As of July 9, the top three components in the S&P 500 – Apple (NASDAQ: AAPL), Microsoft (NASDASQ: MSFT) and Amazon (NASDAQ: AMZN) – combined for about 16% of the benchmark equity gauge’s weight.

That’s a lot of heft in a small number of stocks for a benchmark that’s intended to be a broad-based play on the U.S. equity market. That’s also a result of weighting by market capitalization, as the S&P 500 and a slew of exchange traded funds do. As a stock appreciates in value, so does its market cap, meaning that name takes on a larger percentage in cap-weighted funds.

Many money managers stick with cap weighting, but concentration risk can be reduced with fundamentally weighted strategies, which have long since come of age.

“In 2021, fundamentally weighted indexes are becoming more seasoned with each passing day; track records are getting lengthy. The time is coming when the Street is going to start asking some serious questions about why permanent capital is still being deployed into concepts that make little more sense than Charles Dow’s 1896 basket,” writes Jeff Weniger, WisdomTree head of equity strategy.

Fundamentally Weighted Strategies

WisdomTree offers an expansive lineup of model portfolios, many of which feature exposure to fundamentally weighted exchange traded funds – the issuer’s own and third-party funds.

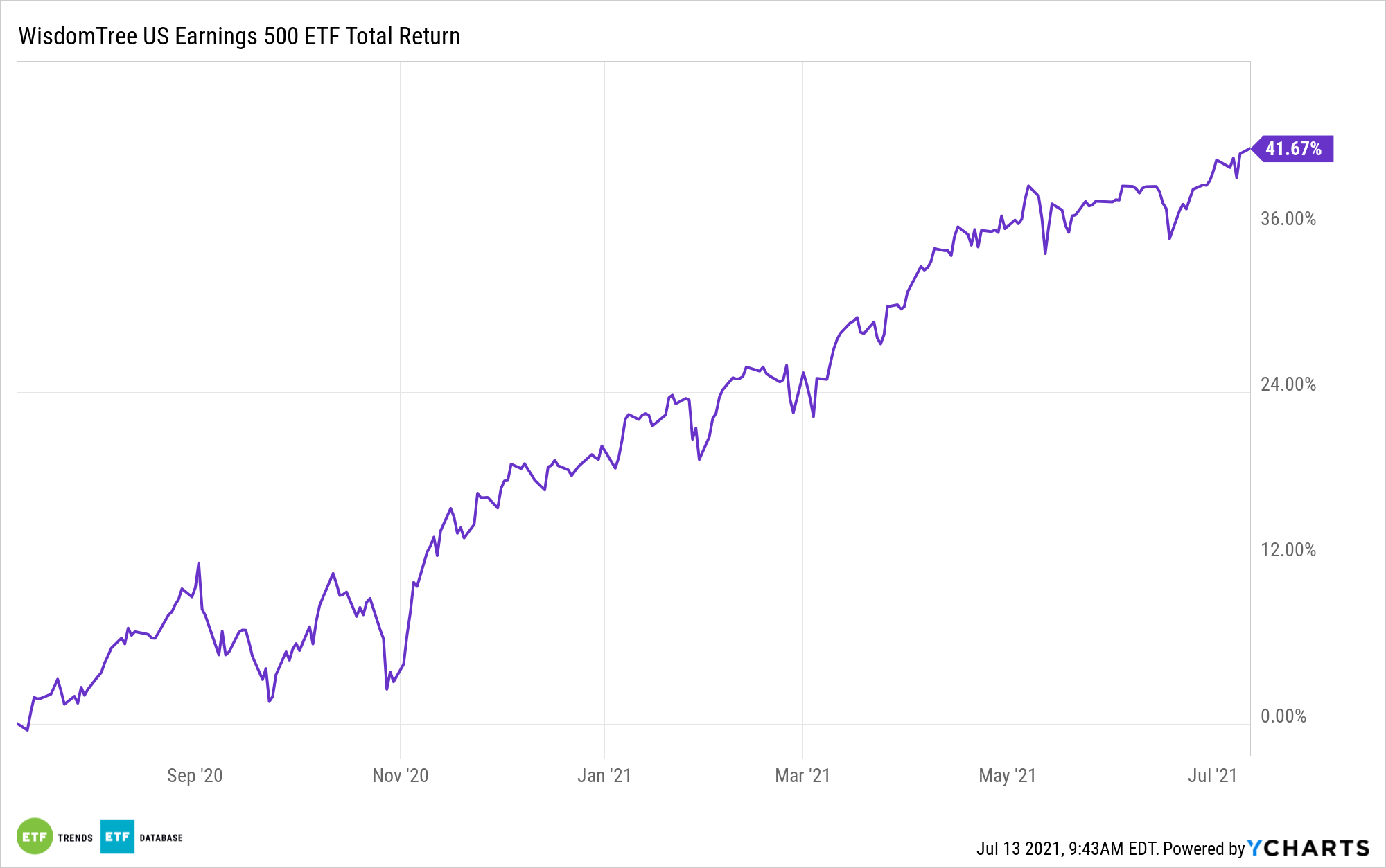

For example, the largest component in the WisdomTree Core Equity Model Portfolio is the WisdomTree Earnings 500 Fund (NYSEArca: EPS). As its name implies, EPS weights components by earnings, not market cap.

