Endowments investment advantages include large sums of cash and the ability to access asset classes off limits to most investors.

Advisors can bring endowment-style investing to client portfolios with WisdomTree’s series of Endowment Model Portfolios.

“By thoughtfully integrating equities, bonds and alternative investments, WisdomTree has created variations of each model with differing risk profiles. WisdomTree’s bespoke approach seeks to ensure that there is a model portfolio for a range of investors, from the conservative to the aggressive,” according to the issuer.

WisdomTree offers five levels of risk tolerance in this model portfolio series – conservative, moderately conservative, moderate, aggressive, and moderately aggressive.

WisdomTree Branching into Endowment Excellence

A cornerstone of endowment investing is generating solid risk-adjusted returns while minimizing volatility. Alone, that’s a tough objective for many advisors to meet. It becomes even thornier when introducing alternative assets, which many endowments rely on to reduce risk and boost returns.

“Endowment is a reference to including non-traditional assets in addition to stocks and bonds, similar to a strategy that many endowments employ. The strategies may use both WisdomTree and non-WisdomTree ETFs. It typically includes U.S. and international equity and fixed income funds, along with different types of alternative strategies,” according to WisdomTree.

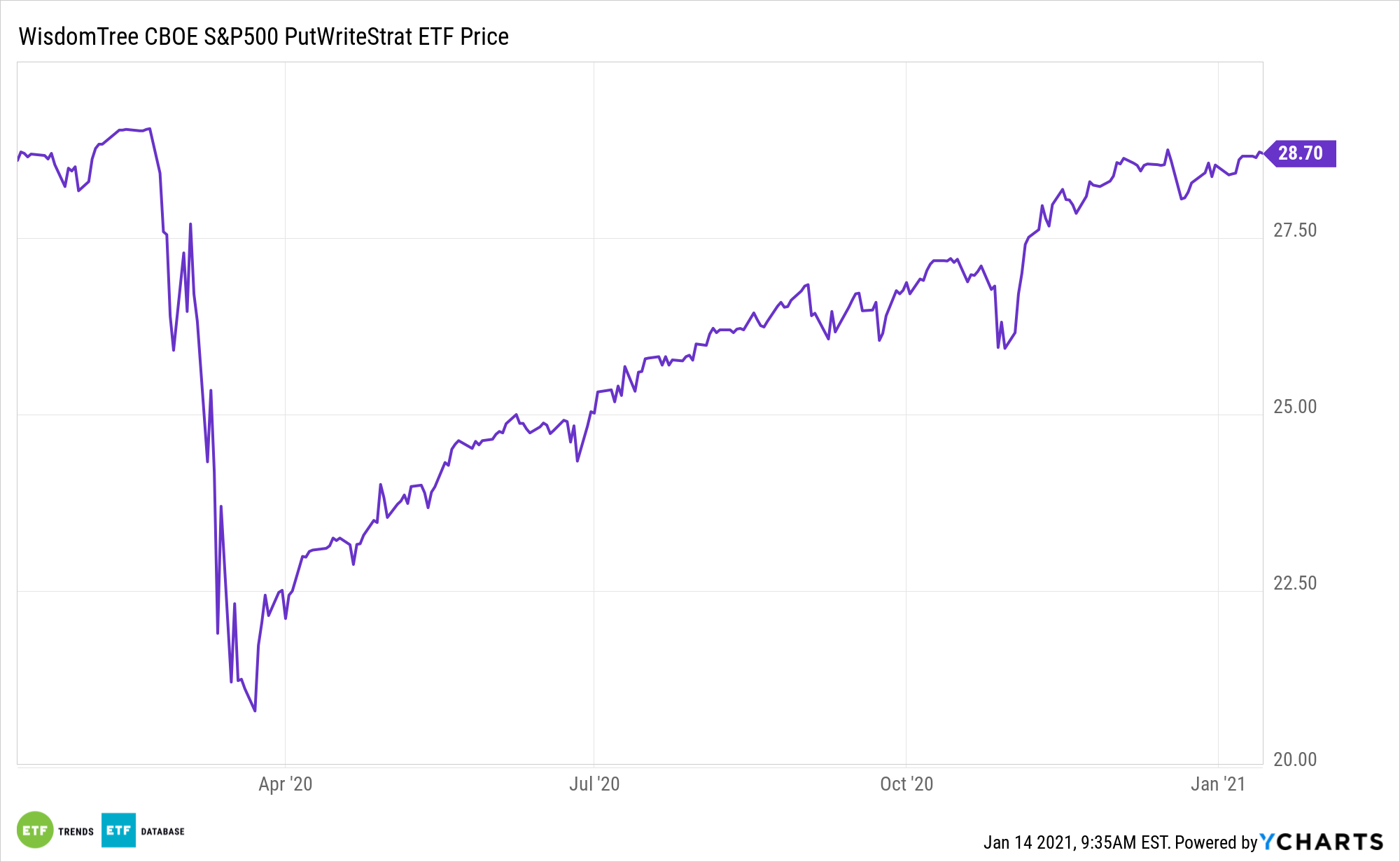

The moderately aggressive sleeve is half allocated to equities, 30% to bonds, and 20% to alternative assets. Additionally, it boasts income-generating assets across the roster, including the WisdomTree CBOE S&P 500 PutWrite Strategy Fund (NYSEArca: PUTW).

PUTW can help investors generate income by selling volatility through writing options. PUTW includes one- and three-month Treasury bills and sells or “writes” one-month, at-the-money, S&P 500 Index puts.

Options writing strategies not only reduce portfolio volatility, but deliver higher yields than common stocks and Treasuries. Additionally, PUTW delivers a steadier stream of income, a relevant consideration for investors in a low-yield environment. Plus, the income offered by a fund like PUTW is likely to keep up with if not exceed inflation.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.