, which saw payouts take a hit last year, are poised for recovery from the pandemic,” reports Carleton English for Barron’s.

Adding to the allure of DGRE is that, following a 2018 conversion, it’s an actively managed fund. That means the managers can emphasize geographic opportunities for payout growth while avoiding potential pitfalls that often arise in emerging markets, including state-controlled banks and commodities producers with challenged balance sheets.

On that note, emerging markets tech stocks are viewed as a source of dividend growth. Citing Jefferies research, Barron’s highlights Taiwan Semiconductor (NYSE:TSM) and Samsung Electronics as two emerging markets tech names with significant payout growth potential. Both companies are expected to deliver significant earnings per share growth, which is supportive of higher dividends. The pair are the fund’s largest and third-largest holdings, respectively, combining for almost 10% of its weight.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.