Congress recently passed the Holding Foreign Companies Accountable Act, legislation that looks to even the playing field between domestic companies and Chinese firms listing here. As President Trump is expected to sign the bill into law and many index providers are removing some Chinese companies from benchmarks.

For advisors, one way to prepare for this scenario is with WisdomTree’s Emerging Markets Multi-Factor Model Portfolio.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs,” according to WisdomTree. “The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETFs.”

Even with impending regime change in the White House, tensions between the world’s two largest economies remain palpable, meaning the aforementioned legislation could be a vital barometer in determining how US-China relations play out over the next several years.

Delisting Will Have Little Immediate Effect

“The bill gives companies three years to become compliant. This is crucial, because in absence of a U.S.-China compromise, the natural home for delisted companies such as Alibaba Group Holding and Baidu is the Hong Kong Stock Exchange (HKSE), which has actively courted them to dual-list their shares,” notes Liqian Ren, WisdomTree director of modern alpha. “Larger companies such as Alibaba, JD.com and NetEase have already finished dual-listing in Hong Kong and New York, and several other companies are preparing to do the same. HKSE has relaxed its rules to allow companies such as Alibaba and JD.com to dual-list, but it still has more stringent listing rules than U.S.-based exchanges.”

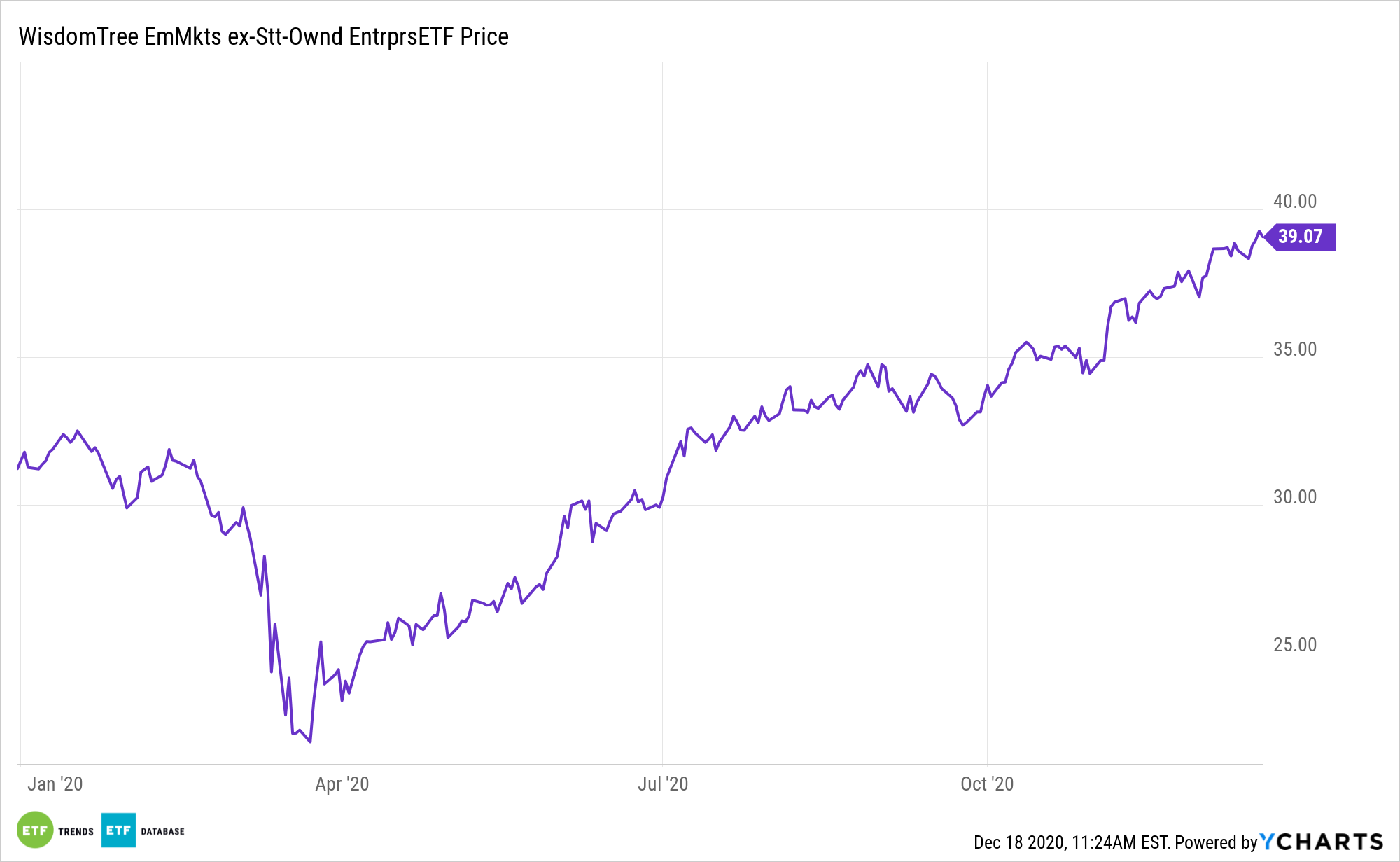

One of the benefits of the WisdomTree model portfolio is its exposure to the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE), an exchange traded fund that features no allocations to companies the U.S. is looking to delist.

Additionally, ETFs aren’t going to be affected by delisting measures in the same way individual equities might.

“A swap of New York Stock Exchange (NYSE) shares for Hong Kong shares would most likely be treated as a corporate action, which portfolio managers deal with daily,” writes Ren. “For investors who directly own those stocks, it may be a bit more complicated, depending on how their brokerages handle corporate actions. WisdomTree has already started trading the HK shares of dual-listed companies where liquidity is sufficient. For an ETF investor, this is already happening in the background. For individual investors, swapping the U.S. share for a Hong Kong share will be a taxable capital gains event in regular accounts. The tax advantage of the ETF structure shines through in events like this.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.