When it comes to rebounding emerging markets equities, several market forces are currently at play. First, avoiding state-backed companies can help keep investors safe in this arena. Second, environmental, social, and governance (ESG) investing has growing applications within the sector.

Advisors can meet those demands with model portfolios, including the Emerging Markets Multi-Factor Portfolio.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs. The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETF,” according to WisdomTree.

Avoiding state-owned enterprises (SOEs) can lead clients to more favorable ESG outcomes.

“WisdomTree’s family of ex-state-owned enterprises (ex-SOE) Indexes was designed to represent the performance of emerging markets companies without significant government ownership—which we define as a 20% or more stock ownership stake,” according to WisdomTree research. “As a result of this state-ownership screening, there were explicit tilts away from poor corporate governance companies and implicit tilts away from companies that score poorly on environmental considerations.”

Why ESG Helps You Avoid SOEs

Avoiding SOEs is one of the easiest ways for investors to apply some level of ESG to emerging markets stocks, because these companies are often in climate-offending industries or have problematic governance and social records.

“A common criticism of SOEs is that political influences force them to employ too many people and pay above-market wages. A real-life example of the principal-agent problem can be seen by contrasting the per-employee revenue numbers of two comparable energy companies: state-owned PetroChina and privately held Exxon Mobil,” notes WisdomTree.

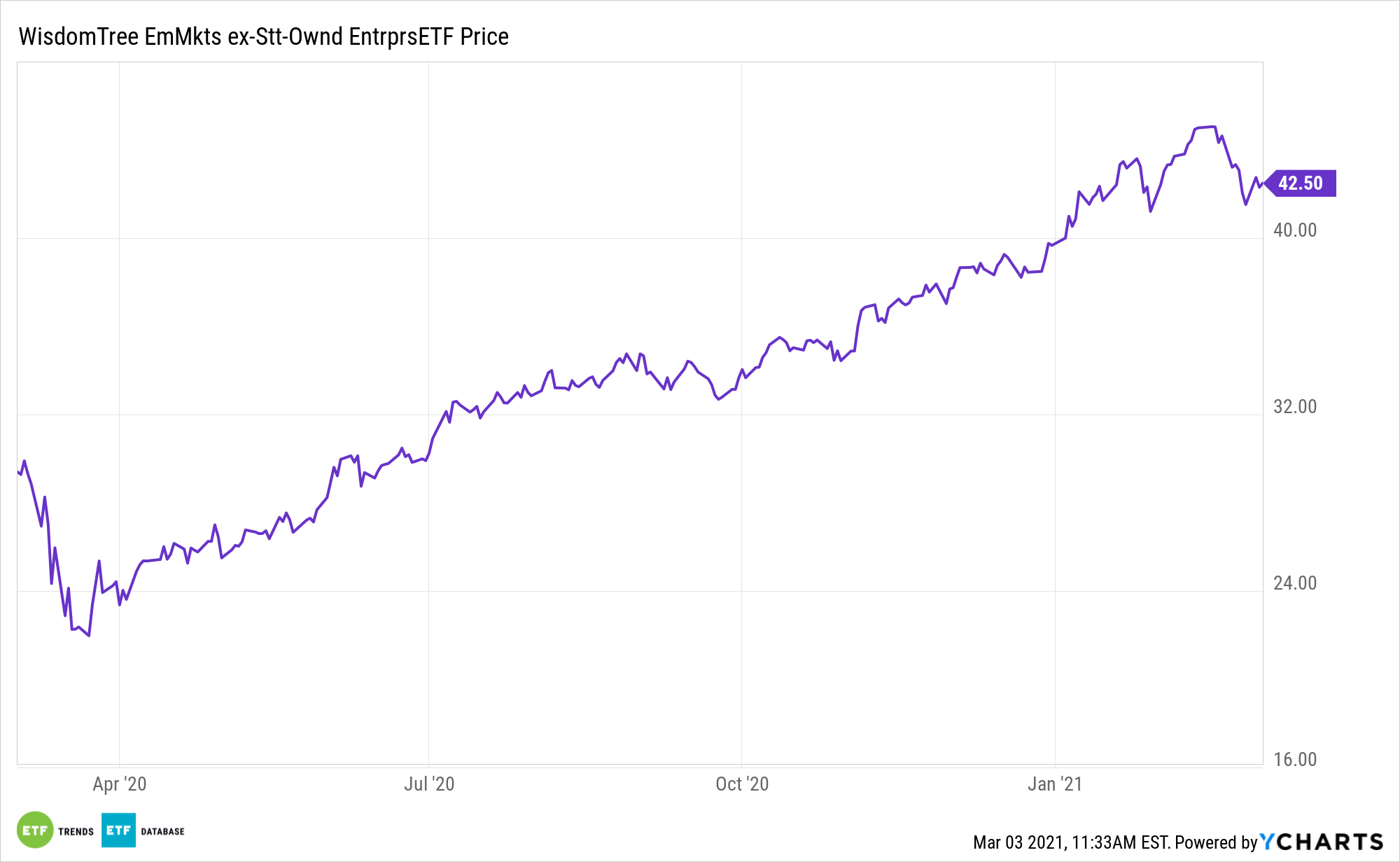

The WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE) is one of the components in the aforementioned model portfolio.

XSOE seeks to track the price and yield performance of the WisdomTree Emerging Markets ex-State-Owned Enterprises Index. Under normal circumstances, at least 80% of the fund’s total assets will be invested in component securities of the index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities. The index is a modified float-adjusted market cap weighted index that consists of common stocks in emerging markets, excluding common stocks of ‘state-owned enterprises’.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.