Cloud computing stocks and the related exchange traded funds are not as hot this year as they were in 2020, but that doesn’t mean investors should be dismissive of the group.

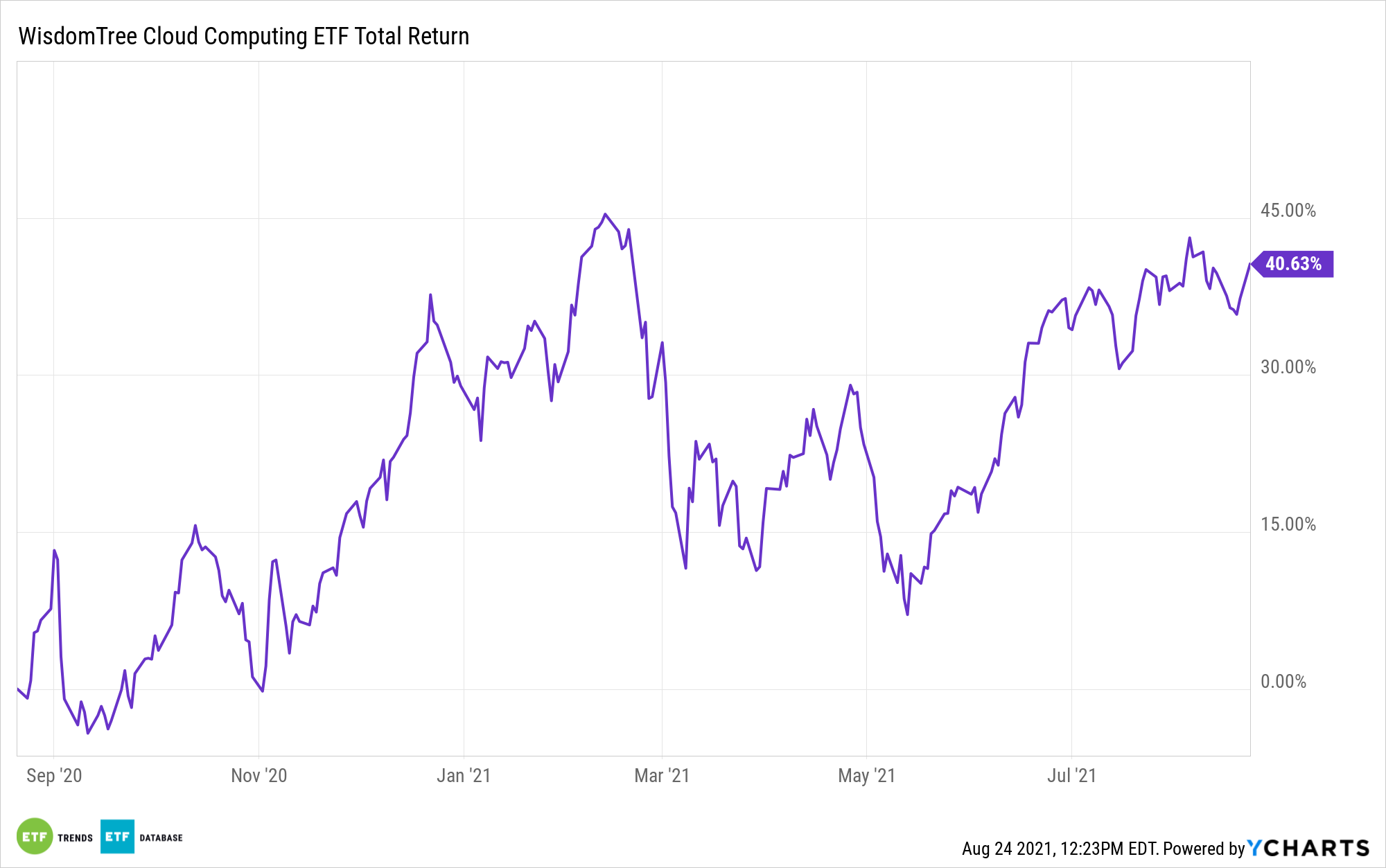

In fact, in a case of “look now,” the WisdomTree Cloud Computing Fund (WCLD) is higher by more than 19% over the past 90 days, indicating there is upside to be had in the cloud. As the recent Cloud 100 report confirms, industry fundamentals are increasingly positive. Bessemer Venture Partners, developer of the BVP Nasdaq Emerging Cloud Index, WCLD’s underlying index, is one of the publishers of that report.

“The cumulative value of the 2021 Cloud 100 is $518 billion, a 94% year-over-year (YoY)increase from $267 billion,” writes WisdomTree analyst Kara Marciscano. “That aggregate valuation is greater than the individual gross domestic product (GDP) of 87% of the world’s countries! The average company on the list is valued at $5.2 billion, which is more than double the 2020 average of $2.5 billion.”

Another encouraging sign for cloud investors is that private market investors remain enthusiastic about the industry’s prospects as the number of unicorns — companies with valuations of $1 billion or more — continues to swell. That could set the stage for more highly anticipated initial public offerings (IPOs) and perhaps, further down the road, some interesting new additions to WCLD’s index.

“In 2021, every company on the Cloud 100 list has at least a $1 billion valuation—companies meeting this threshold are referred to affectionately as ‘unicorns,’” adds Marciscano. “For reference, 87% of last year’s list were unicorns. This is evidence that the appetite for strong cloud computing businesses continues to grow.”

Speaking of fundamental factors, sales growth in the cloud space is accelerating at an impressive rate, potentially indicating some market participants are missing the boat on cloud stocks this year.

“The average revenue growth rate on the list was 90% YoY, which compares to 80% in 2020. The top quartile of companies on the list grew 110% YoY, which is faster than ever, according to Bessemer,” notes Marciscano.

WCLD and cloud stocks in general are growth concepts, but cloud computing is delivering higher returns than broader growth equity benchmarks. Over the three-year period ending August 20, 2021, WCLD is up 125.3% compared to “just” 86.1% for the S&P 500 Growth Index. Adding to the case for WCLD is the cloud industry’s intersection with other disruptive technologies, with fintech being a prime example.

“Many of today’s cloud companies embed financial services and payments within their software solutions,” said Marciscano. “For example, Cloud 100 constituent Toast offers an all-in-one point-of-sale and restaurant management platform for restaurants. In Bessemer’s view, cloud companies like Toast are often able to process payments and payroll more efficiently than many traditional banks.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.