“Microsoft alone earns about 4% of all U.S. corporate earnings, so that is its weight in the WisdomTree U.S. LargeCap Fund (EPS),” adds Weniger. “Similarly, Apple also earns about 4% of the total earnings pie in this country, so that is the company’s weight in EPS too. By weighting this way, you do not end up with some tiny company at the top of your holdings list. To wit, Google-parent Alphabet, JP Morgan and Facebook are EPS’s next three largest holdings.”

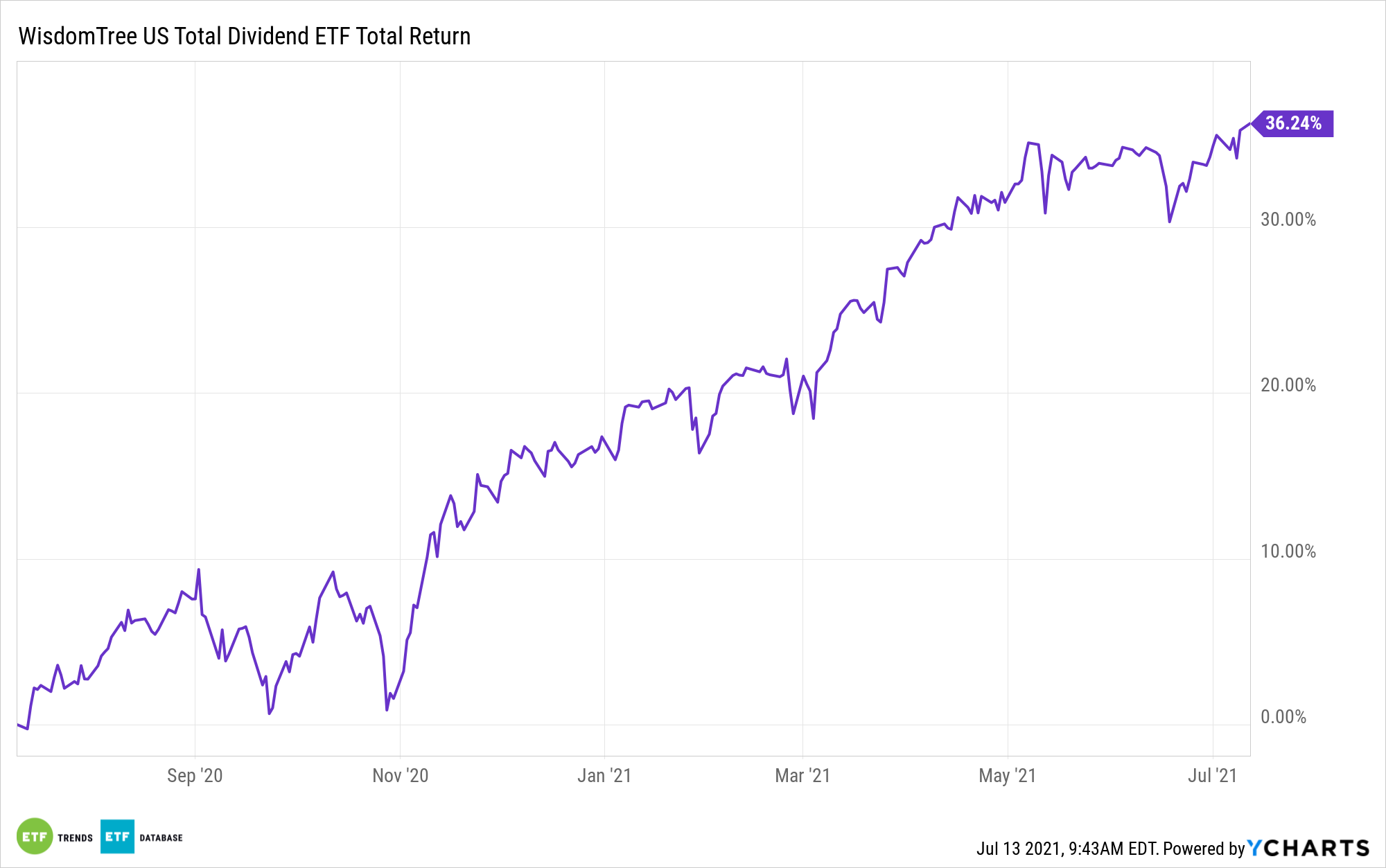

In addition to weighting stocks by earnings, WisdomTree offers ETFs that are weighted by dividends. Several of those reside in the firm’s Global Dividend Model Portfolio.

The largest component in that model portfolio is the WisdomTree U.S. Total Dividend Fund (NYSEArca: DTD). DTD’s underlying index weighs stocks by dividends paid to give investors a potentially clearer picture regarding what companies’ payouts will look like in the upcoming year.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.