Domestic value stocks are garnering ample attention this year, and the returns are there to match. Some of that scenario is attributable to rising commodities prices.

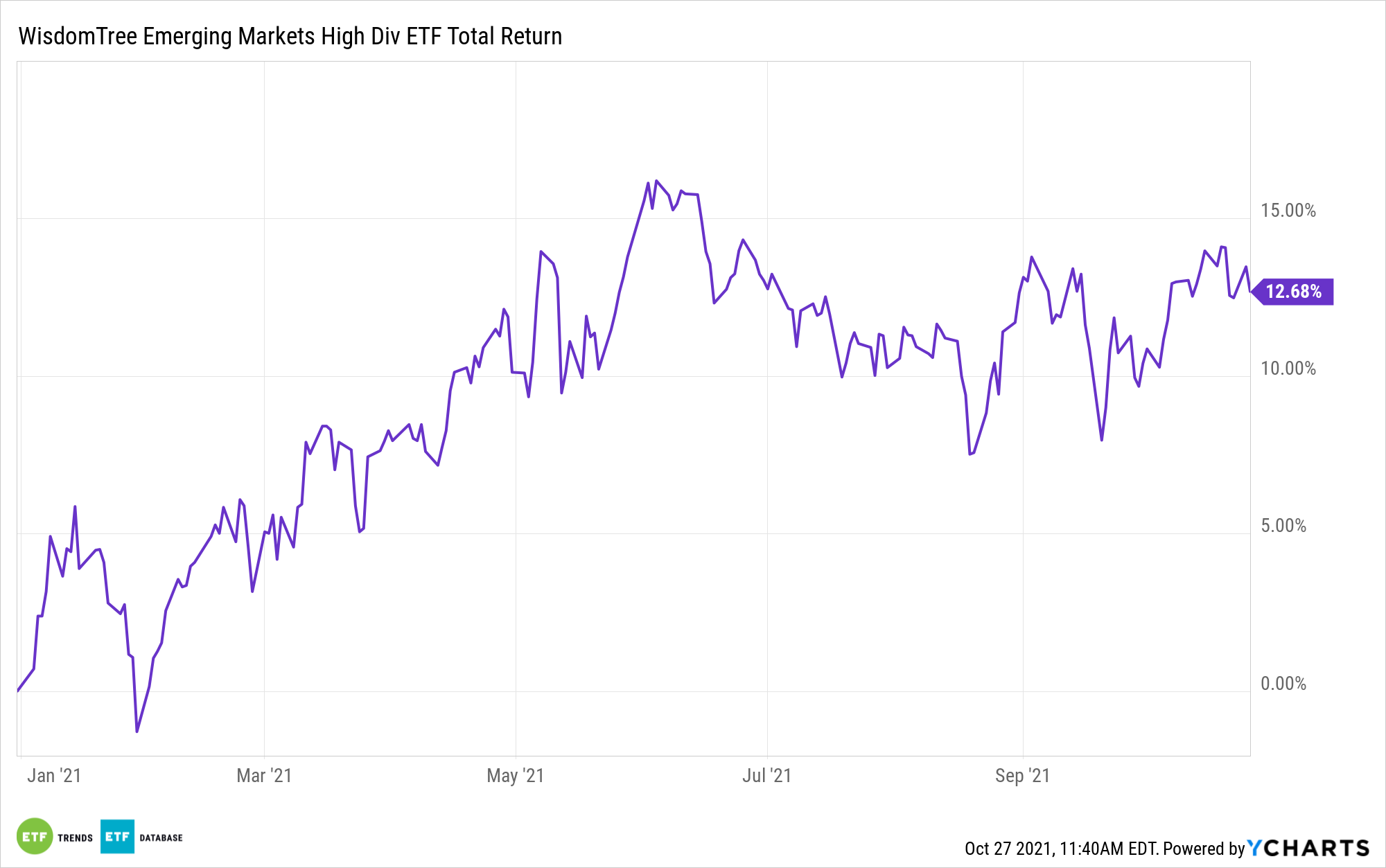

In other words, cyclical value is working in 2021, but investors should note that this is not a distinctly domestic phenomenon. For example, the WisdomTree Emerging Markets High Dividend Fund (NYSEArca: DEM) is higher by 9% year-to-date while the MSCI Emerging Markets Index is up a paltry 1.24%.

DEM, which has nearly $2 billion in assets under management, tracks the WisdomTree’s Emerging Markets High Dividend Index (WTEMHY), a yield-weighted benchmark. Indeed, the fund sports a dividend yield of 4.44%, which is commensurate with that methodology, but the index takes steps to reduce some of the risks associated with high-dividend strategies.

“WTEMHY holds the highest (top 30%) dividend yielding companies in EM and screens out those with the highest risk according to our Composite Risk Screen measure,” says Alejandro Saltiel, WisdomTree associate director of research. “Selected companies are weighted by the dividends they’ve paid out over the past 12 months. In its most recent reconstitution, WTEMHY added weight to the Materials, Energy and Consumer Staples sectors as these have grown dividends proportionally faster in the last year and have shown strong fundamentals.”

As Saltiel notes, DEM tilts toward value sectors. It allocates over half its weight to financial services and materials stocks, far more than the MSCI Emerging Markets Index’s combined weight to those groups. Overall, just 11.5% of the members of the MSCI Emerging Markets Index reside in DEM, and the overlap by weight between the WisdomTree ETF and the MSCI benchmark is just 9%, according to ETF Research Center data.

DEM’s geographic exposures are also reflective of its status as a commodities-driven value play.

“In terms of country exposures, the rebalanced portfolio also favors commodity-driven economies such as Brazil and Russia and is resetting the exposure of Taiwan, which has had a significant run up since the last rebalance in October 2020,” adds Saltiel.

Those two countries combine for almost 24% of DEM’s roster, well above the MSCI index’s combined allocation. In line with historical precedent, Russian stocks are benefiting from higher oil prices this year, helping DEM in the process, as the MSCI Russia 25/50 Index is higher by 41%.

Some of DEM’s commodities exposure is augmented by a 19% weight to Taiwan, a tech-heavy market with a track record of quality dividend growth. Overall, DEM has exposure to 18 developing economies.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.