Interest rates are low, but with the right combination of dividend growth and fixed income exposures, advisors can add quality to client portfolios while bolstering income streams.

WisdomTree’s series of Select Model Portfolios, featuring PIMCO exchange traded funds, provide foundations for lower risk income in a challenging environment. Moreover, these model portfolios are likely to remain relevant regardless of what happens on Election Day.

WisdomTree Select Model Portfolios are “designed to provide exposure to a diversified allocation of stocks and bonds using ETFs. The strategy seeks to balance growth of capital through domestic and international equity ETFs, and preservation of capital with fixed income ETFs that may serve as a source of income and potentially reduce volatility. The strategy may include both WisdomTree and non-WisdomTree ETFs within its equity component, while using PIMCO ETFs in its fixed income component,” according to the issuer.

10 Quality ETFs

On the equity side of the model portfolio, which accounts for 80% of the aggressive sleeve, the portfolio features 10 exchange traded funds, many of which emphasize the quality factor.

That impressive roster includes the WisdomTree International Quality Dividend Growth Fund (CBOE: IQDG). IQDG sets out to capture International Quality Dividend Growth Dividend-paying equities, which have increasingly become an attractive option for investors looking to generate income and pursue higher total return potential.

Ex-U.S. developed market dividend payers often feature larger yields than their U.S. counterparts, an assertion proven by comparing large- and mega-cap dividend stocks from familiar dividend sectors such as consumer staples, energy, financial services, and telecommunications.

With a helping hand extended from the Federal Reserve amid the Covid-19 pandemic, corporate bonds got a nice boost as investors followed suit and piled more capital into debt issues. However, as 2020 comes to a close, bond investors should look towards more quality debt with a lesser likelihood of defaulting–an opportunity to take advantage of investment grade corporate bonds.

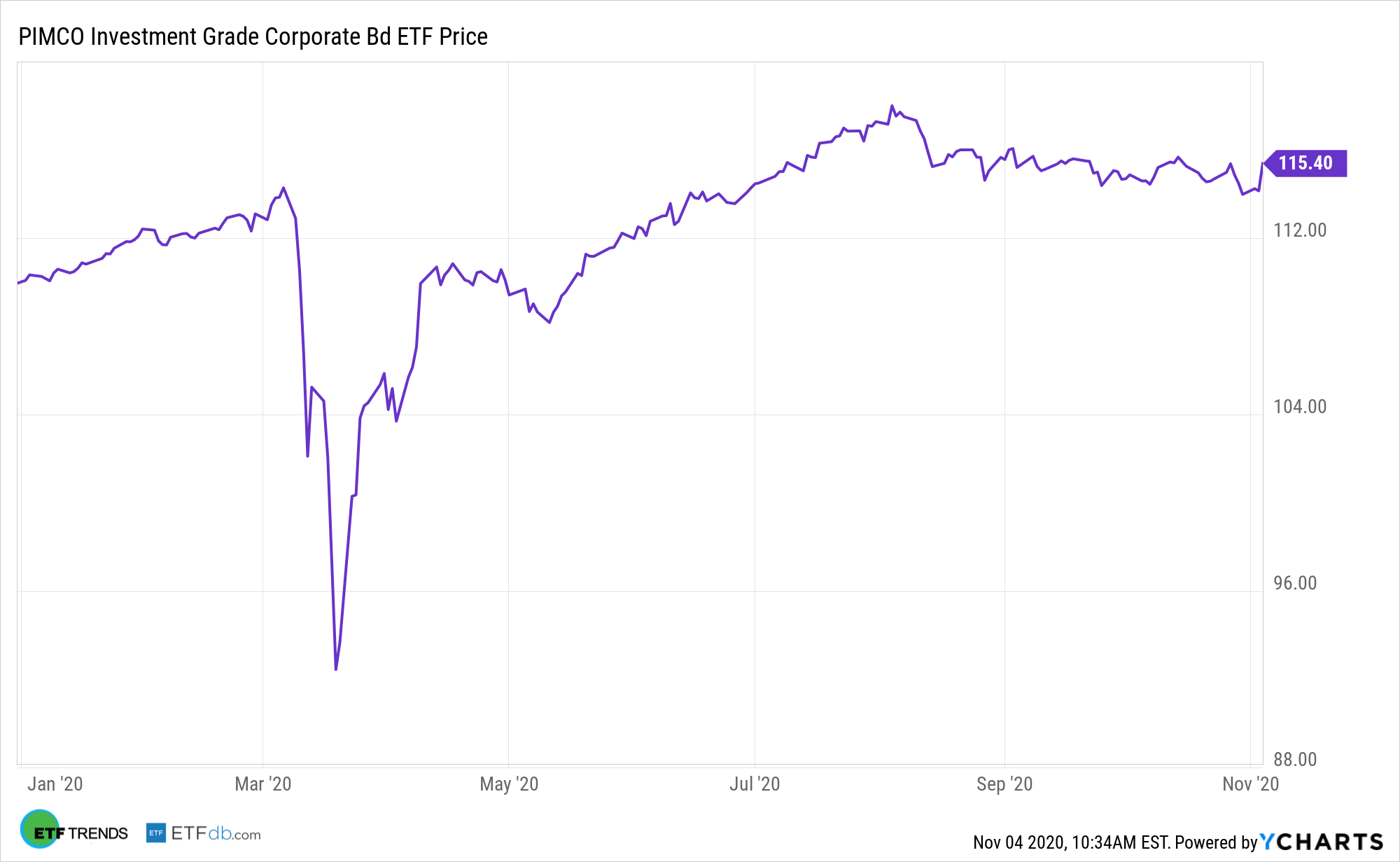

On the fixed income side, one of the holdings is the Pimco Investment Grade Corporate Bond ETF (CORP).

CORP tries to reflect the performance of the BofA Merrill Lynch U.S. Corporate Index, which holds investment grade corporate debt.

Bond investors who are wary of dipping too far into junk bond territory but want better yield payouts than Treasuries may consider investment-grade corporate bond exchange traded funds. The ongoing low-yield environment and improving economic sentiment has helped push investors toward corporate debt.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.