Mid-cap equities aren’t in the middle this year. Using the S&P 500, S&PMidCap 400, and S&P SmallCap 600 indexes, mid-caps are slightly trailing both their large- and small-cap rivals.

That doesn’t mean that the asset class should be ignored, certainly not by investors with long-term time horizons, which are historically conducive to mid-cap ownership and out-performance. In fact, now could be an opportune time for investors to revisit mid-cap stocks.

“Often things that are overlooked provide pleasant surprises. The S&P 400 Mid Cap index sometimes falls through the cracks because many investors are more interested in either big blue chips ( S&P 500 ) or small-cap stocks ( Russell 2000 ). But our work indicates that the S&P Mid Caps are on the verge of soaring higher and providing market leadership,” reports Andrew Addison for Barron’s.

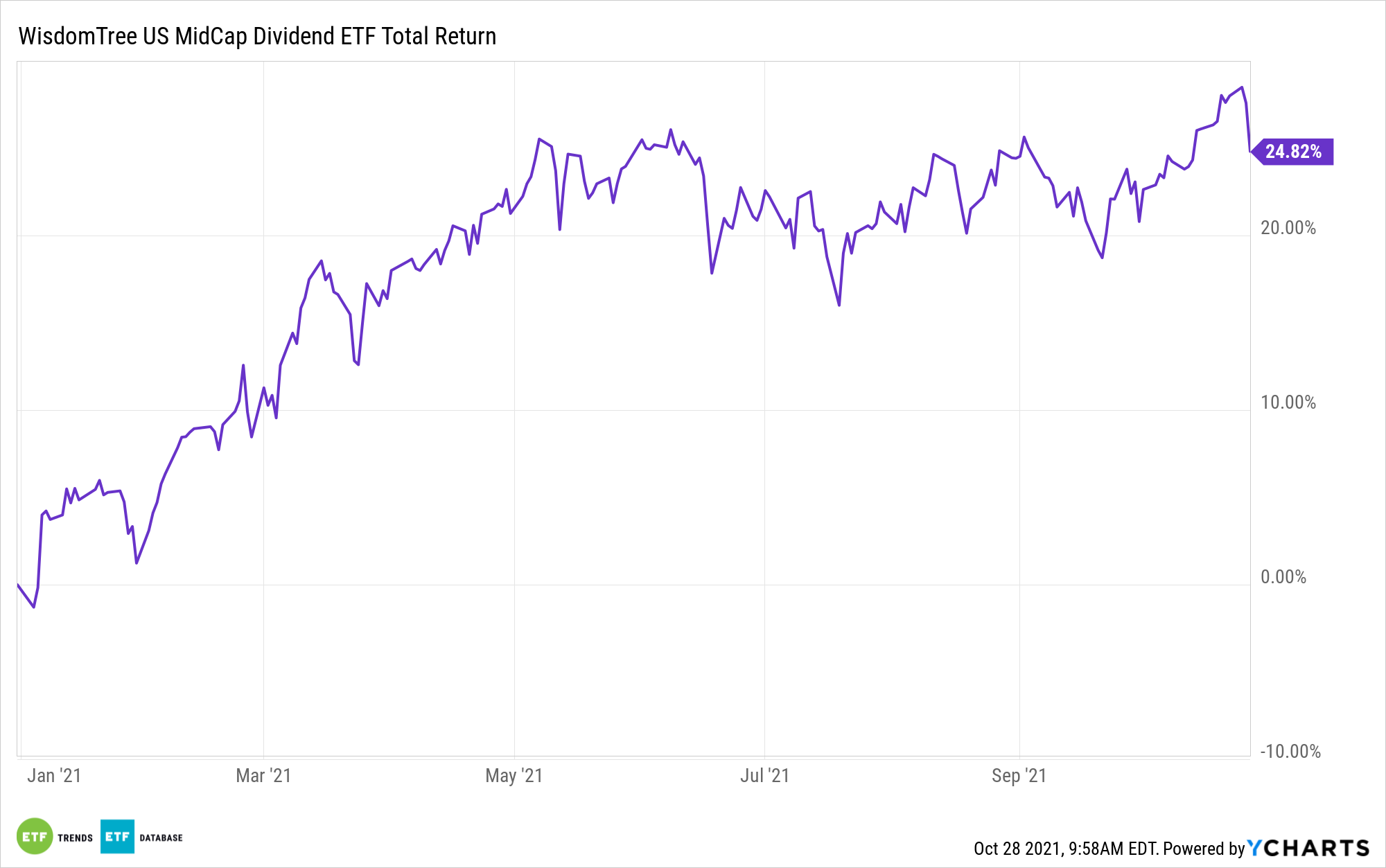

If mid-caps resume leadership roles, it could pay for investors to embrace strategies already displaying leadership. Enter the WisdomTree U.S. MidCap Dividend Fund (NYSEARCA: DON). Not only is DON beating the S&P MidCap 400 this year by 540 basis points (as of Oct. 26), the WisdomTree exchange traded fund is also handily topping the S&P 500 and the S&P SmallCap 600. Add to that, DON is sporting lower annualized volatility than all of the benchmarks mentioned here except the S&P 500.

DON’s accomplishing those impressive feats with a 30-day SEC yield that’s 107 basis points higher than that of the S&P MidCap 400 Index. Using that benchmark as a barometer, it appears that mid-cap stocks could be ready for near-term upside.

“Unlike the S&P 500, the Mid Caps have consolidated since April in a narrow price range. This compression in volatility projects that a sharp price move is directly on the horizon. Our work projects that once the mid-caps close above 2830, they will rocket higher—confirming projections to 3600-3800,” according to Barron’s.

DON, which is home to 303 stocks, has another card to play in terms of near-term relevance: It has cyclical value leanings, and some market observers are wagering that this style will rally into year-end. Also, DON allocates almost 27% of its weight to financial services stocks, positioning the fund to capitalize on rising 10-year Treasury yields, another scenario that could soon be afoot.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.