Broadly speaking, emerging markets equities are disappointing investors yet again this year, but with the proper strategies, advisors can offer investors the potential for better outcomes in developing economies.

WisdomTree’s Emerging Markets Multi-Factor Model Portfolio is one such idea.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs,” according to WisdomTree. “The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETFs.”

Lesson from the Past: Avoid SOEs

What makes this model portfolio relevant today is its avoidance of state-owned enterprises (SOEs), which history indicates can bring investors plenty of heartache in developing economies.

“Though Deng Xiaoping started to open the country shortly after Mao’s 1976 death, let’s get real: it could only be engaged by Western capital in the last quarter century or so, and in a heavily restricted manner at that,” writes Jeff Weniger, director of asset allocation at WisdomTree. “For that matter, everywhere else with a red star on the Cold War map above was basically uninvestable, too. Even after the USSR finally crumbled in 1991, Eastern Europe remained a mess throughout the 1990s.”

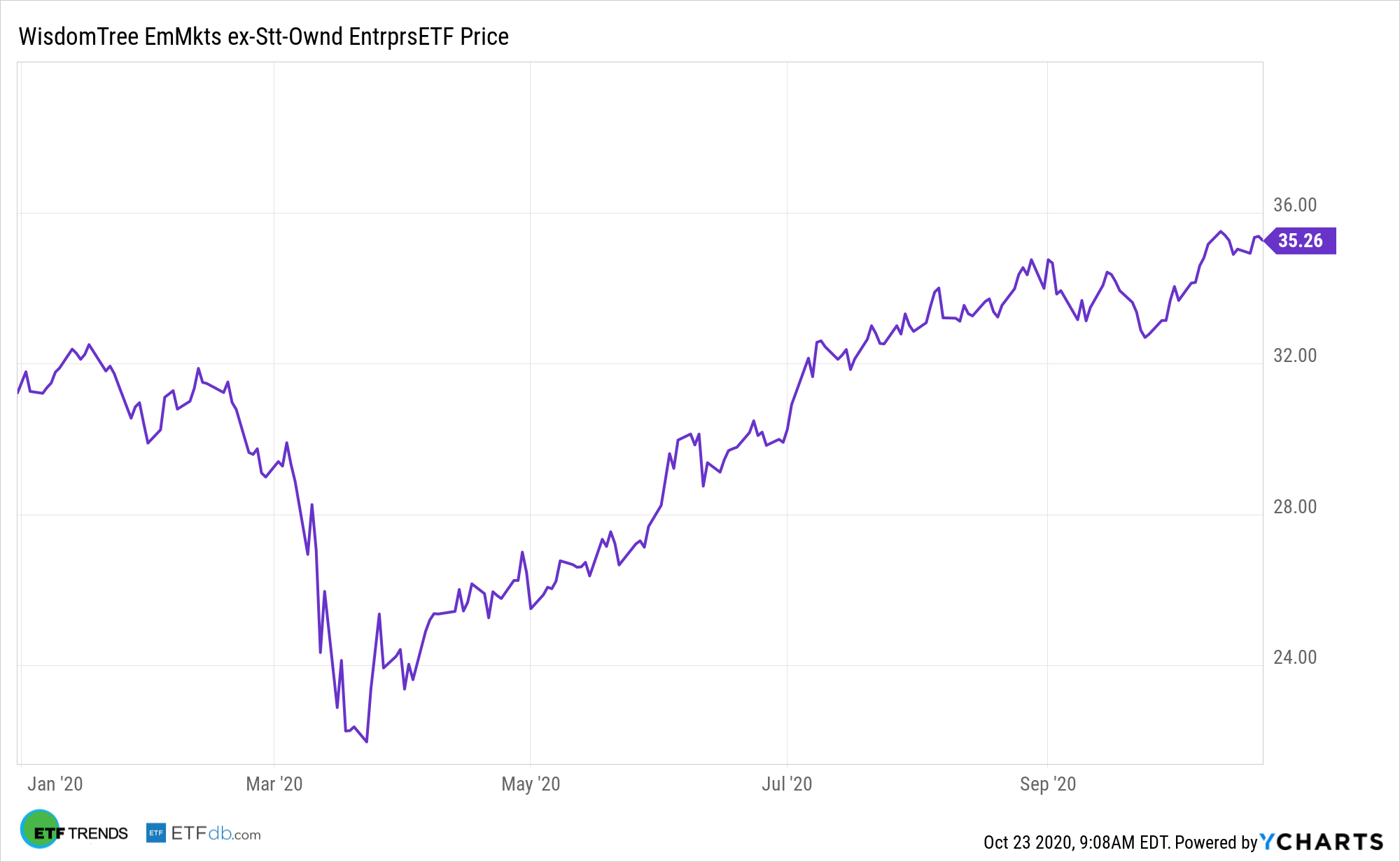

One way the model portfolio avoids lumbering state-owned firms is with the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE).

XSOE seeks to track the price and yield performance of the WisdomTree Emerging Markets ex-State-Owned Enterprises Index. Under normal circumstances, at least 80% of the fund’s total assets will be invested in component securities of the index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities. The index is a modified float-adjusted market cap weighted index that consists of common stocks in emerging markets, excluding common stocks of “state-owned enterprises.”

Confirming that XSOE is a play on the present and future of emerging markets, many of its top 10 overweights relative to the MSCI Emerging Markets Index aren’t old companies. Of that group, six were founded after 1990 and five of those were founded after 1996.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.